Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

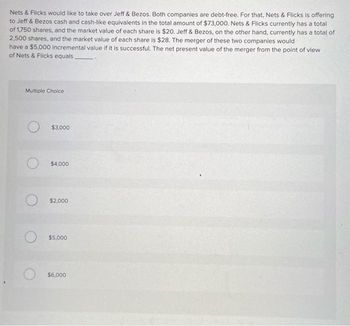

Transcribed Image Text:Nets & Flicks would like to take over Jeff & Bezos. Both companies are debt-free. For that, Nets & Flicks is offering

to Jeff & Bezos cash and cash-like equivalents in the total amount of $73,000. Nets & Flicks currently has a total

of 1,750 shares, and the market value of each share is $20. Jeff & Bezos, on the other hand, currently has a total of

2,500 shares, and the market value of each share is $28. The merger of these two companies would

have a $5,000 incremental value if it is successful. The net present value of the merger from the point of view

of Nets & Flicks equals.

Multiple Choice

$3,000

$4,000

$2,000

$5,000

$6,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use below information for following two questions (Q24-Q25). AAA Corporation and BBB Corporation are identical in every way except their capital structures. AAA Corporation, an all-equity firm, has 35 million shares of stock outstanding, currently worth $25 per share. BBB Corporation uses leverage in its capital structure. The market value of BBB’s debt is $250mil., and its cost of debt is 3.5 percent. Each firm is expected to have earnings before interest and tax of $175mil. in perpetuity. Assume that every investor can borrow at 3.5 percent per year. Corporate tax rate is 35% and personal tax rate on bond interest income is 30%. Q24. What is the value of BBB corporations? $833.33 mil. $892.86 mil. $875 mil. $642.86 mil. $962.5 mil.arrow_forwardMcNabb Enterprises is considering going private through a leveraged buyout by management. Management currently owns 21 percent of the 5 million shares outstanding. Market price per share is $20, and it is felt that a 40 percent premium over the present price will be necessary to entice public shareholders to tender their shares in a cash offer. Management intends to keep its shares and to obtain senior debt equal to 80 percent of the funds necessary to consummate the buyout. The remaining 20 percent will come from junior subordinated debentures. Terms on the senior debt are 2 percent above the prime rate with principal reductions of 20 percent of the initial loan at the end of each of the next five years. The junior subordinated debentures bear a 13 percent interest rate and must be retired at the end of six years with a single balloon payment. The debentures have warrants attached that enable the holders to purchase 30 percent of the stock at the end of the sixth year. Management…arrow_forwardDFS Corporation is currently an all-equity firm, with assets with a market value of $ 163 million and 5 million shares outstanding. DFS is considering a leveraged recapitalization to boost its share price. The firm plans to raise a fixed amount of permanent debt (i.e., the outstanding principal will remain constant) and use the proceeds to repurchase shares. DFS pays a 21 % corporate tax rate, so one motivation for taking on the debt is to reduce the firm's tax liability. However, the upfront investment banking fees associated with the recapitalization will be 6 % of the amount of debt raised. Adding leverage will also create the possibility of future financial distress or agency costs; shown in the table here, are DFS's estimates for different levels of debt. a. Based on this information, which level of debt is the best choice for DFS? b. Estimate the stock price once this transaction is announced. 9 Debt amount ($ million) 0 10 20 30 40 50 Present value of expected distress and…arrow_forward

