FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

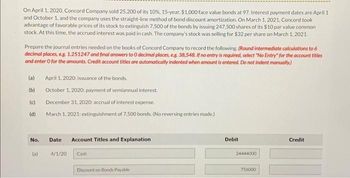

Transcribed Image Text:On April 1, 2020, Concord Company sold 25,200 of its 10%, 15-year. $1,000 face value bonds at 97. Interest payment dates are April 1

and October 1, and the company uses the straight-line method of bond discount amortization. On March 1, 2021, Concord took

advantage of favorable prices of its stock to extinguish 7,500 of the bonds by issuing 247.500 shares of its $10 par value common

stock. At this time, the accrued interest was paid in cash. The company's stock was selling for $32 per share on March 1, 2021.

Prepare the journal entries needed on the books of Concord Company to record the following. (Round intermediate calculations to 6

decimal places, e.g. 1.251247 and final answers to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles

and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

(a)

(b)

(c)

(d)

No.

(a)

April 1, 2020: issuance of the bonds.

October 1, 2020: payment of semiannual interest.

December 31, 2020: accrual of interest expense.

March 1, 2021: extinguishment of 7,500 bonds. (No reversing entries made.)

Date

4/1/20

Account Titles and Explanation

Cash

Discount on Bonds Payable

Debit

24444000

756000

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Flint Company invests $10,000,000 in 6% fixed rate corporate bonds on January 1, 2020. All the bonds are classified as available-for-sale and are purchased at par. At year-end, market interest rates have declined, and the fair value of the bonds is now $10,710,000. Interest is paid on January 1.Prepare journal entries for Flint Company to (a) record the transactions related to these bonds in 2020, assuming Flint does not elect the fair option; and (b) record the transactions related to these bonds in 2020, assuming that Flint Company elects the fair value option to account for these bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Date Account Titles and Explanation Debit Credit (a)…arrow_forwardCotton Candy Company purchased $1,500,000 of 10% bonds of Caramel Company on January 1, 2024, paying $1,410,375. The bonds mature January 1, 2031; interest is payable each July 1 and January 1. The discount of $89,625 provides an effective yield of 11%. For the year ended December 31, 2024, Cotton Candy Companys income statement will report interest revenue from the Caramel Company bonds ofarrow_forwardOn February 1, 2021, Cromley Motor Products issued 9% bonds, dated February 1, with a face amount of $80 million. The bonds mature on January 31, 2025 (4 years). The market yield for bonds of similar risk and maturity was 10%. Interest is paid semiannually on July 31 and January 31. Barnwell Industries acquired $80,000 of the bonds as a long-term investment. The fiscal years of both firms end December 31.Required:1. Determine the price of the bonds issued on February 1, 2021.2. Prepare amortization schedules that indicate (a) Cromley’s effective interest expense and (b) Barnwell’s effective interest revenue for each interest period during the term to maturity.3. Prepare the journal entries to record (a) the issuance of the bonds by Cromley and (b) Barnwell’s investment on February 1, 2021.4. Prepare the journal entries by both firms to record all subsequent events related to the bonds through January 31, 2023.arrow_forward

- On March 1, 2021, E Corp. issued $1,000,000 of 10% nonconvertible bonds at 104, due on February 28, 2031. Each $1,000 bond was issued with 50 detachable stock warrants, each of which entitled the holder to purchase, for $60, one share of Evan's $30 par common stock. On March 1, 2021, the market price of each warrant was $4. By what amount should the bond issue proceeds increase shareholders' equity?arrow_forwardOn August 1, 2024, Perez Communications issued $36 million of 12% nonconvertible bonds at 105. The bonds are due on July 31, 2044. Each $1,000 bond was issued with 25 detachable stock warrants, each of which entitled the bondholder to purchase, for $50, one share of Perez Communications’ no par common stock. Interstate Containers purchased 20% of the bond issue. On August 1, 2024, the market value of the common stock was $48 per share and the market value of each warrant was $8. In February 2035, when Perez common stock had a market price of $62 per share and the unamortized discount balance was $2 million, Interstate Containers exercised the warrants it held. Questions: Prepare the journal entries on August 1, 2024, to record (a) the issuance of the bonds by Perez and (b) the investment by Interstate. Prepare the journal entries for both Perez and Interstate in February 2035, to record the exercise of the warrants.arrow_forwardOn December 1, 2021, Bramble Corp.issued 680 of its 8%, $1,000 bonds at 104. Attached to each bond was one detachable stock warrant entitling the holder to purchase 1 share of Bramble's common stock. On December 1, 2021, the market value of the bonds, without the stock warrants, was 97, and the market value of each stock purchase warrant was $50. The amount of the proceeds from the issuance that should be accounted for as the initial carrying value of the bonds payable would be $700,400 O $680,000 $672,533 $665,380arrow_forward

- On April 1, 2023, Sheridan Corp. sold 11,000 of its $900 face value, 15-year, 10% bonds at 98. Interest payment dates are April 1 and October 1. The company follows ASPE and uses the straight-line method of bond discount amortization. On March 1, 2024, Sheridan extinguished 2,750 of the bonds by issuing 80,000 shares. At this time, the accrued interest was paid in cash to the bondholders whose bonds were being extinguished. In a separate transaction on March 1, 2024, 120, 000 of the company's shares sold for $32 per share .a.Prepare Sheridan's journal entry to record the issuance of the bonds on April 1, 2023 DR.cash 9702000 Cr.bonds payable 9702000 b.Prepare Sheridan's journal entry to record the payment of the semi-annual interest on October 1, 2023. Dr. interest expense5016000 Cr.cash 495000 Cr.bonds payable 6600 c.Prepare Sheridan's journal entry to record the accrual of the interest expense on December 31, 2023. Dr. interest expense 250800 Cr,interest payable 247500 Cr.bonds…arrow_forwardBundle Company issues 1,000,000 par value 10 year bonds at 102 on January 1, 2018, which Mega Corporation purchased. The coupon rate on the bonds is 9%. Interest payment are made semiannually in July 1 and January 1. On July 1, 2021, Parent Company purchased 500,000 par value of the bonds from Mega Corporation for 492,200. Bundle Company owns 65% of A Company's voting shares. During 2021, Bundle Company recorded an interest income on yhe aforementioned bonds payable of 23,100, while A Company recorded an interest expese of 44,000, in ehich 22,000 was incurred from July 1 to December 31. B Company has a comprehensive income of 500,000 while A Company has 150,000. No other intercompany transaction occurred during 2021. Assume straight-line amortization. Compute for the gain on extinguishment of bonds to be recognized in the 2021 consolidated statement of comprehensive income. Compute the comprehensive income assigned to the controlling interest for 2021. Compute the comprehensive…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education