EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

6: Answer this question

Transcribed Image Text:In terms of paying less in interest, which is more economical for a $110,000 mortgage: a 30-year fixed-rate at 9% or a

15-year fixed-rate at 8.5%? How much is saved in interest? Use the following formula to determine the regular

payment amount.

P

n

1-91

+

PMT=

nt

www

Determine which loan is more economical. Choose the correct answer below.

The 30-year 9% loan is more economical.

The 15-year 8.5% loan is more economical.

The buyer will save in interest approximately $.

(Do not round until the final answer. Then round to the nearest thousand dollars.)

63°F Clear

<

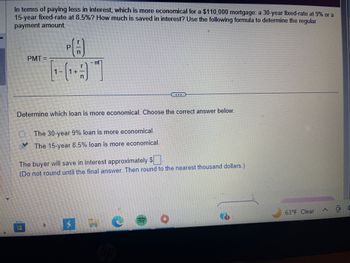

Transcribed Image Text:In terms of paying less in interest, which is more economical for a $110,000 mortgage: a 30-year fixed-rate at 9% or a

15-year fixed-rate at 8.5%? How much is saved in interest? Use the following formula to determine the regular

payment amount.

PMT=

C

1

PA

-nt

Determine which loan is more economical. Choose the correct answer below.

a

The 30-year 9% loan is more economical.

The 15-year 8.5% loan is more economical.

The buyer will save in interest approximately $

(Do not round until the final answer. Then round to the nearest thousand dollars.)

...

C

63°F Clear

(2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In terms of paying less in interest, which is more economical for a $140,000 mortgage: a 30-year fixed-rate at 7.5% or a 15-year fixed-rate at 7%? How much is saved in interest? Use the following formula to determine the regular payment amount. PMT= PA [¹-(1+) -nt7 Select the correct choice below and fill in the answer box within your choice. (Do not round until the final answer. Then round to the nearest thousand dollars.) O A. The 15-year 7% loan is more economical. The buyer will save approximately $ OB. The 30-year 7.5% loan is more economical. The buyer will save approximately $ in interest. in interest.arrow_forwardSuppose a homeowner has an existing mortgage loan with these terms: Remaining balance of $150,000, interest rate of 8 percent, and remaining term of 10 years (monthly payments). This loan can be replaced by a loan at an interest rate of 6 percent, at a cost of 8 percent of the outstanding loan amount. Required: a. What is the net benefit of refinancing? Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places. b. What is the NPV if the homeowner expects to be in the home for only five more years? Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places. a. Net benefit of refinancing b. NPV $ + 6,552.77 1,819.91arrow_forwardIn terms of paying less in interest, which is more economical for a $140,000 mortgage: a 30-year fixed-rate at 9.5% or a 15-year fixed-rate at 9%? How much is saved in interest?... The buyer will save in interest approximately $... (Do not round until the final answer. Then round to the nearest thousand dollars.) Use the following formula to determine the regular payment amount. PMT=Prn1−1+rn−ntarrow_forward

- You are taking out a single-payment loan that uses the simple interest method to compute the finance charge. You need to figure out what your payment will be when the loan comes due. The equation to calculate the finance charge is: FsFs = Amount of Loanx Interest Ratex Term of Loan where FsFs is the finance charge for the loan, and the term of the loan is in . You’re borrowing $10,000 for two years with a stated annual interest rate of 6%.arrow_forwardcoparrow_forwardIn a discount interest loan, you pay the interest payment up front. For example, if a 1-year loan is stated as $34,000 and the interest rate is 9.50%, the borrower “pays” 0.0950 × $34,000 = $3,230 immediately, thereby receiving net funds of $30,770 and repaying $34,000 in a year. A. What is the effective interest rate on this loan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) B. What is the effective annual rate on a 1-year loan with an interest rate quoted on a discount basis of 19.50%? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forward

- Use to determine the regular payment amount, rounded to the nearest dollar. Consider the following pair of mortgage loan options for a $180,000 -nt mortgage. Which mortgage loan has the larger total cost (closing costs + the amount paid for points + total cost of interest)? By how much? Mortgage A: 15-year fixed at 12.25% with closing costs of $1700 and 1 point. Mortgage B: 15-year fixed at 11.25% with closing costs of $1700 and 5 points. Choose the correct answer below, and fill in the answer box to complete your choice. (Do not round until the final answer. Then round to the nearest dollar as needed.) O A. Mortgage B has a larger total cost than mortgage A by $ B. Mortgage A has a larger total cost than mortgage B by $ P.arrow_forwardI need help with this problemarrow_forwardUse P ÞA to determine the regular payment amount, rounded to the nearest dollar. Consider the following pair of mortgage loan options for a $145,000 mortgage. Which mortgage loan has the larger total cost (closing costs + the amount paid for points + total cost of interest)? By how much? Mortgage A: 15-year fixed at 6.25% with closing costs of $2200 and 1 point. Mortgage B: 15-year fixed at 4.5% with closing costs of $2200 and 5 points. Choose the correct answer below, and fill in the answer box to complete your choice. (Do not round until the final answer. Then round to the nearest dollar as needed.) OA. Mortgage A has a larger total cost than mortgage B by $ O B. Mortgage B has a larger total cost than mortgage A by $arrow_forward

- P Use to determine the regular payment amount, rounded to the nearest dollar. Consider the following pair of mortgage loan options for a nt $150,000 mortgage. Which mortgage loan has the larger total cost (closing costs + the amount paid for points + total cost of interest)? By how much? Mortgage A: 30-year fixed at 9.25% with closing costs of $2900 and 1 point. Mortgage B: 30-year fixed at 8.25% with closing costs of $2900 and 5 points. Choose the correct answer below, and fill in the answer box to complete your choice. (Do not round until the final answer. Then round to the nearest dollar as needed.) O A. Mortgage A has a larger total cost than mortgage B by $ O B. Mortgage B has a larger total cost than mortgage A by $ Help Me Solve This View an Example Get More Help - Clear All Check Answer MacBook Air >> 吕口 F3 esc F10 F1 F12 F1 F2 F5 F6 F7 F8 2# $ A & 2 3 4 6 7 8arrow_forward1. You have just obtained a commercial mortgage for $6.25M with a 5-year term, 25-year amortization period and 6.50% mortgage interest rate. (a) Construct an amortization table for the term of the loan assuming annual payments. What is the annual payment? What is the balance at maturity? (b) What is the e¤ective cost of borrowing if the borrower pays an origination fee of $30,000? (c) The borrower can repay the balance of the loan at any time prior to its maturity, but must pay a penalty of 5% of the outstanding balance. What is the cost of borrowing if the borrower pays an origination fee of $30,000 and pays off the remaining balance of the loan after making payments for 4 years?arrow_forward2. Use 啁 to determine the regular payment amount, rounded to the nearest dollar. Consider the following pair of mortgage loan options for a [ $130,000 mortgage. Which mortgage loan has the larger total cost (closing costs + the amount paid for points + total cost of interest)? By how much? Mortgage A: 15-year fixed at 12.25% with closing costs of $1300 and 1 point. Mortgage B: 15-year fixed at 10.5% with closing costs of $1300 and 4 points. Choose the correct answer below, and fill in the answer box to complete your choice. (Do not round until the final answer. Then round to the nearest dollar as needed.) OA. Mortgage B has a larger total cost than mortgage A by $ OB. Mortgage A has a larger total cost than mortgage B by $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning