Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

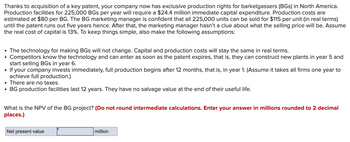

Transcribed Image Text:Thanks to acquisition of a key patent, your company now has exclusive production rights for barkelgassers (BGs) in North America.

Production facilities for 225,000 BGs per year will require a $24.4 million immediate capital expenditure. Production costs are

estimated at $80 per BG. The BG marketing manager is confident that all 225,000 units can be sold for $115 per unit (in real terms)

until the patent runs out five years hence. After that, the marketing manager hasn't a clue about what the selling price will be. Assume

the real cost of capital is 13%. To keep things simple, also make the following assumptions:

• The technology for making BGs will not change. Capital and production costs will stay the same in real terms.

Competitors know the technology and can enter as soon as the patent expires, that is, they can construct new plants in year 5 and

start selling BGs in year 6.

• If your company invests immediately, full production begins after 12 months, that is, in year 1. (Assume it takes all firms one year to

achieve full production.)

• There are no taxes.

BG production facilities last 12 years. They have no salvage value at the end of their useful life.

What is the NPV of the BG project? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal

places.)

Net present value

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm is considering taking a project that will produce $12 million of revenue per year. Cash expenses will be $5 million, and depreciation expenses will be $1 million per year. If the firm takes that project, then it will reduce the cash revenues of an existing project by $3 million. What is the free cash flow on the project, per year, if the firm uses a 40 percent marginal tax rate? O$2.8 million O $2.4 million 0 $4.6 million $3.4 millionarrow_forwardAster Company is considering an investment in technology to improve its operations. The investment will require an initial outlay of $800,000 and yield the following expected cash flows. Management requires investments to have a payback period of two years, and it requires a 10% return on its investments.arrow_forward: Assume that the company, where you are working as a team in FinancialDepartment, is considering a potential project with a new product that is expected to sell foran average price of $22 per unit and the company expects it can sell 650 000 unit per year atthis price for a period of 4 years. Launching this project will require purchase of a $3 500 000equipment that has residual value in four years of $500 000 and adding $ 850 000 in workingcapital which is expected to be fully retrieved at the end of the project. Other information isavailable below:Depreciation method: straight lineVariable cost per unit: $17Cash fixed costs per year: $450 000Discount rate: 10%Tax Rate: 30%Do a scenario analysis with cash flows of the assumed project to determine the sensitivity ofthe project’s NPV to different scenarios that are defined in terms of the estimated values foreach of the project’s value drivers. Please work on two scenarios corresponding to the worstand best-case outcomes for the…arrow_forward

- Jamaica Corp. is adding a new assembly line at a cost of $6 million. The firm expects the project to generate cash flows of $1 million, $1 million, $3 million, and $4 million over the next four years. Its cost of capital is 16 percent. What is the MIRR on this project, and should the company add the new assembly line? 18.25 percent, no O 18.25 percent, yes O 21 percent, no O 21 percent, yes none of these G13arrow_forwardKolby’s Korndogs is looking at a new sausage system with an installed cost of $725,000. This cost will be depreciated straight-line to zero over the project’s 7-year life, at the end of which the sausage system can be scrapped for $99,000. The sausage system will save the firm $211,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $63,000. If the tax rate is 24 percent and the discount rate is 10 percent, what is the NPV of this project? Please answer fast i give you uipvote.arrow_forwardNonearrow_forward

- Atech Industries has initial resources of 150 million USD. Optimal operation requires an investment of 200 million USD. The firm must raise 50 million USD additional capital borrowing from the markets. Management projects 200 million USD investment (Optimal time 1 investment required) will generate 330 million USD cash flow at time 2. Market interest rate is 8%. Assume no dividend is paid at time 1. What is the closest present value of the Atech Industries in millions USD with this project at time 1 with the investment taking place in full?A -256 B-330 -276 -50 -300arrow_forwardMost you can pay negative NPV? 22. You are getting ready to start a new project that will incur some cleanup and shutdown costs when it is completed. The project costs $5.4 million up front and is expected to generate $1.1 million per year for 10 years and then have some shutdown costs in year 11. Use the MIRR approach to find the maximum shutdown costs you could incur and still meet your cost of capital of 15% on this project. Cald in South Africaarrow_forwardUniversal Exports Inc. is a small company and is considering a project that will require $650,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 25%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $155,000? 10.73% 17.88% 18.77% 12.52% Determine what the project’s ROE will be if its EBIT is –$50,000. When calculating the tax effects, assume that Universal Exports Inc. as a whole will have a large, positive income this year. -4.64% -6.67% -5.22% -5.8% Universal Exports Inc. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company’s debt will be 12%. What will be the project’s ROE if it produces an EBIT of $155,000? 28.11% 18.74% 26.77% 21.42% What will be the project’s ROE if it produces an EBIT of –$50,000 and it…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education