ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

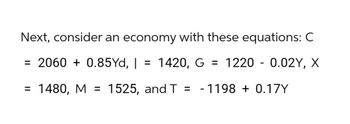

Transcribed Image Text:Next, consider an economy with these equations: C

= 2060 + 0.85Yd, |

= 1420, G = 1220 - 0.02Y, X

= 1480, M = 1525, and T = -1198 + 0.17Y

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the mean of these numbers? (Please round your answer to 2 decimal places, ex: 3.21) X: 254 319 246 230 156 219 321arrow_forwardPlot the following system of equations on the following graph. System of Equations: p=6−2qp=6−2q p=4+qp=4+qarrow_forwardSuppose that the annual rates of growth of real GDP of Econoland over a five-year period were as follows: Year Growth Rate 1 4% 2 28 3 -2% 4 48 5 6% What was the average of these growth rates in Econoland over these five years? Instructions: Round your answer to one decimal place. % What term would economists use to describe what happened in year 3? (Click to select) If the growth rate in year 3 had been a positive 2 percent rather than a negative 2 percent, what would have been the average growth rate? 1%arrow_forward

- This case study focuses on the Australian economy in 2019, before the COVID-19 pandemic hit. On 4th September 2019, the Australian Bureau of Statistics (ABS) published Real GDP data for the quarter ending June 2019. (The reporting of GDP always lags by about 2 months as it takes time to collect and compile data). The data showed that the Australian economy recorded quarterly growth of 0.5%. However, there was a decrease in Real GDP per capita. Furthermore, Real GDP per capita in June 2019 was lower than it was a year before (June 2018). Overall, while Real GDP still increased, the growth was very weak; the weakest on record since March 2001. (Source: Australian Financial Review and The Guardian). Required: Question 1. Clearly explain what Real GDP per capita means.Clearly explain why Real GDP per capita decreased whereas there was still growth in Real GDP for the quarter ending June 2019. Question 2. Given the economic conditions described above, predict how the following key…arrow_forwardThe figure above shows the log of UK real GDP per capita between 1875 and 1914. Which of the following is correct? Log of Real GDP per capita 10,5 10,0 9,5 9,0 8,5 8,0 7,5 1875 1890 5061 1920 1935 1950 1965 1980 y=0,0156x +7,7734 R²=0,94451 1995 2010 O The growth of GDP in the 1950s was above the long-run average. O The growth of GDP in the 1880s was above the long-run average. In the figure the coefficient on x is 0.0156 and tells us the slope of the regression line (line of best fit). If, instead, this were 0.02 the line would be flatter. ● The slope of the blue line tells us the rate of growth of per capita GDP but can tell us nothing about the level.arrow_forwardA certain country's GDP (total monetary value of all finished goods and services produced in that country) can be approximated by g(t) = 2,000-420e 0.07t billion dollars per year (0 ≤t≤ 5), where t is time in years since January 2010. Find an expression for the total GDP G(t) of sold goods in this country from January 2010 to time t. HINT: [Use the shortcuts.] G(t) = Estimate, to the nearest billion dollars, the country's total GDP from January 2010 through June 2014. (The actual value was 7,321 billion dollars.) Xbillion dollarsarrow_forward

- Solve the following system of equations for a and for b: System of Equations: Value of a Value of b 9a + 3b = 30 8a + 4b = 24arrow_forwardThe GDP of South Africa in 1950 was 77,836.88 million dollars. In 2019 it was 748,861 million dollars. What has been the annualized growth rate of GDP for South Africa during the period 1950 to 2019? Use growth compounding to calculate the number and write the answer in percent terms with up to two decimals (e.g., 10.22 for 10.22%, or 2.33 for 2.33%).arrow_forwardWhat does it mean for a steady-state to be unstable (a.k.a, a source)?Explain................ in economicsarrow_forward

- In 2018, the country of Questville had a GDP of $39000.00 and the country of Mistania had a GDP of $19500.00, which is half, or 50% of Questville's GDP. If Questville grows at the slow rate of 1% for 5 years while Mistania grows at the fast rate of 6% for 5 years, what will Mistania's GDP be as a percentage of Questville's GDP in 5 years from now? Include the % sign in your answer. Does this example illustrate the concept of convergence? OYes SONOarrow_forwardSuppose that the world's current oil reserves is R = 2060 billion barrels. If, on average, the total reserves is decreasing by 15 billion barrels of oil each year, answer the following: A.) Give a linear equation for the total remaining oil reserves, R, in terms of t, the number of years since now. (Be sure to use the correct variable and Preview before you submit.) R= B.) 8 years from now, the total oil reserves will be billions of barrels. C.) If no other oil is deposited into the reserves, the world's oil reserves will be completely depleted (all used up) approximately years from now. (Round your answer to two decimal places.)arrow_forwardThe Montag Family purchased a house in 2020 and expects its value (in thousands of dollars) t years in the future will be well-modeled by the function V(t)=310(1.08). By what percentage does the model predict the house will increase in value each year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education