FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

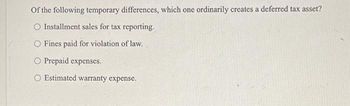

Transcribed Image Text:Of the following temporary differences, which one ordinarily creates a deferred tax asset?

O Installment sales for tax reporting.

O Fines paid for violation of law.

O Prepaid expenses.

O Estimated warranty expense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Recognition of tax benefits in the loss year due to a NOL carry back involves: O The establishment of an income tax refund receivable. Only a note to the financial statements. The establishment of a deferred tax liability. O The establishment of a deferred tax asset.arrow_forwardA deferred tax account is classified on the balance sheet as: A net noncurrent amount A net current amount It should never appear on the balance sheet Either a current or a noncurrent liabilityarrow_forwardListed below are items that are treated differently for accounting purposes than they are for tax purposes. Indicate whether the items are permanent differences or temporary differences. For temporary differences, indicate whether they will create deferred tax assets or deferred tax liabilities. 1. Investments accounted for by the equity method (ignore dividends received deduction). 2. Advance rental receipts. 3. Fine for polluting. 4. Estimated future warranty costs. 5. Excess…arrow_forward

- Expenditures currently deducted in the tax return but not included with expenses in the income statement until subsequent years create deferred tax liabilities. O True O Falsearrow_forward* Your answer is incorrect. All of the following are procedures for the computation of deferred income taxes except to determine taxes payable. measure the total deferred tax liability for deductible temporary differences. • measure the total deferred tax liability for taxable temporary differences. identify the types and amounts of existing temporary differences.arrow_forwardRecognition of tax benefits in a loss year due to a loss carryforward requires A) the establishment of a deferred tax liability. B) only a note to the financial statements. OC) the establishment of an income tax receivable. OD) the establishment of a deferred tax asset.arrow_forward

- 20. A temporary difference arises when a revenue item is reported for tax purposes in a period After it is reportedin financial income Before it is reportedin financial income No Yes No No Yes No Yes Yesarrow_forwardAn unused tax loss will arise when: a. Expenses deductible for tax purposes are less than the taxable income b. Expenses deductible for tax purposes exceeds the taxable income. c. Expenses deductible for tax purposes are equal to the taxable income d. Expenses deductible for tax purposes do not exist.arrow_forward1 contiune Listed below are items that are commonly accounted for differently for financial reporting purposes than they are for tax purposes.For each item below, indicate whether it involves: 1. A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income tax asset. 2. A temporary difference that will result in future taxable amounts and, therefore, will usually give rise to a deferred income tax liability. 3. A permanent difference. (e) Installment sales of investments are accounted for by the accrual method for financial reporting purposes and the installment method for tax purposes.(f) For some assets, straight-line depreciation is used for both financial reporting purposes and tax purposes, but the assets’ lives are shorter for tax purposes.(g)…arrow_forward

- Which of the following causes a temporary difference between taxable and pretax accounting income? A. Investment expenses incurred to generate tax-exempt income. B. MACRS used for depreciating equipment. C. The dividends received deduction. D. Life insurance proceeds received due to the death of an executive.arrow_forward1. Permanent differences between tax income and financial reporting income results from deferred tax assets resulting from timing differences. items that are allowable deductions for income tax reporting that do not qualify as expenses under GAAP. deferred tax liabilities resulting from timing differences. all of these choices. 2. Operating loss carrybacks will result in tax refunds. deferred tax assets. deferred tax liabilities. all of these choicesarrow_forwardWhich of the following is a temporary difference that normally is recognized for accounting purposes before being reported as an expense for tax purposes? Unearned revenue Product warranty costs Depreciation Fines resulting from violations of the law.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education