Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

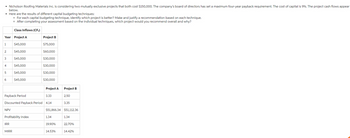

Question

Transcribed Image Text:• Nicholson Roofing Materials Inc. is considering two mutually exclusive projects that both cost $150,000. The company's board of directors has set a maximum four-year payback requirement. The cost of capital is 9%. The project cash flows appear

below.

Here are the results of different capital budgeting techniques:

• For each capital budgeting technique, identify which project is better? Make and justify a recommendation based on each technique.

• After completing your assessment based on the individual techniques, which project would you recommend overall and why?

Year Project A

$45,000

$45,000

3 $45,000

$45,000

$45,000

$45,000

1

2

4

5

6

NPV

Class Inflows (CF+)

Profitability Index

IRR

Payback Period

3.33

Discounted Payback Period 4.14

MIRR

Project B

$75,000

$60,000

$30,000

$30,000

$30,000

$30,000

Project A

1.34

19.90%

Project B

$51,866.34 $51,112.36

14.53%

2.50

3.35

1.34

22.70%

14.42%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are responsible to manage an IS project with a 4-year horizon. The annal cost of the project is estimated at $40,000 per year, and a one-time costs of $120,000. The annual monetary benefit of the project is estimated at $96,000 per year with a discount rate of 6 percent. a. Calculate the overall return on investment (ROI) of the project. b. Perform a break-even analysis (BEA). At what year does break-even occur?arrow_forwardConsider how Root Valley River Park Lodge could use capital budgeting to decide whether the $13,000,000 River Park Lodge expansion would be a good investment. Assume Root Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) (Click the icon to view additional information.) The internal rate of return (IRR) of the expansion is Data table More info example 10-12% Number of additional skiers per day Average number of days per year that weather conditions allow skiing at Root Valley Useful life of expansion (in years) Average cash spent by each skier per day Average variable cost of serving each skier per day Cost of expansion Discount rate Get more help. 12-14% Print 15-16% 16-18% S Done 122 skiers 149 days Assume that Root Valley uses the straight-line depreciation method and expects the lodge expansion to have no residual value at the end of its nine-year life. The project is expected to have an average annual net cash…arrow_forwardYou have been tasked with recommending one of the two investment projects for acceptance by your company. Project 1 costs $100,000 to implement today (it is a cost), it will bring subsequent positive cash flows of $50,000 at the end of year one; and subsequently $30,000; $45,000; $8,000. Project 2 initial cost is $14,000, and subsequent cash flows are $7,000 per year for 3 years. Your company is using WACC of14% for both projects. a. Calculate NPV and IRR for each project, and decide which one to recommend. b. Calculate MIRR for projects A and B. Which project would you recommend based on MIRR? c. Find the crossover rate. What does this rate represent? Describe in YOUR OWN words.arrow_forward

- Explain well with step by step type the answer.arrow_forwardGoergen Corporation is considering a capital budgeting project that would require an initial investment of $700,000. The investment would generate annual cash inflows of $267,000 for the life of the project, which is 4 years. The company's discount rate is 10%. The net present value of the project is closest to: Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice $368,000 $700,000 $846,123 $146,123arrow_forwardAnswer the given question with a proper explanation and step-by-step solution. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 7%. 0 1 2 3 4 Project A -1,000 600 440 210 260 Project B -1,000 200 375 360 710 What is Project A's payback? Do not round intermediate calculations. Round your answer to four decimal places. ____ years What is Project A's discounted payback? Do not round intermediate calculations. Round your answer to four decimal places. ______ years What is Project B's payback? Do not round intermediate…arrow_forward

- U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono Project Edge Project Clayton Capital investment $176,000 $192,500 $212,000 Annual net income: Year 1 15,400 19,800 29,700 15,400 18,700 25,300 15,400 17,600 23,100 4 15,400 13,200 14,300 15,400 9,900 13,200 Total $77,000 $79,200 $105,600 Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. (a) Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) years Project Bono years Project Edge years Project Claytonarrow_forward7. Fiftycent Inc., has hired you to advise the firm on a capital budgeting issue involving two unequal-lived, mutually exclusive projects, S and T. The cash flows for each project are presented in the following table. Calculate the NPV and the annualized net present value (ANPV) in order to copy for each project using the firm's cost of capital of 9.0%. Which project would you recommend? (Click on the icon here the contents of the data table below into a spreadsheet.) Initial Investment Year 1 2 456 A WN 3 4 7 Project S $42,000 The NPV for project S is $ The NPV for project T is $ The ANPV for project S is $ The ANPV for project T is $ Which project would you recommend? The firm should choose project (1) - (1) OS OT $17,750 24,600 36,800 - Cash Inflows Project T $67,500 $26,400 22,600 37,000 19,700 10,900 15,350 9,780 (Round to the nearest cent.) (Round to the nearest cent.) 203 005 (Round to the nearest cent.) (Round to the nearest cent.) (Select from the drop-down menu.) bau bao otis…arrow_forwardA company is considering a 10-year capital investment project. The project has annual positive cash flows each year. The accounting manager has calculated the NPV of the same project using three different costs of capital (8%, 10% and 18 %) as discount rates. Select the most logical combination of NPVS from the choices given. Note: You cannot calculate the NPVS nor do you need to. O $(5,743) $3,152 $6,612 O $(5,743) $6,612 $3,152 $3,152 $6,512 $(5,743) O $6,512 $3,152 $(5,743) O None of the abovearrow_forward

- OPPfel Hospitality Consulting Inc. has two similar financial projects to offer one of its corporate clients in the hospitality industry. OPPfel wants to evaluate a set of capital budgeting projects and come up with the best decision according to the project’s IRR and PI for the client. NINV and NCF data for both of the projects are shown in the data table below: Year Project AR Project BF 0 -$100,000 -$100,000 1 $70,000 $20,000 2 $60,000 $50,000 3 $20,000 $100,000 If the minimum required rate of return is 10.00% for both of the capital budgeting projects, which one of the projects provides a better investment decision that OPPfel can consult to the its client?arrow_forwardThe senior management of Netherworld Ltd is evaluating four project proposals and will select one project to invest in. The following summary information is available: Project Code Initial Investment Required Net Present Value Project life (years) A 172,000 48,000 7 B 155,000 48,000 12 C 115,000 39,100 7 D 141,000 38,500 3 Required: Calculate the profitability index for each project. In order of preference, rank the four projects in terms of net present value and the profitability index. Which project do you think should be chosen?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education