Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

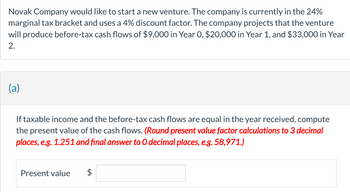

Transcribed Image Text:Novak Company would like to start a new venture. The company is currently in the 24%

marginal tax bracket and uses a 4% discount factor. The company projects that the venture

will produce before-tax cash flows of $9,000 in Year 0, $20,000 in Year 1, and $33,000 in Year

2.

(a)

If taxable income and the before-tax cash flows are equal in the year received, compute

the present value of the cash flows. (Round present value factor calculations to 3 decimal

places, e.g. 1.251 and final answer to O decimal places, e.g. 58,971.)

Present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Similar questions

- Baghibenarrow_forwardVinubhaiarrow_forwardShelton Tax Services is considering investing in new software for their corporate tax business. The investment will require an outlay of $350,000 initially, and is expected to generate the following after-tax cash flows: Year 1, $60,000; Year 2, $80,000; Year 3, $105,000; Year 4, $120,000; Year 5, $145,000. Shelton uses a discount rate of 10%. What is the net present value of the proposed investment? Should this investment be accepted or rejected? Must show your computation steps. Use the appropriate tables in Appendix A to obtain the relevant present value factor and round up your final answer to the nearest dollar.arrow_forward

- You are considering an investment in Fields and Struthers, Inc., and want to evaluate the firm's free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $70 million, had a tax rate of 21 percent, and its depreciation expense was $7 million. Fields and Struthers's NOPAT gross fixed assets increased by $36 million from 2020 and 2021. The firm's current assets increased by $32 million and spontaneous current liabilities increased by $18 million. Calculate Fields and Struthers's NOPAT operating cash flow for 2021. Calculate Fields and Struthers's NOPAT investment in operating capital for 2021. Calculate Fields and Struthers's NOPAT free cash flow for 2021.arrow_forwardAs a financial analyst, you have been tasked with evaluating Randy Watson Music's free cash flow. Based on the 2022 income statement, BIT was $41 million, the tax rate was 21 percent, and its depreciation expense was $6 million. NOPAT gross fixed assets increased by $28 million from 2021 and 2022. The company's current assets increased by $18 million and current liabilities increased by $14 million. Calculate the Investment in operating capital (IOC) for 2022.arrow_forwardPleasearrow_forward

- Chase Brew Inc is considering an investment with the following information: initial investment in assets = $1,600,000 to be depreciated to $0 via straight-line method over 8-year project life sales will increase by $1,750,000/year expenses will increase by $1,240,000/year firm's marginal tax rate is 28% What is the incremental after-tax cash flow (OCF) per year associated with the following project? Enter answer in dollars, rounded to the nearest dollar.arrow_forwardBlossom Company accumulates the following data concerning a proposed capital investment: cash cost $217,280, net annual cash flows $44,000, and present value factor of cash inflows for 10 years is 5.22 (rounded). (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45).) Determine the net present value, and indicate whether the investment should be made. Net present value 24 The investment be made.arrow_forwardTHX Ltd is a private equity firm that is considering investing in an investment project with a cost of R300m which will result in after-tax operating cash flows of R100m per year for 5 years. The company is considering borrowing R150m at an interest rate of 10% per year to partly finance the project. The loan is repayable at the end of year 5. The tax rate is 2896. Determine the IRR of the investment without any borrowing and the IRR if the company undertakes the borrowing.arrow_forward

- You are considering an investment in Fields and Struthers, Inc., and want to evaluate the firm's free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $64 million, had a tax rate of 21 percent, and its depreciation expense was $5 million. Fields and Struthers's NOPAT gross fixed assets increased by $30 million from 2020 and 2021. The firm's current assets increased by $26 million and spontaneous current liabilities increased by $15 million. Calculate Fields and Struthers's NOPAT operating cash flow for 2021. (Enter your answer in millions of dollars rounded to 2 decimal places.) Operating cash flow Calculate Fields and Struthers's NOPAT investment in operating capital for 2021. (Enter your answer in millions of dollars.) Investment in operating capital million Free cash flow Check my work million million Calculate Fields and Struthers's NOPAT free cash flow for 2021. (Enter your answer in millions of dollars rounded to 2 decimal places.)arrow_forwardA new project will generate sales of $97 million, costs of $49 million, and depreciation expense of $10 million in the coming year. The firm's tax rate is 27%. Calculate cash flow for the year (you may use any of the three methods discussed in the chapter 9 -- if done correctly, they should all provide the same answer). (Answer in $ Million, e.g. 10.5 is $10.5 million)arrow_forwardLet's say you are going to be an Uber driver and want to estimate your annual operating after tax cash flows. Assume the following annual estimates: -trip revenue of $20,000 -depreciation expense of $1,000 -gas and maintenance of $3,000 -insurance of $900 -tax rate of 25% - 5 year project - 10% discount rate - for sake of calculation ease, all cash flows occur on the last day of the year. What is the present value of your OCF? $61,031 $49,565 $36,861 $57,240 $28,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education