FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

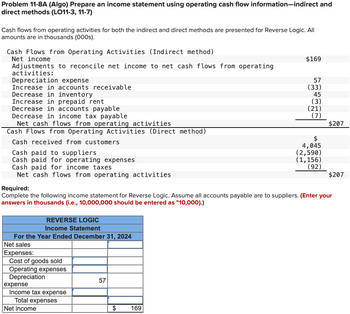

Transcribed Image Text:Problem 11-8A (Algo) Prepare an income statement using operating cash flow information-indirect and

direct methods (LO11-3, 11-7)

Cash flows from operating activities for both the indirect and direct methods are presented for Reverse Logic. All

amounts are in thousands (000s).

Cash Flows from Operating Activities (Indirect method)

Net income

Adjustments to reconcile net income to net cash flows from operating

activities:

Depreciation expense

Increase in accounts receivable

Decrease in inventory

Increase in prepaid rent

Decrease in accounts payable

Decrease in income tax payable

Net cash flows from operating activities

Cash Flows from Operating Activities (Direct method)

Cash received from customers

Cash paid to suppliers

Cash paid for operating expenses

Cash paid for income taxes

Net cash flows from operating activities

REVERSE LOGIC

Income Statement

For the Year Ended December 31, 2024

Net sales

Expenses:

Cost of goods sold

Operating expenses

Depreciation

expense

Income tax expense

Total expenses

Net income

Required:

Complete the following income statement for Reverse Logic. Assume all accounts payable are to suppliers. (Enter your

answers in thousands (i.e., 10,000,000 should be entered as "10,000).)

57

$

$169

169

57

(33)

45

(3)

(21)

(7)

$

4,045

(2,590)

(1,156)

(92)

$207

$207

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $73,600. Depreciation recorded on store equipment for the year amounted to $27,400. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Cash Accounts receivable (net) Merchandise inventory Prepaid expenses Accounts payable (merchandise creditors) Wages payable End of Year $23,500 56,000 35,500 4,750 21,800 4,900 Beginning of Year $18,700 48,000 40,000 7,000 16,800 5,800 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, casharrow_forwardWhich of the following would be subtracted from net income when using the indirect method to derive net cash from operating activities? a. Decrease in accounts payable b. Loss on sale of investments c. Decrease in accounts receivable d. Depreciation expensearrow_forwardIn a statement of cash flows using indirect method, an increase ininventory is A. deducted from Net IncomeB. reported as an outflow of cashC. added to net incomeD. no effect on cash flowsarrow_forward

- Why is it necessary to convert profits (as determined in the income Statement) to cash nows?arrow_forwardWhen using the Indirect Method of preparing the Statement of Cash Flows, in the operating section, some accounts are added and some costs are subtracted. If you had to explain to someone why an increase in accounts receivable is subtracted and the opposite as to why a decrease In accounts recelvable is added, what information would you relay to them? (Include in your response the concept of accruals, FASB guidelines, sales and net income on the income statement, and the balance sheet). Answer should be in a paragraph form.arrow_forwardUsing the following answer keys, you are to identify in which activity each of the transactions is classified and its effect on cash flows. Cash Flow Classification.using the capital letter only: . .Operating Activity • L.Investing Activity • F..Financing Activity • OL.Operating and Investing Activity • N.Noncash Transaction Effect on Cash Flows.using the capital letter only: • .Increase • D.Decrease N.No Effect Transaction Cash Flow Classification Effect on Cash Flows Paid a cash dividend. Decreased accounts receivable. Increased inventory. Retired long-term debt with cash. Sold long-term securities at a loss. Issued stock for equipment. Decreased prepaid insurance. Purchased treasury stock with cash. Retired a fully depreciated truck (no gain or loss). Transferred cash to money market account.arrow_forward

- a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from (used for) operating activities: Net income ✓ Adjustments to reconcile net income to net cash flows from (used for) operating activities: Depreciation expense ✓ ✓ Gain on disposal of equipment ✓ Changes in current operating assets and liabilities: Increase in accounts receivable Decrease in inventory Decrease in prepaid insurance Decrease in accounts payable Increase in income taxes payable Net cash flows from operating activities Feedback 00 00000arrow_forwardView previous at Required information Assume a company prepares the statement of cash flows using the indirect method. The company purchases its Inventory on credit from suppliers. How should a decrease in accounts payable be reflected In the section that reconciles net income to cash flow from operating activitles? Multiple Choice It would be added if the section starts with net income and subtracted if it starts with a net loss It would be added in reconciling net income to cash flow from operafing activities It would be subtracted in reconciling net income to cash flow from operating activities A change in accounts payable does not affect the reconciliation of net income to cash flow from operating activities < Prev 15 of 15 Next Form 1040Sch...pdf 6 Form1040 Sch...pdf B1040 Sohedul...pdf Form8829 (1).pdf MacBook Airarrow_forwardHelp with part "a" please!arrow_forward

- Provide iand Create nformation needed to create a Statement of Cash Flows using the Indirect Method. You MUST include: Net Income At least 3 items that go under operating activities. At least 2 items that go under investing activities. At least 2 items that go under financing activities. And 1 non-cash transaction.arrow_forwardWhich of the cash flows would be classified as cash flows from operating activities? i) Cash received from fees earnedii) Cash paid for repayment of loaniii) Cash received from sale of landiv) Cash paid to suppliersv) Cash paid for marketing expenses Options i, ii and ii, Options ii, iv and iii Options v, iv and iii Options i, iv and varrow_forwardMatch each of the following term with the corresponding description. Not all descriptions will be used._____ Operating activities_____ Indirect method_____ Cash equivalent_____ Investing activities_____ Direct method_____ Financing activitiesA. Measures the percent of net income that comes from high-margin products.B. Includes such events as the receipt of dividends and interest on investment assets.C. Includes assets that are very liquid and have original maturities of three months or less.D. The percent of total debt represented by a company's cash account.E. These activities include only purchases made with borrowed funds.F. Where cash flows from operating activities are calculated by converting each revenue and expense item from an accrual to a cash basis.G. This ratio multiplies net income by the average rate of interest the company receives on its investments.H. This ratio uses net income instead of operating cash flow to Analysis a company's ability to finance the cost of its…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education