FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:2:54

Chegg Home Expert Q&A My solutions

Student question

Skip question

||||

=

Start Solving

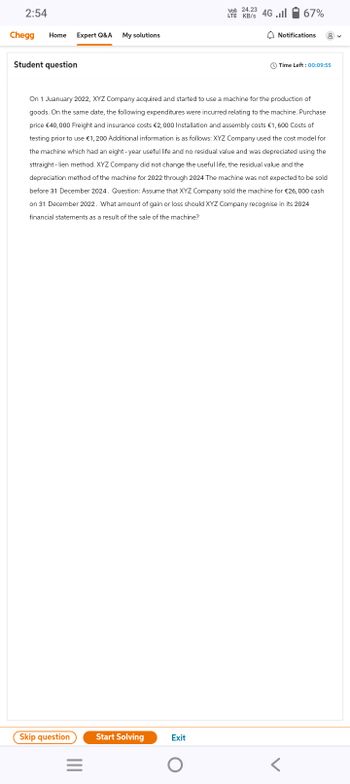

On 1 Juanuary 2022, XYZ Company acquired and started to use a machine for the production of

goods. On the same date, the following expenditures were incurred relating to the machine. Purchase

price €40,000 Freight and insurance costs €2,000 Installation and assembly costs €1,600 Costs of

testing prior to use €1,200 Additional information is as follows: XYZ Company used the cost model for

the machine which had an eight-year useful life and no residual value and was depreciated using the

sttraight - lien method. XYZ Company did not change the useful life, the residual value and the

depreciation method of the machine for 2022 through 2024 The machine was not expected to be sold

before 31 December 2024. Question: Assume that XYZ Company sold the machine for €26,000 cash

on 31 December 2022. What amount of gain or loss should XYZ Company recognise in its 2024

financial statements as a result of the sale of the machine?

Exit

Vol) 24.23

LTE KB/S 4G

O

...|

67%

Notifications

Time Left: 00:09:55

<

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wardell Company purchased a minicomputer on January 1, 2022, at a cost of $48.000 The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $3,000. On January 1, 2024, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $1,200 Exercise 11-23 (Algo) Part 2 2. Prepare the year-end journal entry for depreciation on December 31, 2024. Assume that the company uses the double-decline balance method instead of the straight-line method. Note: If no entry is required for a transaction/event, select "No journal entry required in the first account field. Do not round intermediate calculations. Round your final answers to nearest whole dollar. View transaction list Journal entry worksheet 1 Record depreciation expense for 2024,arrow_forwardA company purchased a new machine on January 1, 2014. The supplier, "Forever supply" was paid $2,000 in cash. In addition, transportation and installation were $180 (paid in cash), legal costs associated with the asset were $20 (paid in cash). The machine has an estimated life of 5 years and an estimated salvage value of $300. It is company policy to use straight line depreciation for all of its machines. question: Assume the machine was sold on July 1, 2015 to "company A" for $1200 cash. Prepare the journal entry/entries to record this transaction. What was the gain/loss? Include the classification of the accounts and clearly label your debits and credits.arrow_forwardOn January 2, 2022, Sandhill Ltd. purchased equipment to be used in its manufacturing operations. The equipment has an estimated useful life of ten years, and an estimated residual value of $34000 It was also estimated that the equipment would be used a total of 71000 hours over its useful life. The depreciation expense for this equipment was $159040 for calendar 2023, using the units of production method. The machine was used for 8000 hours in 2023. The acquisition cost of the equipment was O $1713230. $1648490. $1143730. O $1445480.arrow_forward

- A elearning.act.edu.om Muscat LLC purchased a machine on 1st January, 2019 for OMR 250,000. The rate of depreciation is 20% p.a. under straight line method. Replacement Cost of the machine on 31st December,2019 was OMR 350,000 and on 31st December, 2020 was OMR 500,000. The company wishes to follow Current Cost Accounting rather than the Historical Cost Accounting. a. What is the amount of Depreciation Adjustment? b. What is the amount of Additional Depreciation? C. What is the amount of Back Log Depreciation?arrow_forwardVikarrow_forwardAlpesharrow_forward

- Don't give solution in image format..arrow_forwardAsset ImpairmentGreen Light Ltd (GLL) tested a machine for impairment on 31 December 2018. The machine was carried at depreciated historical cost, and its carrying amount was $150,000. It had an estimated remaining useful life of 10 years. GLL's accounting policy required all property, plant and equipment's recoverable amount was determined on the basis of value-in-use calculation, using a discount rate of 15%. The management of GLL estimated the future net cash flows of the machine using reasonable assumptions. The following information related to future net cash flows of the machine was available at the end of 2018. Year Future net cash flow ('000)2019 22,1652020 21,4502021 20,5502022 24,7252023 25,3252024 24,8252025 24,1232026 25,5332027 24,2342028 22,850 Suppose in the years 2019-2021, no event occurred that required the machine's recoverable amount to be re-estimated. On 31 December 2022, costs of $25,000 were incurred to enhance the machine's performance. Revised estimated…arrow_forwardOn January 1, 2020, Techno Company sold a machine for RO15,000 cash. The Machine originally cost RO 56,000. As of January 1, 2020, it had accumulated depreciation of RO 35,000. Prepare the journal entry to record the sales of the Machine Select one: О. 15,000 35,000 Cash Accumulated Depreciation Loss on disposal of Machine Machine 6,000 56,000 O b. Accumulated Depreciation 35,000 Equipment 35,000 O c. Truck 56,000 直。 كتب هنا ل لبحثarrow_forward

- Machinery was bought October 2,2021. The total purchase cost was $182 900 which is inclusive of $600 installation expense and $14 900 normal repair and maintenance cost, and with a $6 000 estimated salvage value was sold on February 1, 2023. It's residual value is $6,000 and estimated useful life of 8 years. What is the cost of Machinery?arrow_forwardsarrow_forwardExplain to what extent the value of the diesel lorry is to be imparied. Support your answer with calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education