FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

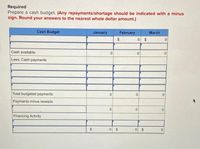

Transcribed Image Text:Required

Prepare a cash budget. (Any repayments/shortage should be indicated with a minus

sign. Round your answers to the nearest whole dollar amount.)

Cash Budget

January

February

March

0 $

Cash available

Less: Cash payments

Total budgeted payments

Payments minus receipts

Financing Activity

%24

%24

%24

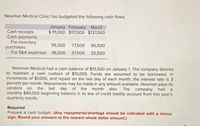

Transcribed Image Text:Newman Medical Clinic has budgeted the following cash flows.

January February March

$11,000 $117,000 $137,000

Cash receipts

Cash payments

For inventory

purchases

For S&A expenses 36,500

95,500

77,500 90,500

37,500

32,500

Newman Medical had a cash balance of $13,500 on January 1. The company desires

to maintain a cash cushion of $10,000. Funds are assumed to be borrowed, in

increments of $1,000, and repaid on the last day of each month; the interest rate is 3

percent per month. Repayments may be made in any amount available. Newman pays its

vendors on

the last day of the month also. The company had a

monthly $40,000 beginning balance in its line of credit liability account from this year's

quarterly results.

Required

Prepare a cash budget. (Any repayments/shortage should be indicated with a minus

sign. Round your answers to the nearest whole dollar amount.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Newman Medical Clinic has budgeted the following cash flows. January February March $101,000 $107,000 $127,000 Cash receipts Cash payments For inventory purchases For S&A expenses Newman Medical had a cash balance of $8,500 on January 1. The company desires to maintain a cash cushion of $6,000. Funds are assumed to be borrowed, in increments of $1,000, and repaid on the last day of each month; the interest rate is 2 percent per month. Repayments may be made in any amount available. Newman pays its vendors on the last day of the month also. The company had a monthly $40,000 beginning balance in its line of credit liability account from this year's quarterly results. Cash Budget Beginning cash balance Add: Cash receipt Cash available Less: Cash payments 90,500 31,500 Required Prepare a cash budget. (Any repayments/shortage should be indicated with a minus sign. Round your answers to the nearest whole dollar amount.) For inventory purchases For S&A expenses Interest expense per month…arrow_forwardCheyenne Company has budgeted the following information for June: Cash receipts Beginning cash balance Cash payments Desired ending cash balance If there is a cash shortage, the company borrows money from the bank. All cash is borrowed at the beginning of the month in $1,000 increments, and interest is paid monthly at 1% on the first day of the following month. The company had no debt before June 1. The amount of interest paid on July 1 would be: Multiple Choice $590. $ 339,000 22,000 382,000 42,000 $476.arrow_forwardThe following information was taken from Bonita Industries's cash budget for the month of July: Beginning cash balance $440000 Cash receipts 404000 Cash disbursements 558000 If the company's policy is to maintain a minimum end of the month cash balance of $430000, the amount the company would have to borrow in July is $286000. $144000. $10000. $26000.arrow_forward

- Gadubhaiarrow_forwardGarden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: Total cash receipts. Total cash disbursements 1st Quarter 2nd Quarter 3rd Quarter $ 210,000 $ 240,000 $ 281,000 $ 241,000 The company's beginning cash balance for the upcoming fiscal year will be $26,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Beginning cash balance Total cash receipts Total cash available Total cash disbursements Excess (deficiency) of cash available over disbursements Financing: Borrowings Repayments Interest $360,000 $ 251,000 Required: Prepare…arrow_forwardGarden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter $ 200,000 $ 350,000 $ 230,000 $250,000 $274,000 $244,000 $234,000 $ 254,000 Total cash receipts Total cash disbursements The company's beginning cash balance for the upcoming fiscal year will be $24,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Required: Prepare the company's cash budget for the upcoming fiscal year. (Repayments, interest, and cash deficiencies should be indicated by a minus sign.)arrow_forward

- Fayette Medical Clinic has budgeted the following cash flows. February $232,000 January March Cash receipts Cash payments For inventory purchases For S&A expenses $240,000 $272,000 220,000 62,000 164,000 64,000 190,000 54,000 Fayette Medical had a cash balance of $16,000 on January 1. The company desires to maintain a cash cushion of $10,000. Funds are assumed to be borrowed, in increments of $2,000, and repaid on the last day of each month; the interest rate is 1 percent per month. Repayments may be made in any amount available. Fayette pays its vendors on the last day of the month also. The company had a monthly $80,000 beginning balance in its line of credit liability account from this year's quarterly results. Required Prepare a cash budget. (Any repayments/shortage should be indicated with a minus sign. Round intermediate and final answers to the nearest whole dollar amounts.) X Answer is not complete. Cash Budget January February March Section 1: Cash receipts Beginning cash…arrow_forwardFoyert Corporation requires a minimum $7,000 cash balance. Loans taken to meet this requirement cost 1% interest per month (paid at the end of each month). Any preliminary cash balance above $7,000 is used to repay loans at month-end. The cash balance on October 1 is $7,000, and the company has an outstanding loan of $3,000. Budgeted cash receipts (other than for loans received) and budgeted cash payments (other than for loan or interest payments) follow. (please see picture for other info) October November December Cash receipts $ 23,000 $ 17,000 $ 21,000 Cash payments 25,500 16,000 15,000 Prepare a cash budget for October, November, and December.arrow_forwardPlease answer with excel forumlas and step by step explanations. Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. Cash Receipts Cash payments January $ 569,000 $ 508,000 February 455,000 425,000 March 505,000 600,000 Kayak requires a minimum cash balance of $38,000 at each month-end. Loans taken to meet this requirement charge 0.7% interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $38,000 is used to repay loans at month-end. The company has a cash balance of $38,000 and a loan balance of $76,000 at January 1. Prepare monthly cash budgets for January, February, and March.arrow_forward

- Newman Medical Clinic has budgeted the following cash flows. January February March $109,000 $115,000 $135,000 Cash receipts Cash payments For inventory purchases For S&A expenses Newman Medical had a cash balance of $12,500 on January 1. The company desires to maintain a cash cushion of $8,000. Funds are assumed to be borrowed, in increments of $1,000, and repaid on the last day of each month; the interest rate is 1 percent per month. Repayments may be made in any amount available. Newman pays its vendors on the last day of the month also. The company had a monthly $40,000 beginning balance in its line of credit liability account from this year's quarterly results. Required Prepare a cash budget. (Any repayments/shortage should be indicated with a minus sign. Round your answers to the nearest whole dollar amount.) 94,500 76,500 89,500 35,500 36,500 31,500 Cash Budget Cash available Less: Cash payments Total budgeted payments Payments minus receipts Financing Activity $ EA January 0 0…arrow_forwardGarden Depot is a retailer that provided the following budgeted cash flows for next year: 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterTotal cash receipts $ 290,000 $ 410,000 $ 340,000 $ 360,000Total cash disbursements $ 351,000 $ 321,000 $ 311,000 $ 331,000The company’s beginning cash balance for next year will be $47,000. The company requires a minimum cash balance of $10,000 and may borrow money at the beginning of any quarter and may repay any part of its loans at the end of any quarter. Interest payments, based on a quarterly interest rate of 3%, are due on any principal at the time it is repaid. For simplicity, assume interest is not compounded. Required:Prepare the company’s cash budget for next year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education