FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Need to fix Debit and Credit on #13 of the table (it is incorrect)

| No | Account Titles and Explanation | Debit | Credit |

| 1 | Cash | 25,900 | |

| Common Stock | 25,900 | ||

| Issued common stock for $25,900 cash. Cash is received and stock is issued. | |||

| 2 | Cash | 7,600 | |

| Note payable | 7,600 | ||

|

Obtained a bank loan for $7,600 by issuing a note payable. Cash is received and the liability is also increased.

|

|||

| 3 | Equipment | 11,900 | |

| Cash | 11,900 | ||

| Equipment is bought by paying cash. | |||

| 4 | Office rent | 1,300 | |

| Cash | 1,300 | ||

| Office rent is paid through cash. | |||

| 5 | Supplies | 1,550 | |

| Cash | 1,550 | ||

| Supplies are bought for $1,550 cash. | |||

| 6 | Advertising Expense | 650 | |

| Accounts Payable Daily Herald | 650 | ||

| Advertising is purchased on accounts of Daily Herald for $650. | |||

| 7 | Cash | 2,160 | |

| 17,240 | |||

| Revenue | 19,400 | ||

| Performed services for $19,400, cash of $2,160 is received from customers, and the balance of $17,240 is billed to customers on account. | |||

| 8 | Dividends | 430 | |

| Cash | 430 | ||

| Paid $430 dividend to stockholders. | |||

| 9 | Utilities | 2,160 | |

| Cash | 2,160 | ||

| Utility bill is paid for the month,2,160 | |||

| 10 | Accounts Payable | 650 | |

| Daily Herald | 650 | ||

| Advertising bought on accounts is paid in cash $650 | |||

| 11 | Interest Expense | 40 | |

| Cash | 40 | ||

| Paid $40 of interest on the bank for the loan of $7,600 obtained from the bank. | |||

| 12 | Salaries | 6,910 | |

| Cash | 6,910 | ||

| Salaries for $6,910 are paid in cash. | |||

| 13 | Cash | 17,240 | (need value here) |

| Accounts Receivable | (need value here) | 17,240 | |

|

Accounts Receivable $17,240 Cr Cash is received for the balance of $17,240 billed to customers on account for services performed. |

|||

More information

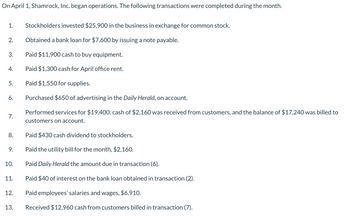

Transcribed Image Text:On April 1, Shamrock, Inc. began operations. The following transactions were completed during the month.

1. Stockholders invested $25,900 in the business in exchange for common stock.

Obtained a bank loan for $7,600 by issuing a note payable.

Paid $11,900 cash to buy equipment.

Paid $1,300 cash for April office rent.

Paid $1,550 for supplies.

Purchased $650 of advertising in the Daily Herald, on account.

Performed services for $19,400: cash of $2,160 was received from customers, and the balance of $17,240 was billed to

customers on account.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

Paid $430 cash dividend to stockholders.

Paid the utility bill for the month, $2,160.

Paid Daily Herald the amount due in transaction (6).

Paid $40 of interest on the bank loan obtained in transaction (2).

Paid employees' salaries and wages, $6,910.

Received $12,960 cash from customers billed in transaction (7).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Do not give answer in imagearrow_forwardA -1 Prepared by Reviewed by William, Inc. Bank Confirmation - General Account December 31, 2022 Balance per Bank at December 31, 2022 $20,200.22 * Deposit in Transit - per A-1-2 2,000.00 # Outstanding Checks - per A-1-3 (5,200.00) Other - Note Collected by Bank (10,000.00) ^ Bank Service Charge (9.50) Balance per Books at December 31, 2022 $8,990.72 * f f Column footed. ^ Amount agrees to amount recorded as a deposit on the bank statement and description agrees with receipt enclosed with 12/31/22 bank statement. This note is the Kristopher note receivable that was recorded as a receipt by the client in the cash receipts journal on January 3, 2023. The receivable was appropriately credited and properly reflected in the January cash receipts journal. No adjustment needed as bank and books simply record this in different periods. #Agreed to December 31,…arrow_forwardaj.8arrow_forward

- Don't give answer in image formatarrow_forwardhow do you do the IF formula?arrow_forwardInstructions: Calculate the following Reconciliation for Hancock, Reid, & Carson for the period ending March 31, 2021. Prepare the March bank reconciliation statement on the blank statement provided for Hancock, Reid, & Carson Ltd. according to the following information: • Royal Bank of Canada statement says the current balance is $17,864.12. • There was an NSF cheque #1706 from Peter Bartrum in the amount of $1,870.54. There are bank service charges of $60.00; there are overdraft interest charges of $86.90; there is a preauthorized loan payment charge of $617.44; the bank paid Hancock, Reid & Carson Ltd. $204.12 interest on a revolving T-bill investment, and there is a charge of $54.00 for the annual rental of a safety deposit box. Upon comparing the bank statement to the company's cheque register, you noted that the final balance in the cheque register was $16,627.01 and that cheques #588 for $198.27, #592 for $i,846.40, #596 for $374.80 and #599 for $1,320.40 are outstanding. You…arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.]The August bank statement and cash T-account for Martha Company follow: BANK STATEMENT Date Checks Deposits Other Balance August 1 $ 13,600 August 2 $ 120 13,480 August 3 $ 9,300 22,780 August 4 220 22,560 August 5 160 22,400 August 9 530 21,870 August 10 130 21,740 August 15 3,100 24,840 August 21 220 24,620 August 24 15,500 9,120 August 25 5,650 14,770 August 30 620 14,150 August 30 Interest earned $ 20 14,170 August 31 Service charge 10 14,160 Cash (A) Debit Credit August 1 Balance 13,600 Deposits Checks written August 2 9,300 120 August 1 August 12 3,100 220 August 2 August 24 5,650 160 August 3 August 31 4,100 130 August 4 530 August 5 200 August 15 280 August 17 620 August 18 220 August 19…arrow_forwardQuestion attached appreicaietd it 2io4n2o4i24oih24oyih24oi24hy24oihg wrgwoirgh14oih1oiharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education