Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

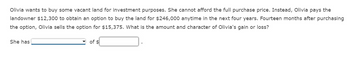

Transcribed Image Text:Olivia wants to buy some vacant land for investment purposes. She cannot afford the full purchase price. Instead, Olivia pays the

landowner $12,300 to obtain an option to buy the land for $246,000 anytime in the next four years. Fourteen months after purchasing

the option, Olivia sells the option for $15,375. What is the amount and character of Olivia's gain or loss?

She has

of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- In 2011, Avery bought a gold necklace for her own use at a cost of $8,000. In 2018 when the fair market value of the gold necklace was $10,000, Avery gave this necklace to her daughter Bella. Later in 2018, Bella sold the necklace for 10,500. What is Bella's taxable gain for the sale of the necklace ?arrow_forwardMadeline sells her personal scooter for $3,600. She purchased the scooter for $4,320 three years ago. She also sells a painting for $6,221 that she acquired five years ago for $5,184. What are the tax implications of these sales? Madeline has a $ realized on the painting. Madeline will recognize the gain or loss associated with on the scooter and a realizedarrow_forwardAmanda purchased a home for $500,000 in 2016. She paid $100,000 cash and borrowed the remaining $400,000. This is Amanda's only residence. Assume that in year 2023, when the home had appreciated to $750,000 and the remaining mortgage was $300,000, interest rates declined and Amanda refinanced her home. She borrowed $500,000 at the time of the refinancing, paid off the first mortgage, and used the remainder for purposes unrelated to the home. What is her total amount of acquisition indebtedness for the purposes of determining the deduction for home mortgage interest? (Assume not married filing separately.)arrow_forward

- Amanda purchased a home for $520,000 in 2016. She paid $104,000 cash and borrowed the remaining $416,000. This is Amanda's only residence. Assume that in year 2021 when the home had appreciated to $780,000 and the remaining mortgage was $312,000, interest rates declined and Amanda refinanced her home. She borrowed $520,000 at the time of the refinancing, paid off the first mortgage, and used the remainder for purposes unrelated to the home. What is her total amount of her amount of acquisition indebtedness for purposes of determining the deduction for home mortgage interest? (Assume not married filing separately.)arrow_forwardJames and his wife, Carla sell their personal residence which they have occupied for three years on November 11th 2020 for a total sum of $800,000. They made renovations in preparation for the sale in the amount of $25,000 and the costs of selling the house were $10,000. Their cost basis in the home was $250,000. On November 30, they occupied a new home that they purchased for $350,000. Calculate: (a) their realized gain on the sale of the residence (b) their recognized gain on the sale (c) their adjusted basis in the new residence.arrow_forwardBrian purchased a block of land in June 1987 for $110,000. At the time that he acquired the land he did not anticipate selling it in the near future. He purchased and held the land because he considered that the land represented a safe investment for his money and that generally land prices went up with inflation. Brian sold the land for $250,000 in the current income year. Which of the following statements about Brian is most correct? a. The amount is not ordinary income but may be assessed under the capital gains provisions. b. The entire $250,000 is ordinary income. c. Section 15-15 ITAA97 will apply to make the amount of $140,000 assessable income. d. Section 25A ITAA36 will apply to make the amount of $140,000 assessable income.arrow_forward

- I hire Susan to sell my house. I tell her that I'm hoping to get $200,000 for the house. She tells me she needs $2,000 to make repairs on the house before it is listed for sale. I give her the $2,000. She takes my money but never makes the repairs. The house sells for $220,000. If Susan is ordered to pay restitution, she will have to pay $ 2000arrow_forwardAmanda purchased a home for $860,000 in 2016. She paid $172,000 cash and borrowed the remaining $688,000. This is Amanda's only residence. Assume that in year 2021 when the home had appreciated to $1,290,000 and the remaining mortgage was $516,000, interest rates declined and Amanda refinanced her home. She borrowed $860,000 at the time of the refinancing, paid off the first mortgage, and used the remainder for purposes unrelated to the home. What is her total amount of her amount of acquisition indebtedness for purposes of determining the deduction for home mortgage interest? (Assume not married filing separately.) Multiple Choice ___ $516,000. ___ $645,000. ___ $860,000. ___ $946,000.arrow_forwardGadubhiarrow_forward

- Tina, your client, is the 55-year-old widow of Paul, who was 58 years old when he died earlier this year. Ed, age 35, is their only child. Tina is the primary beneficiary and Ed is the contingent beneficiary of Paul's IRA, which is worth $400,000. Which one of the following planning techniques will accomplish Tina's goal of deferring taxes for as long as possible on Paul's IRA? A) beginning payments to Tina based on her remaining life expectancy B) beginning payments to Ed based on his life expectancy C) initiating a dependent rollover to Ed D) doing a rollover to Tina's IRAarrow_forwardCallie Cooper purchased two pieces of property in 1990: Property Q cost $15,000 and Property R cost $30,000. In 2020, when Callie died, she left the property to her daughter, Christy. At that time, Property Q had appreciated in value to $80,000 while Property R had declined in value, now worth only $10,000. What is Christy’s basis in each piece of property? What are the tax consequences of the changes in value of the properties from the time of original purchase to the death of Callie?arrow_forwardMary owns a home with a with a replacement value of $331,195. She purchased home insurance in the amount of $200,000, and therefore does not meet the 80% rule. If Mary's deductible is $3,000 and a BBQ fire caused $75,000 worth of damage, how much will Mary have to pay herself?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education