FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

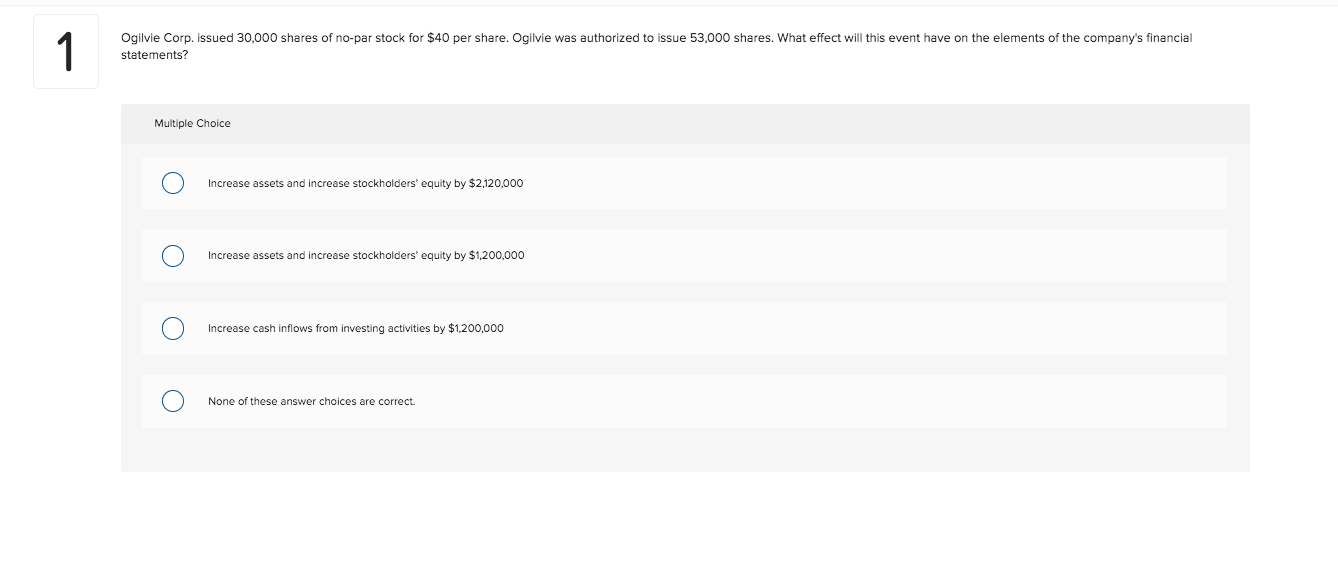

Transcribed Image Text:Ogilvie Corp. issued 30,000 shares of no-par stock for $40 per share. Ogilvie was authorized to issue 53,000 shares. What effect will this event have on the elements of the company's financial

statements?

Multiple Choice

Increase assets and increase stockholders' equity by $2,120,000

Increase assets and increase stockholders' equity by $1,200,000

Increase cash inflows from investing activities by $1,200,000

None of these answer choices are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Summit Apparel has the following accounts at December 31: Common Stock, $1 par value, 1,400,000 shares issued; Additional Paid-in Capital, $17.40 million; Retained Earnings, $10.40 million; and Treasury Stock, 54,000 shares, $1.188 million. Prepare the stockholders' equity section of the balance sheet. (Amounts to be deducted should be indicated by a minus sign. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) SUMMIT APPAREL Balance Sheet (Stockholders' Equity Section) December 31 Stockholders' equity: Total Paid-in Capital Total Stockholders' Equityarrow_forwardPlease do not give solution in image format ?arrow_forwardThe balance sheet for Tempest, Inc., is shown here in market value terms. There are 29,000 shares of stock outstanding. Market Value Balance Sheet Cash Fixed assets $156,000 560,010 Equity $716,010 Total $ 716,010 Total $716,010 The compay has announced it is going to repurchase $49,300 worth of stock instead of paying a dividend of $1.70. a. What effect will this transaction have on the equity of the firm? (Input the answer as positive value. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. How many shares will be outstanding after the repurchase? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c. What will the price per share be after the repurchase? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. The transaction will b. New shares outstanding c. Share price shareholders' equity byarrow_forward

- Astro Corporation was started with the issue of 4,400 shares of $12 par stock for cash on January 1, Year 1. The stock was issued at a market price of $17 per share. During Year 1, the company earned $66,650 in cash revenues and paid $44,656 for cash expenses. Also, a $4,000 cash dividend was paid to the stockholders. Prepare a statement of changes in stockholders’ equity.arrow_forwardXYZ Company has 100,000 shares of stock outstanding. On January 1, 200X XYZ Company declared a cash dividend of .50 per share to be paid on January 31. On January 1 XYZ Company will make the following journal entry: Credit cash $50,000and debit dividends declared $50,000. Debit dividends declared $50,000 and credit dividends payable $50,000. No entry is made until January 31. Debit cash $50,000 and credit dividends payable $50,000.arrow_forwardKaranarrow_forward

- Agri Gold Ltd. began operations on January 1, 1983 by issuing 54,000 common shares at $13 per share and 26,000 $8 cumulative preferred shares at $20 per share. During 1983 Agri Gold Ltd issued an additional 8,000 common shares at $11 per share and 2,000 preferred shares at $30 per share. 2019 profit was $355,000 and the Board declared $81,000 in dividends. Required: Prepare the Shareholders' Equity section of Agri Gold Ltds Balance Sheet at December 31, 1983.arrow_forwardStar Ltd. presents the following information from the Statement of Financial Position: Equity £ Capital (120, 000 shares of £1 120,000 each) Retained Profits Share premium Total Equity 22,000 50,000 192,000 Star Ltd. issues 20, 000 ordinary shares for a price of £2. Considering the previous information and the economic transaction of issuing ordinary shares, which of the following statements is correct? O a. The company increases cash in £20,000 and share premium decreases in the same amount. O b. The company decreases cash in £40,000 and total equity remains unchanged. O c. The company increases cash in £40,000 and equity increases in the same amount. O d. None of the answers is true.arrow_forwardIf my company has in my capital(equity accounts common stock($1 par, 100,000 shares outstanding) $ 100,000 additional paid in capital 200,00 retained earnings 225,000 the board of director has declared a 20 percent stock dividend on january 1 and a 0.25 cash dividend on marz 1. what changes occur in the capital account after each transation if the price of the stock is $4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education