Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

1. I need help with this question.

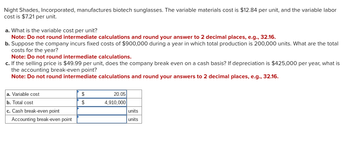

Transcribed Image Text:Night Shades, Incorporated, manufactures biotech sunglasses. The variable materials cost is $12.84 per unit, and the variable labor

cost is $7.21 per unit.

a. What is the variable cost per unit?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

b. Suppose the company incurs fixed costs of $900,000 during a year in which total production is 200,000 units. What are the total

costs for the year?

Note: Do not round intermediate calculations.

c. If the selling price is $49.99 per unit, does the company break even on a cash basis? If depreciation is $425,000 per year, what is

the accounting break-even point?

Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.

a. Variable cost

b. Total cost

c. Cash break-even point

Accounting break-even point

$

20.05

$

4,910,000

units

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Night Shades, Incorporated, manufactures biotech sunglasses. The variable materials cost is $12.14 per unit, and the variable labor cost is $6.89 per unit. a. What is the variable cost per unit? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Suppose the company incurs fixed costs of $845,000 during a year in which total production is 210,000 units. What are the total costs for the year? (Do not round intermediate calculations.) c. If the selling price is $49.99 per unit, does the company break even on a cash basis? If depreciation is $450,000 per year, what is the accounting break-even point? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. Variable cost b. Total cost units c. Cash break-even point units c. Accounting break-even pointarrow_forwardNight Shades Inc. (NSI) manufactures biotech sunglasses. The variable materials cost is $1.89 per unit, and the variable labor cost is $3.4 per unit. a. What is the variable cost per unit? b. Suppose the company incurs fixed costs of $790,000 during a year in which total production is 355,500 units. What are the total costs for the year? c. If the selling price is $10.2 per unit, what is the NSI break-even on a cash basis?arrow_forwardRitchie Manufacturing Company makes a product that it sells for $150 per unit. The company incurs variable manufacturing costs of $60 per unit. Variable selling expenses are $18 per unit, annual fixed manufacturing costs are $480,000, and fixed selling and administrative costs are $240,000 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Use the contribution margin ratio approach. d. Prepare a contribution margin income statement for the break-even sales volume. Complete this question by entering your answers in the tabs below.arrow_forward

- Ritchie Manufacturing Company makes a product that it sells for $140 per unit. The company incurs variable manufacturing costs of $73 per unit. Variable selling expenses are $11 per unit, annual fixed manufacturing costs are $468,000, and fixed selling and administrative costs are $271,200 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Use the contribution margin ratio approach. d. Prepare a contribution margin income statement for the break-even sales volume. Complete this question by entering your answers in the tabs below. Req A to C Req D Determine the break-even point in units and dollars using the equation method, the contribution margin per unit approach and the contribution margin ratio approach. a. Break-even point in units a. Break-even point in dollars b. Contribution margin per unit b. Break-even point in units #arrow_forwardOjo Outerwear Corporation can manufacture mountain climbing shoes for $42.98 per pair in variable raw material costs and $25.40 per pair in variable labor expense. The shoes sell for $134 per pair. Last year, production was 150,000 pairs. Fixed costs were $1,105,000. a. What were total production costs? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What is the marginal cost per pair? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the average cost per pair? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. If the company is considering a one-time order for an extra 6,000 pairs, what is the minimum acceptable total revenue from the order? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) a. Total production cost b. Marginal cost per pair c. Average cost per pair d.…arrow_forwardSuppose that Larimer Company sells a product for $20. Unit costs are as follows: Direct materials $1.70 Direct labor 1.60 Variable factory overhead 2.00 Variable selling and administrative expense 1.50 Total fixed factory overhead is $55,240 per year, and total fixed selling and administrative expense is $38,480. Required: 1. Calculate the variable cost per unit and the contribution margin per unit. 2. Calculate the contribution margin ratio and the variable cost ratio. 3. Calculate the break-even units. 4. Prepare a contribution margin income statement at the break-even number of units. Enter all amounts as positive numbers.arrow_forward

- K-Too Everwear Corporation can manufacture mountain climbing shoes for $11 per pair in variable raw material costs and $13.34 per pair in variable labor expense. The shoes sell for $126 per pair. Last year, production was 180,000 pairs. Fixed costs were $780,000. a. What were total production costs? b. What is the marginal cost per pair? c. What is the average cost? d. If the company is considering a one-time order for an extra 13, 000 pairs, what is the minimum acceptable total revenue from the order?arrow_forwardThe following information is about xyz limited. The usual capacity is 40000 units per month. A number of 44000 units were produced at a variable cost of $10 per unit. Sales are nil. Fixed production overhead at normal capacity is OMR 100000 per month, or OMR 2.500 per unit. 8000 OMR in other recurring costs You must produce a financial statements under 1. Absorbing Spending. 2. Using excess as a price tool .arrow_forwardBlanchard Company manufactures a single product that sells for $180 per unit and whose total variable costs are $135 per unit. The company’s annual fixed costs are $562,500. 1. Prepare a contribution margin income statement for Blanchard Company showing sales, variable costs, and fixed costs at the break-even point. 2. If the company’s fixed costs increase by $135,000, what amount of sales (in dollars) is needed to break even?arrow_forward

- Ritchie manufacturing company makes a product that it sells for $170 per unit. The company incurs variable manufacturing costs of $86 per unit variable selling expenses are 416 per unit, annual fixed manufacturing costs are $458,000, and fixed selling and administrative costs are $242,400 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a) use the equation method b) use the contribution margin per unit approach c) prepare a contribution margin income statement for the break-even sales volume.arrow_forwardDengerarrow_forwardSport Caps Co. manufactures and sells caps for different sporting events. The fixed costs of operating the company are $150,000 per month, and variable costs are $5 per cap. The caps are sold for $8 per unit. The production capacity is 100,000 caps per month.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education