FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Prepare The General

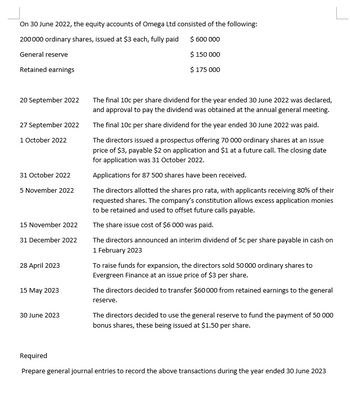

Transcribed Image Text:On 30 June 2022, the equity accounts of Omega Ltd consisted of the following:

200 000 ordinary shares, issued at $3 each, fully paid

$ 600 000

General reserve

Retained earnings

20 September 2022

27 September 2022

1 October 2022

31 October 2022

5 November 2022

15 November 2022

31 December 2022

28 April 2023

15 May 2023

30 June 2023

$ 150 000

$ 175 000

The final 10c per share dividend for the year ended 30 June 2022 was declared,

and approval to pay the dividend was obtained at the annual general meeting.

The final 10c per share dividend for the year ended 30 June 2022 was paid.

The directors issued a prospectus offering 70 000 ordinary shares at an issue

price of $3, payable $2 on application and $1 at a future call. The closing date

for application was 31 October 2022.

Applications for 87 500 shares have been received.

The directors allotted the shares pro rata, with applicants receiving 80% of their

requested shares. The company's constitution allows excess application monies

to be retained and used to offset future calls payable.

The share issue cost of $6 000 was paid.

The directors announced an interim dividend of 5c per share payable in cash on

1 February 2023

To raise funds for expansion, the directors sold 50000 ordinary shares to

Evergreen Finance at an issue price of $3 per share.

The directors decided to transfer $60000 from retained earnings to the general

reserve.

The directors decided to use the general reserve to fund the payment of 50 000

bonus shares, these being issued at $1.50 per share.

Required

Prepare general journal entries to record the above transactions during the year ended 30 June 2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The answer given is in journal entry form, the question is asking for tabular summary form. Could this please be provided?arrow_forwardWhat is the process of recording a transaction in the journal called? Group of answer choices journalizing posting charting ledgeringarrow_forwardWhat is the purpose of a journal? What is the purpose of a general ledger?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education