FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

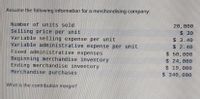

Transcribed Image Text:Assume the following information for a merchandising company:

Number of units sold

20,000

Selling price per unit

Variable selling expense per unit

Variable administrative expense per unit

Fixed administrative expenses

$ 30

$3.40

Beginning merchandise inventory

Ending merchandise inventory

Merchandise purchases

$ 2.40

$ 50,000

$24,000

$ 19,000

$340, 000

What is the contribution margin?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

My question is asking the amount of the total variable expense. Please help.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

My question is asking the amount of the total variable expense. Please help.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sales Cost of goods sold Gross profit Expenses: $186,000,000 (102,000,000) $84,000,000 Selling expenses $16,000,000 Administrative expenses 5,200,000 Total expenses (21,200,000) Operating income $62,800,000 The division of costs between variable and fixed is as follows: Cost of goods sold Selling expenses Administrative expenses Variable Fixed 70% 30% 75% 25% 50% 50% Management is considering a plant expansion program for the following year that will permit an increase of $11,160,000 in yearly sales. The expansion will increase fixed costs by $3,000,000 but will not affect the relationship between sales and variable costs. Required: 1. Determine the total variable costs and the total fixed costs for the current year. Total variable costs Total fixed costs 86,000,000 ✓ 37,700,000 X 2. Determine (a) the unit variable cost and (b) the unit contribution margin for the current year. Unit variable cost Unit contribution margin 86 V ✓ 100 3. Compute the break-even sales (units) for the…arrow_forwardSales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a traditional income statement for the quarter ended March 31. The Alpine House, Incorporated Traditional Income Statement 138 25 Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses 1 Required 3 Net operating income $ 1,470,000 $ 420 49 $16 $ 135,000 $ 110,000 HON 1.470 000 $ 65,000 $ 115,000 $ 320,000 0arrow_forwardTodrick Company is a merchandiser that reported the following information based on 1,000 units sold: Sales $ 300,000 Beginning merchandise inventory $ 20,000 Purchases $ 200,000 Ending merchandise inventory $ 7,000 Fixed selling expense ?question mark Fixed administrative expense $ 12,000 Variable selling expense $ 15,000 Variable administrative expense ?question mark Contribution margin $ 60,000 Net operating income $ 18,000 3. Calculate the selling price per unit. 4. Calculate the variable cost per unit. 5. Calculate the contribution margin per unit.arrow_forward

- Restate the following income statement for a retailer in contribution format. Sales revenue ($100 per unit) $ 70,000 Less cost of goods sold ($58 per unit) 40,600 Gross margin 29,400 Less operating costs: Commissions expense ($6 per unit) $ 4,200 Salaries expense 7,900 Advertising expense 5,900 Shipping expense ($1 per unit) 700 18,700 Operating income $ 10,700 Per Unit select an income statement item $enter a dollar amount $enter a dollar amount select an opening name for section one : select an income statement item $enter a dollar amount enter a dollar amount select an income statement item…arrow_forwardSelling price per unit 14 current sales 25,249 break – even sales 20,735 Compute the margin of safety in dollars. Enter only the amount of the margin of safety in the box provided below. Enter the amount only do not enter letters, words, dollar signs, or the calculation.arrow_forwardConsider the following information: Retail price per unit: Wholesale price per unit: Manufacturer's price per unit: Manufacturer's variable cost: Retailer's fixed costs per quarter: Wholesaler's fixed costs per quarter: Manufacturer's fixed costs per quarter: Retailer's unit sales this quarter: Wholesaler's unit sales this quarter: Manufacturer's unit sales this quarter: $150 O $90.91 O $111.12 O $72.50 O $145.46 $80 $50 $35 $75,000 $1,750,000 $2,500,000 1,800 80,000 160,000 If the wholesaler wants his margin to be 45%, but doesn't believe he can convince the manufacturer to lower her price below $50, what price does the wholesaler need to charge the retailer? O Searcharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education