FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Solve.

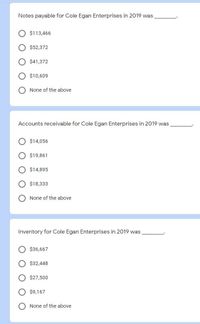

Transcribed Image Text:Notes payable for Cole Egan Enterprises in 2019 was,

$113,466

$52,372

$41,372

O $10,609

None of the above

Accounts receivable for Cole Egan Enterprises in 2019 was

$14,056

$19,861

$14,895

$18,333

None of the above

Inventory for Cole Egan Enterprises in 2019 was,

$36,667

$32,448

$27,500

$9,167

O None of the above

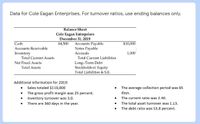

Transcribed Image Text:Data for Cole Eagan Enterprises. For turnover ratios, use ending balances only.

Balance Sheet

Cole Eagan Enterprises

December 31, 2019

$4,500

Accounts Payable

Notes Payable

Accruals

Cash

$10,000

Accounts Receivable

1,000

Inventory

Total Current Assets

Total Current Liabilities

Net Fixed Assets

Long-Term Debt

Stockholders' Equity

Total Liabilities & S.E.

Total Assets

Additional Information for 2019:

Sales totaled $110,000

The average collection period was 65

days.

• The current ratio was 2.40.

• The total asset turnover was 1.13.

The debt ratio was 53.8 percent.

The gross profit margin was 25 percent.

Inventory turnover was 3.0.

There are 360 days in the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you explain DCF model?arrow_forwardThe summarized balance sheets of Pharoah Company and Sheridan Company as of December 31, 2025 are as follows: Assets Liabilities Capital stock Retained earnings Total equities Assets Liabilities Capital stock Retained earnings Total equities Pharoah Company Balance Sheet December 31, 2025 O $444000. O $297000. O $345000. O $350000. Sheridan Company Balance Sheet December 31, 2025 $2000000 $220000 1000000 780000 $2000000 $1480000 $330000 990000 160000 $1480000 If Pharoah Company acquired a 30% interest in Sheridan Company on December 31, 2025 for $350000 and the equity method of accounting for the investment was used, the amount of the debit to Equity Investments (Sheridan) to record the purchase would have beenarrow_forwardDescribe the features of JIT.arrow_forward

- provide answer with explantionarrow_forwardHoover Corp., a wholesaler of music equipment, issued $11,200,000 of 20-year, 9% callable bonds on March 1, 20Y2, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions. Refer to the Chart of Accounts for exact wording of account titles. 20Y2 Mar. 1 Issued the bonds for cash at their face amount. Sept. 1 Paid the interest on the bonds. 20Y4 Sept. 1 Called the bond issue at 102, the rate provided in the bond indenture. (Omit entry for payment of interest.)arrow_forwardExplain an example of external users.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education