Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

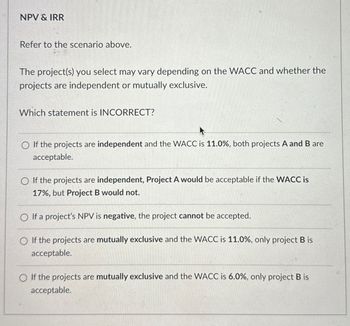

Transcribed Image Text:NPV & IRR

Refer to the scenario above.

The project(s) you select may vary depending on the WACC and whether the

projects are independent or mutually exclusive.

Which statement is INCORRECT?

If the projects are independent and the WACC is 11.0%, both projects A and B are

acceptable.

If the projects are independent, Project A would be acceptable if the WACC is

17%, but Project B would not.

If a project's NPV is negative, the project cannot be accepted.

If the projects are mutually exclusive and the WACC is 11.0%, only project B is

acceptable.

If the projects are mutually exclusive and the WACC is 6.0%, only project B is

acceptable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2) The expected return of Project Y is at least equal to the expected return of Project X, and the variance of Y is less than that of X. What would you do? A) Prefer Project Y B) Accept both projects C) Prefer Project X D) Reject both projects.arrow_forwardWhich of the following is FALSE regarding scenario analysis? Scenario analysis ignores diversification that exists if the project is part of a larger firm Scenario analysis provides a range of outcomes Scenario analysis assumes all "bad" values occur simultaneously and all "good" values occur simultaneously The decision rule for scenario analysis is to accept the project if the range of the outcomes is less than 30% of the base outcome Scenario analysis examines a best case, worst case, and base case situationarrow_forwardConsider the following figure. If firm A were to use the average or composite WACC it would Rate of Return 13.0 (5) 11.0 10.0 90 Project L 70 70 Division L's WACC О Riskov Division H's WACC WACC Project H Composite WACC Firm A Risk Riskov O accept Project L and reject Project H O be making the right decisions on acceptance or rejection of both projects O accept both Project L and Project H O reject both Project L and Project H O accept Project H and reject Project Larrow_forward

- How do I determine which is the correct answer for this problem? A company estimates that an average-risk project has a WACC of 10 percent, a below-average-risk project has a WACC of 8 percent, and an above-average-risk project has a WACC of 12 percent. Which of the following independent projects should the company accept? a. Project A has average risk and an IRR = 9 percent. b. Project B has below-average risk and an IRR = 8.5 percent. c. Project C has above-average risk and an IRR = 11 percent. d. All of the projects above should be accepted. e. None of the projects above should be accepted. Please answer fast I give you upvote.arrow_forwardI think question 3 is not answered clearly. If Project A is rejected due to negative NPV, then all positive NPVs projects should be accepted. The answer is not clear. Please correct me if I am missing something. Question 3) If the firm uses the discounted-payback rule, will it accept any negative NPV projects? Will it turn down any positive NPV projects? How do you know? Your answer is: No Due to Project A's negative NPV, it cannot cover the initial investment within its useful life. Will it turn down any positive NPV projects? It will reject projects with positive NPVs but not those with negative NPVs. If all potential cash flows are taken into account but the project still doesn't reach the designated cutoff point, the NPV can still be positive.arrow_forwardplease solve this practice problem using the images belowarrow_forward

- 1) What is the company's WACC? 2) Should the company take the projects? Assume that the projects have the same risk as an average project for your firm. 3) If one project is depended on the other in a way that the company can only take both projects, should it take it?arrow_forwardWHICH OF THE FOLLOWING STATEMENT IS CORRECT?arrow_forwardEngineering Economicsarrow_forward

- When faced with a set of independent projects, one should select (choose the best answer) all projects with a PI greater than one. all projects with an IRR greater than the hurdle rate all projects with a positive NPV or an IRR greater than the hurdle rate or a PI greater than one. all projects with a positive NPV or an IRR greater than the hurdle rate. all projects with an IRR greater than the hurdle rate or a PI greater than one. all projects with a positive NPV or a PI greater than the one. all projects with a positive NPVarrow_forwardWhich of the following were listed as potential Problems or Issues associated with Using a Rate of Return Approach to justifying single or multiple Mutually Exclusive projects? Note: This is a Multiple Answer question. Please select all of the following options you think are correct? O The ROR calculations are typically more complex than the PW, AW, or FW methods and frequently require the use of trial and error techniques. O You cannot rely on the best Mutually Exclusive project to have the highest ROR. O An incremental approach is required to reliably determine the best project when comparing multiple Mutually Exclusive projects with the ROR approach. O This method assumes that any net positive cash flows are reinvested at the ROR rate. If the ROR rate is substantially larger than MARR, this might not be a realistic assumption. OFor any sequence of Net Cash Flows with more than one sign chance over the life of the project there may be more than one ROR value that satisfies the Rate…arrow_forward29....When using the NPV method the decision making rationale includes the following (select all that apply): a.If projects are mutually exclusive, accept the project with the highest positive NPV. b.If projects are independent, accept if the project NPV<0. c.If projects are independent, accept if the project NPV>0 d.If the projects are mutually exclusive, accept the project with lowest NPV.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education