Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

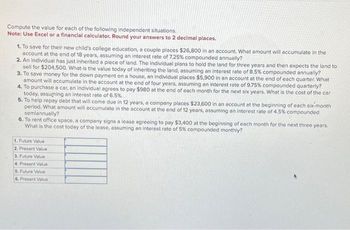

Transcribed Image Text:Compute the value for each of the following independent situations.

Note: Use Excel or a financial calculator. Round your answers to 2 decimal places.

1. To save for their new child's college education, a couple places $26,800 in an account. What amount will accumulate in the

account at the end of 18 years, assuming an interest rate of 7.25% compounded annually?

2. An individual has just inherited a piece of land. The individual plans to hold the land for three years and then expects the land to

sell for $204,500. What is the value today of inheriting the land, assuming an interest rate of 8.5% compounded annually?

3. To save money for the down payment on a house, an individual places $5,900 in an account at the end of each quarter. What

amount will accumulate in the account at the end of four years, assuming an interest rate of 9.75% compounded quarterly?

4. To purchase a car, an individual agrees to pay $980 at the end of each month for the next six years. What is the cost of the car

today, assuming an interest rate of 6.5%.

5. To help repay debt that will come due in 12 years, a company places $23,600 in an account at the beginning of each six-month

period. What amount will accumulate in the account at the end of 12 years, assuming an interest rate of 4.5% compounded

semiannually?

6. To rent office space, a company signs a lease agreeing to pay $3,400 at the beginning of each month for the next three years.

What is the cost today of the lease, assuming an interest rate of 5% compounded monthly?

1. Future Value

2. Present Value

3. Future Value

4. Present Value

5. Future Value

6. Present Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Related to The Business of Life: Saving for Your First House) (Future value) You are hoping to buy a house the future and recently received an inheritance of $18,000. You intend to use your inheritance as a down payment o your house. a. If you put your inheritance in an account that earns 8 percent interest compounded annually, how many years will be before your inheritance grows to $34,000? b. If you let your money grow for 10.25 years at 8 percent, how much will you have? c. How long will it take your money to grow to $34,000 if you move it into an account that pays 4 percent compounded annually? How long will it take your money to grow to $34,000 if you move it into an account that pays 13 percent? d. What does all this tell you about the relationship among interest rates, time, and future sums? it be before your inheritance grows to $34,000? 8.26 years (Round to one decimal place.) b. If you let your money grow for 10.25 years at 8 percent, how much will you have? (Round to the…arrow_forwardHow much will Larissa have in her savings account 10 years from now, if she deposits the $5817 that her grandfather gave her at 5% interest rate, compounded annually? Round your answer to 2 decimal places and do not enter any symbols such as $, % or commas. Answer: 8725.50arrow_forwardSuppose a husband wants to take his wife on a trip three years from now to Europe to celebrate their 40th anniversary. He has just received a $26,000 inheritance from an uncle and intends to invest it for the trip. The husband estimates the trip will cost $33,800. What interest rate, compounded annually, must be earned to accumulate enough to pay for the trip? Note: Use tables, Excel, or a financial calculator. Do not round your Intermediate values. Enter your answer rounded to the nearest whole percentage. (FV of $1, PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Solve for i Present Value: Future Value Th (M $ 26,000 3 8%arrow_forward

- A couple plans to save for their child's college education. What principal must be deposited by the parents when their child is born in order to have $40,000 when the child reaches the age of 18? Assume the money earns 7% interest, compounded quarterly. (Round your answer to two decimal places.)arrow_forwardA couple plans to save for their child's college education. What principal must be deposited by the parents when their child is born in order to have $41,000 when the child reaches the age of 18? Assume the money earns 5% interest, compounded monthly. (Round your answer to two decimal places.)arrow_forwardDon't give answer inarrow_forward

- Formulate a system of equations for the situation below and solve. Michael Perez has a total of $2900 on deposit with two savings institutions. One pays interest at the rate of 6% / year, whereas the other pays interest at the rate of 8% / year. If Michael earned a total of $212 in interest during a single year, how much does he have on deposit in each institution? at 6%/year $ at 8%/year $arrow_forwardA couple plans to save for their child's college education. What principal must be deposited by the parents when their child is born in order to have 39,000$ When the child reaches the age of 18? Assume the money earns 7% interest, compounded quarterly.?round your answer to two decimal places.arrow_forwardA student wants to save for her retirement. At the end of every year, she deposits 475 in a brokerage account with an expected annual return of 4.3%. How much money will she have in the account in 30 years? Enter your answer as a number with 2 places of precision (i.e. 1.23). Do not include dollar signs or commas.arrow_forward

- Here is the deal: You can pay your college tuition at the beginning of the academic year or the same amount at the end of the academic year. You either already have the money in an interestbearing account or will have to borrow it. Deal, or no deal? Explain your financial reasoning. Relate your answer to the time-value of money, present value, and future valuearrow_forwardA couple plans to purchase a vacation home. The bank requires a 5% down payment on the $450,000 vacation home. The couple will finance the rest of the cost with a fixed-rate mortgage at 9% annual interest with monthly payments over 30 years. Complete the parts below. Do not round any intermediate computations. Round your final answers to the nearest cent if necessary. If necessary, refer to the list of financial formulas. (a) Find the required down payment. (b) Find the amount of the mortgage. (c) Find the monthly payment.arrow_forwardA couple plans to save for their child's college education. What principal must be deposited by the parents when their child is born in order to have $41,000 when the child reaches the age of 18? Assume the money earns 7% interest, compounded quarterly. (Round your answer to two decimal places.)$ ??arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education