FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

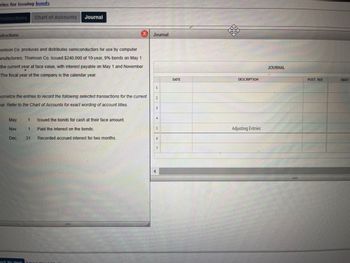

Transcribed Image Text:### Bond Issuance and Interest Journal Entries

#### Instructions:

Thomson Co. produces and distributes semiconductors for use by computer manufacturers. Thomson Co. issued $240,000 of 10-year, 9% bonds on May 1 of the current year at face value, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year.

Journalize the entries to record the following selected transactions for the current year. Refer to the Chart of Accounts for exact wording of account titles.

#### Transactions:

**May 1:** Issued the bonds for cash at their face amount.

**Nov. 1:** Paid the interest on the bonds.

**Dec. 31:** Recorded accrued interest for two months.

#### Journal Entry Table:

| DATE | DESCRIPTION | POST. REF. | DEBIT | CREDIT |

|------------|-------------------------|------------|-------|--------|

| | | | | |

| | | | | |

| | | | | |

| May 1 | | | | |

| | | | | |

| | | | | |

| Nov. 1 | | | | |

| | | | | |

| | | | | |

| Dec. 31 | Adjusting Entries | | | |

| | | | | |

This information will help students understand how to record journal entries for the issuance of bonds and the payment and accrual of bond interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A business issued a 30-day, 7% note for $33,600 to a creditor on account. The company uses a 360-day year for interest calculations. Required: Journalize the entries to record (a) the issuance of the note on April 30 and (b) the payment of the note at maturity, including interest. Refer to the Chart of Accounts for exact wording of account titles. Chart Of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Accounts Receivable 112 Interest Receivable 113 Notes Receivable 115 Merchandise Inventory 116 Supplies 118 Prepaid Insurance 120 Land 123 Building 124 Accumulated Depreciation-Building 125 Office Equipment 126 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 213 Interest Payable 214 Notes Payable 215 Salaries Payable 216 Social Security Tax Payable 217 Medicare Tax Payable 218 Employees Federal Income Tax Payable 219 Employees State Income…arrow_forwardLundquist Company received a 60-day, 4% note for $46,000, dated July 23, from a customer on account. Required: a. Determine the due date of the note. b. Determine the maturity value of the note. Assume 360 days in a year. c. Journalize the entry to record the receipt of the payment of the note at maturity. Refer to the Chart of Accounts for exact wording of account titles.arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education