FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format and fast answering please and explain proper steps by Step.?

Transcribed Image Text:8

9

10

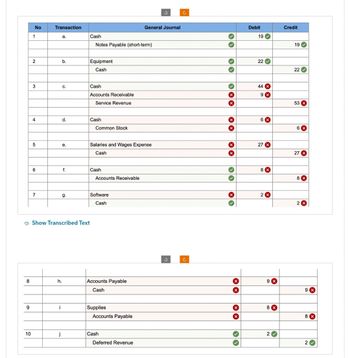

No

1

2

3

4

5

6

7

Transaction

a.

i

b.

j

C.

d.

e.

h.

f.

g.

Show Transcribed Text

Cash

Notes Payable (short-term)

Equipment

Cash

Cash

Accounts Receivable

Service Revenue

Cash

Common Stock

Salaries and Wages Expense

Cash

Cash

Accounts Receivable

Software

Cash

Accounts Payable

Cash

Supplies

Accounts Payable

Cash

General Journal

Deferred Revenue

3

3

››

››

***

X

X

X

X

XX

33

X

X

X

X

››

Debit

19

>

22✔

44 X

9 x

6 x

27 X

8 X

2 X

9 x

8 X

2✔

Credit

19✔

22✔

53

6 x

27 X

8 X

2 x

9 X

8 X

2

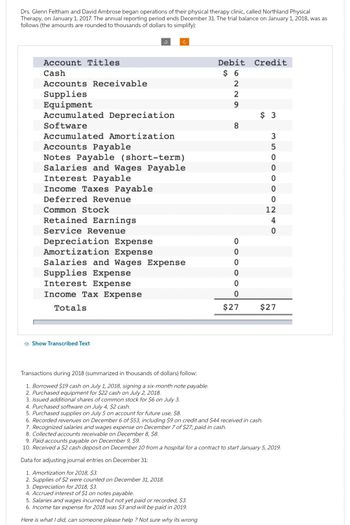

Transcribed Image Text:Drs. Glenn Feltham and David Ambrose began operations of their physical therapy clinic, called Northland Physical

Therapy, on January 1, 2017. The annual reporting period ends December 31. The trial balance on January 1, 2018, was as

follows (the amounts are rounded to thousands of dollars to simplify):

Account Titles

Cash

Accounts Receivable

Supplies

Equipment

Accumulated Depreciation

Software

Accumulated Amortization

Accounts Payable

Notes Payable (short-term)

Salaries and Wages Payable

Interest Payable

Income Taxes Payable

Deferred Revenue

Common Stock

Retained Earnings

Service Revenue

Depreciation Expense

Amortization Expense

Salaries and Wages Expense

Supplies Expense

In

Expense

Income Tax Expense

Totals

Show Transcribed Text

Transactions during 2018 (summarized in thousands of dollars) follow:

1. Borrowed $19 cash on July 1, 2018, signing a six-month note payable.

2. Purchased equipment for $22 cash on July 2, 2018.

3. Issued additional shares of common stock for $6 on July 3.

4. Purchased software on July 4, $2 cash.

5. Purchased supplies on July 5 on account for future use, $8.

Debit

$ 6

2

2

9

8

5. Salaries and wages incurred but not yet paid or recorded, $3.

6. Income tax expense for 2018 was $3 and will be paid in 2019.

Here is what I did, can someone please help ? Not sure why its wrong

0

O O O OOO

0

0

0

Credit

$ 3

6. Recorded revenues on December 6 of $53, including $9 on credit and $44 received in cash.

7. Recognized salaries and wages expense on December 7 of $27; paid in cash.

8. Collected accounts receivable on December 8, $8.

3

35 O

5

0

0

0

0

0

12

4

0

0

$27 $27

9. Paid accounts payable on December 9, $9.

10. Received a $2 cash deposit on December 10 from a hospital for a contract to start January 5, 2019.

Data for adjusting journal entries on December 31:

1. Amortization for 2018, $3.

2. Supplies of $2 were counted on December 31, 2018.

3. Depreciation for 2018, $3.

4. Accrued interest of $1 on notes payable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardMatch each of the components of faithful representation with its definition.Faithful Representation Definition1 . Freedom from error a. All information necessary to describe an item is reported. 2. Neutrality b. Information that does not bias the decision maker. 3. Completeness c. Reported amounts reflect the best available information.arrow_forwardPlease show and explain all steps to solve this problem.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education