- ABC Co. and XYZ Co. are identical firms in all respects except for their capital structures. ABC is all-equity financed with $575,000 in stock. XYZ uses both stock and perpetual debt; its stock is worth $287,500 and the interest rate on its debt is 8.5 percent. Both firms expect EBIT to be $64,000. Ignore taxes. a. Richard owns $34,500 worth of XYZ's stock. What rate of return is he expecting? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. Suppose Richard invests in ABC Co. and uses homemade leverage to match his cash flow in part (a). Calculate his total cash flow and rate of return. (Enter your return answer as a percent. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What is the cost of equity for ABC and XYZ? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g ., 32.16.) d. What is the WACC for ABC…arrow_forwardTrux Ltd is a listed company in the heavy vehicle industry. The market value of Trux Ltd's net debt is $800 million and the company has 250 million shares outstanding. Use this information to help answer the questions below. An analyst has collected the following information and wants to estimate the value of Trux's shares using the discounted free cash flow (FCF) model: Trux's FCF was $120 million in year 0 (historical FCF in the year just passed). Trux expects its FCF to grow by 10% per year for the next three years (in year 1, year 2 and year 3). Trux expects its FCF to grow by 4% per year indefinitely thereafter. The cost of equity is 15%. The cost of debt is 5%. The weighted average cost of capital is 12%. Using the discounted free cash flow model and the information above, what is the enterprise value of Trux? If a different analyst believes that the enterprise value of Trux Ltd is $2,500 million. According to this analyst, what will be the equity value per share of Trux Ltd?arrow_forwarda) Jetpack Ltd. has an all equity capital structure. It has total assets worth $10 million, 10,000 outstanding shares and an EBIT of $750,000. It is contemplating a move to incorporate debt to the tune of 25% of itsasset value and can arrange the borrowing at a 5% p.a. interest rate. Wendy, a shareholder in the company, has 700 shares.i) What is Wendy's current percentage return if Jetpack follows a 100% dividend pay-out policy and there are no taxes?ii) If Wendy prefers the company to remain all equity financed, show how she could unlever her position to maintain the same percentage return as she is earning currently?b) Companies X and Y both wish to raise $100 million 10-year loans. Company X wishes to borrow at a fixed rate of interest as it wants to have a certainty about its future interest liabilities, while company Y wishes to borrow at a floating rate because its treasurer believes that interest rates are likely to fall in the future. Company X has been offered a fixed interest…arrow_forward

- ABC Co. and XYZ Co. are identical firms in all respects except for their capital structures. ABC is all-equity financed with $500,000 in stock. XYZ uses both stock and perpetual debt; its stock is worth $250,000 and the interest rate on its debt is 8 percent. Both firms expect EBIT to be $51,000. Ignore taxes. a. Richard owns $25,000 worth of XYZ's stock. What rate of return is he expecting? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. Suppose Richard invests in ABC Co. and uses homemade leverage to match his cash flow in part (a). Calculate his total cash flow and rate of return. (Enter your return answer as a percent. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What is the cost of equity for ABC and XYZ? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) d. What is the WACC for ABC and…arrow_forwardCede & Co can borrow at 11 percent. Cede currently has no debt, and the cost of equity is 12 percent. The current value of the firm is $664,000. The corporate tax rate is 30 percent. Required: What will the value be if Cede borrows $223,000 and uses the proceeds to repurchase shares?arrow_forwardSupercool Inc is currently an unlevered firm with 1,000 outstanding shares. It expects togenerate $1,600 in EBIT in perpetuity. The tax rate is 35%. All earnings after tax are paid outas dividends. The firm is considering a capital restructuring for which the company will issue$3,000 of debt to buy back shares. Its cost of debt is 10%. Unlevered firms in the sameindustry have a cost of equity of 20%. The capital restructuring is going to take place onemonth after its announcement. What is the share price of Supercool on the day before andafter the restructuring completion?arrow_forward

- You currently own 1,500 shares of JKL, Inc. JKL is an all equity that has 700,000 shares of stock outstanding at a market price of $25 a share. The company's earnings before interest and taxes are $3,500,000. You believe that the JKL should finance 50 percent of assets with debt, but management refuses to leverage the company. Given that similar firms' pay 9 percent interest on their debt, answer the following questions. Part A: How much money should you borrow to create the leverage on your own? Assume you can borrow funds at 9 percent interest. Part B. How many additional shares of JKL stock must you purchase (using the borrowed funds in Part A) to create the leverage on your own?arrow_forwardNOPREM Inc. is a firm whose shareholders don't possess the preemptive right. The firm currently has 1,000 shares of stock outstanding, the price is $100 per share. The firm plans to issue an additional 1,000 shares at $90.00 per share. Since the shares will be offered to the public at large, what is the amount per share that old shareholders will lose if they are excluded from purchasing new shares?a. $90.00b. $5.00c. $10.00d. $0e. $2.50arrow_forwardYou currently own 1,100 shares of JKL, Inc. JKL is an all equity that has 700,000 shares of stock outstanding at a market price of $15 a share. The company's earnings before interest and taxes are $2,100,000. You believe that the JKL should finance 33.33 percent of assets with debt, but management refuses to leverage the company. Given that similar firms' pay 11 percent interest on their debt, answer the following questions. Part A: How much money should you borrow to create the leverage on your own? Assume you can borrow funds at 11 percent interest. Part B: How many additional shares of JKL stock must you purchase (using the borrowed funds in Part A) to create the leverage on your own?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education