Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

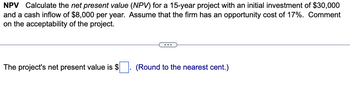

Transcribed Image Text:NPV Calculate the net present value (NPV) for a 15-year project with an initial investment of $30,000

and a cash inflow of $8,000 per year. Assume that the firm has an opportunity cost of 17%. Comment

on the acceptability of the project.

The project's net present value is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Compute the payback statistic for Project Y and recommend whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 11 percent and the maximum allowable payback is one year. Time: 0 1 2 3 4 5 Cash flow: −100 75 100 300 75 200arrow_forwardConnor Corporation is considering two projects (see below). For your analysis, assume these projects are mutually exclusive with a required rate of return of 12%. project 1 project 2 initial investment $(510,000) $(685,000) cash flow year 1 485,000 610,000 Compute the following for each project: NPV (net present value) PI (profitability index) IRR (internal rate of return) Based on your analysis, answer the following questions : Which is the best choice? Why? Which project should be selected and why? If the projects had the same IRR amounts but different NPV totals, then how would you know which project to select? Explain.arrow_forwardA project has an initial cost of $50,000, expected net cash inflows of $11,000 per year for 10 years, and a cost of capital of 14%. What is the project's NPV? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- (NPV, PI, and IRR calculations) Fijisawa Inc. is considering a major expansion of its product line and has estimated the following free cash flows associated with such an expansion. The initial outlay would be $1,850,000, and the project would generate incremental free cash flows of $600,000 per year for 5 years. The appropriate required rate of return is 9 percent. a. Calculate the NPV. b. Calculate the PI. c. Calculate the IRR. d. Should this project be accepted?arrow_forwardYou are responsible to manage an IS project with a 4-year horizon. The annal cost of the project is estimated at $40,000 per year, and a one-time costs of $120,000. The annual monetary benefit of the project is estimated at $96,000 per year with a discount rate of 6 percent. a. Calculate the overall return on investment (ROI) of the project. b. Perform a break-even analysis (BEA). At what year does break-even occur?arrow_forwardFind internal rate of return of a project with an initial cost of $43,000, expected net cash inflows of $9,550 per year for 8 years, and a cost of capital of 9.35%. Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. A. 15.64% B. 14.90% C. 13.70% D. 14.75% E. 11.17%arrow_forward

- A project has an initial cost of $65,000, expected net cash inflows of $12,000 per year for 8 years, and a cost of capital of 8%. What is the project's NPV? (Hint:Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardMolin Inc. is considering to a project that will have the following series of cash flow from assets (in $ million): Year Cash flow 0 -1,580.92 1 453 2 749 3 935 The required return for the project is 6%. Year Cash flow 0 -1,580.92 1 453 2 749 3 935 1. The required return for the project is 6%. 2. What is the project's profitability index? 3. What is the internal rate of return (IRR) for this project?arrow_forwardFind internal rate of return of a project with an initial cost of $43,000, expected net cash inflows of $9,550 per year for 8 years, and a cost of capital of 10.50%.Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. Group of answer choices 15.05% 14.60% 14.90% 16.24% 17.73%arrow_forward

- Compute the traditional payback period (PB) and the discounted payback period (DPB) for a project that costs $329,000 if it is expected to generate $94,000 per year for five years? The firm’s required rate of return is 12.5 percent? Should the project be purchased?arrow_forwardA project has initial costs of $3,000 and subsequent cash inflows of $1350,275,875 and 1525 . The company's 10% cost of capital is an appropriate discount rate for this average risk project. Calculate the following: NPV IRR Profitability Index Please number/label each of your answers as shown above. Be sure to show your TVM function calculator inputs, and four decimal places.arrow_forwardUse the following information to answer questions 11-15:A firm evaluates a project with the following cash flows. The firm has a 2 year payback period criteria and a required return of 11 percent.Year0 1 2 3 4 5Cash flow (OMR) -24,000 17,000 12,000 9,000 -8,000 11,0001-Whatis the net present value for the project?2-Whatis the payback period for the project?3-what is the discounted payback period for the project? 4-What is the profitability index for the project?5-Given your analysis, should the firm accept or reject the project?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education