ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

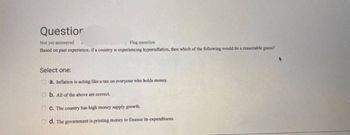

Transcribed Image Text:Questior

Not yet answered

Flag question

Based on past experience, if a country is experiencing hyperinflation, then which of the following would be a reasonable guess?

Select one:

a. Inflation is acting like a tax on everyone who holds money.

b. All of the above are correct.

OC. The country has high money supply growth.

Od. The government is printing money to finance its expenditures.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- stant, does this zero-inflation goal require that the rate of money growth equal zero? If yes, explain why. If no, explain what the rate of money growth should equal. 4. The economist John Maynard Keynes wrote in The Economic Consequences of the Peace (1919): "Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can con- fiscate, secretly and unobserved, an important part of the wealth of their citizens." Justify Lenin's assertion. 5. Suppose that a country's inflation rate increases sharply.. What happens to the inflation tax on the holders of money? Why is wealth that is held in savings accounts not subject to a change in the inflation tax? Can think of any way in which holders of savings accounts are hurt by the increase in the inflation rate? you 12 6. Hyperinflations are extremely rare in countries whose central banks are independent of the rest of the ernment. Why might…arrow_forward11. Which of the following best represents a combination of inflation, slow economic growth and high unemployment in an economy? a.Deflation b.Stagflation c.Disinflation d.Disguised inflationarrow_forwardAnswer this for me mate. Much appreciated.arrow_forward

- If printing of money creates higher inflation, then why may underdeveloped nations print too much money? (Choose One) Money behaves differently in those economies. They believe more money is better. It is easier for them to borrow money. No other nations wish to fund their public projects.arrow_forwardIf a central bank buys government securities from the private sector-money markets,leading to an expansion of the money supply, other things being equal, what would theeffect be on the following?(d) Aggregate Supply(e) Aggregate Demand(f) Economic activity(g) Price level of the economy can you help giving me these 4 ans.arrow_forwardExplain how inflation can be “built into the system.arrow_forward

- What does the term monetary policy primarily refer to in economics? A. Government spending and taxation B. The regulation of international trade C. The control of the money supply and interest rates by a central bank D. The management of government debtarrow_forwardThe economy of Macro Island is described by the quantity equation with constant velocity. All residents of Macro Island understand the quantity theory and use it to form their expectations of inflation. Real income grows at a steady 2 percent per year, and the nominal interest rate is 5 percent. In one year, people had expected the money supply to grow by 4 percent, but in fact it grew by only 3 percent. a. What was the inflation rate? (3% 4% 1% 2%) b. What was the expected inflation rate? (1% 4% 3% 2%) c. What was the ex ante real interest rate? (4% 2% 1% 3%) d. What was the ex post real interest rate? (2% 1% 4% 3%) e. Did the deviation of inflation from what was expected hurt creditors or debtors? ( Creditors Debtors)arrow_forwardThe number of times per year each dollar is spent A. Money Supply B. Velocity C. Price Level D. Quantity of Output E. All of the abovearrow_forward

- Solve this problem I upvotearrow_forwardIf the Bank of Canada wanted to reduce inflation, it could Select one: a. increase the reserve requirement or implement an open market sale. b. increase the reserve requirement or implement an open market purchase. c. decrease the reserve requirement or implement an open market purchase. d. decrease the reserve requirement or implement an open market sale.arrow_forwardAn increase in ________ decreases the quantity of money people want to hold. a. the price level b. real GDP c. the interest rate d. the quantity of moneyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education