FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

These is the question based on the picture given

No. 16 (Roman Construction Company)

The billings in excess of cost or the cost in excess of billings to be reported in the

a. 20,000 excess of cost over billings

b. 20,000 excess of billings over cost

c. 900,000 excess of cost over billings

d. 900,000 excess of billings over cost

Provide a complete solution. Thank You

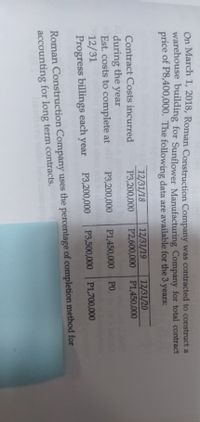

Transcribed Image Text:On March T, 2018, Roman Construction Company was contracted to construct a

warehouse building for Sunflower Manufacturing Company for total contract

price of P8,400,000. The following data are available for the 3 years:

12/31/19

P2,600,000

12/31/18

P3,200,000

ndenco

P3,200,000

12/31/20

P1,450,000

Contract Costs incurred

during the year

Est. costs to complete at

12/31

Progress billings each year

P1,450,000

PO

P3,200,000

P3,500,000 P1,700,000

Roman Construction Company uses the percentage of completion method for

accounting for long term contracts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardBrief Exercise 9-4 (Algo) Calculating return on investment LO 9-4 The following financial information pertains to Smith Architects: Net income Items Beginning assets Ending assets Year 4 $ 241,000 782,000 982,000 a-1. Return on investment Year 3 a-2. Return on investment Year 4 b. The company performed better in Year 3 $ 221,000 706,000 786,000 Required: a. Calculate Smith Architects return on investment for Year 3 and Year 4. Note: Round percentages to 1 decimal place. b. Did the company perform better in Year 3 or Year 4? % %arrow_forwardd Required information [The following information applies to the questions displayed below.] Use the following information: Department Service 1 (S1) Service 2 (52) Production 1 (P1) Production 2 (P2) P1 P2 Total Service Department 2's Costs Cost $ 121,000 53,000 435,000 306,000 $ 915,000 3/8 x 5/8 X Percentage Service Provided to S1 0% 20 52 20% 0 What percentage of S2's costs is allocated to P1 and to P2 under the direct method? (Round your answer to the nearest fraction.) P1 30% 20 P2 50% 60arrow_forward

- eBook Determining missing items in return on investment and residual income computations The following table presents various rates of return on investment and residual incomes: InvestedAssets OperatingIncome Return onInvestment MinimumRate ofReturn MinimumAcceptableOperatingIncome ResidualIncome $980,000 $215,600 (a) 12% (b) (c) 520,000 (d) (e) (f) $62,400 $20,800 320,000 (g) 14% (h) 35,200 (i) 240,000 50,400 (j) 12% (k) (l) Determine the missing items, identifying each item by the appropriate letter. Round dollar amounts to the nearest whole number. Answer a. fill in the blank 1 % b. $fill in the blank 2 c. $fill in the blank 3 d. $fill in the blank 4 e. fill in the blank 5 % f. fill in the blank 6 % g. $fill in the blank 7 h. fill in the blank 8 % i. $fill in the blank 9 j. fill in the blank 10 % k. $fill in the blank 11 l. $fill in the blank 12arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardHi there, from that income statement I am stuck on the following calculations: your help would be greatly appreciated thank you 2019 2020 Asset Turnover: Sales revenue \ total assets (current assets + fixed assets) Non-current asset turnover: Sales \ non-current assets (FA) 440\405=1.09 330\361=0.91 Current ratio: Current assets\ current liabilities Quick ratio: (current asset- inventories) \ current liabilities Inventory days: Average inventory\cost of sales x 365 Receivable days: Average receivables\credit sales x 365 Payable days: Average payables\credit purchases x 365 Interest cover: Operating profit\interest payablearrow_forward

- Based on the pro - forma income statement, please estimate OCF and complete the tables. Sales 125,000 Variable costs -29, 000 Fixed costs -30,000 Depreciation -12,800 EBIT 53, 200 Tax -18, 620 NI 34, 580 Enter your final answers as whole numbers without using 1000 separators. Use a " -" sign for cash costs, expenses, cash outflows. (1) Starting from EBIT EBIT + Depreciation - Tax OCF? = OCF What is EBIT? What is Depreciation? What is Tax? What isarrow_forwardHello Tutor, Can I have assistance with creating the attached commomn statement using income and Balance sheet statements along with the interpreation. I would really appreciate it. using the column of difference on Balance sheet and some transactions on income to determine added or subtracted and transfer to appropriate activity (operating, investing, and financing) with numbers (NO ü). Please insert more column as you need Items 2020 2019 Difference Added Subtracted Operating Investing Financing…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education