FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Alert for not submit AI generated answer. I need unique and correct answer. Don't try to copy from anywhere. Do not give answer in image and hand writing

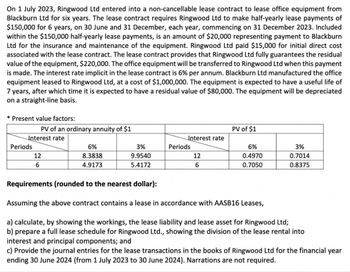

Transcribed Image Text:On 1 July 2023, Ringwood Ltd entered into a non-cancellable lease contract to lease office equipment from

Blackburn Ltd for six years. The lease contract requires Ringwood Ltd to make half-yearly lease payments of

$150,000 for 6 years, on 30 June and 31 December, each year, commencing on 31 December 2023. Included

within the $150,000 half-yearly lease payments, is an amount of $20,000 representing payment to Blackburn

Ltd for the insurance and maintenance of the equipment. Ringwood Ltd paid $15,000 for initial direct cost

associated with the lease contract. The lease contract provides that Ringwood Ltd fully guarantees the residual

value of the equipment, $220,000. The office equipment will be transferred to Ringwood Ltd when this payment

is made. The interest rate implicit in the lease contract is 6% per annum. Blackburn Ltd manufactured the office

equipment leased to Ringwood Ltd, at a cost of $1,000,000. The equipment is expected to have a useful life of

7 years, after which time it is expected to have a residual value of $80,000. The equipment will be depreciated

on a straight-line basis.

* Present value factors:

PV of an ordinary annuity of $1

Interest rate

Periods

12

6

6%

8.3838

4.9173

3%

9.9540

5.4172

Interest rate

T

Periods

12

6

PV of $1

6%

0.4970

0.7050

3%

0.7014

0.8375

Requirements (rounded to the nearest dollar):

Assuming the above contract contains a lease in accordance with AASB16 Leases,

a) calculate, by showing the workings, the lease liability and lease asset for Ringwood Ltd;

b) prepare a full lease schedule for Ringwood Ltd., showing the division of the lease rental into

interest and principal components; and

c) Provide the journal entries for the lease transactions in the books of Ringwood Ltd for the financial year

ending 30 June 2024 (from 1 July 2023 to 30 June 2024). Narrations are not required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A system contains many processes. Three common processes that are “grouped” together are transaction corrections, adjustments, and cancellations. These three elements work to properly serve customers. Imagine a system that allows you to register for a class online. The online system must give you a way to correct any errors you made, such as registering for the wrong class. This would be a transaction correction. The system should also allow you to make adjustments, such as adding or dropping classes. Finally, the system should allow you to make cancellations, such as cancelling the registration process entirely. Notice that all three of these processes, correction, adjustment, and cancellation, work together to provide you with one service, which is registering for classes. What type of requirements are transaction corrections, adjustments, and cancellations? Select one. Question 4 options: A Functional Requirements B Nonfunctional Requirementsarrow_forwardSearch Google images for bad data visualizations. Post a link to the image.Describe what is inaccurate or misleading about the visualization. Replace the inaccurate and misleading information with what you think makes the image a good visualization.arrow_forwardWhen should you use Power BI Services?arrow_forward

- 1. Having a clean electronic image includes: A. Maintaining a professional voice mail message B. Maintaining a professional e-mail address C. Evaluating your Internet social networking sites D. All of these 2. Personal references should: A. Be included on a résumé and cover letter B. Not be included on a résumé or cover letter C. Only be listed on your résumé D. Only be listed on your cover letter 3. Self-discovery is the process of: A. Identifying your key selling points B. Identifying key skills C. Identifying key interests D. All of thesearrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardDuring the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education