FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

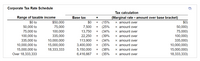

Need help to learn how to calculate the tax liability, after-tax earnings, and average tax rates for the following levels of corporate earnings before taxes:

$7,700; $81,100; $304,000; $499,000;$1.9 million; $9.8 million; and $19.8 million.

b. Plot the average tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). What generalization can be made concerning the relationship between these variables?

Attached is the chart

Transcribed Image Text:Corporate Tax Rate Schedule

Tax calculation

Range of taxable income

$0 to

(Marginal rate x amount over base bracket)

$0)

50,000)

Base tax

+

$50,000

$0

x amount over

(15%

(25%

(34%

(39%

(34%

(35%

(38%

(35%

+

50,000 to

x amount over

75,000

100,000

335,000

7,500

+

x amount over

x amount over

75,000)

100,000)

335,000)

10,000,000)

15,000,000)

18,333,333)

75,000 to

13,750

22,250

100,000 to

x amount over

335,000 to

10,000,000 to

10,000,000

113,900

+

15,000,000

3,400,000

+

x amount over

15,000,000 to

Over 18,333,333

x amount over

x amount over

18,333,333

5,150,000

6,416,667

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Data table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) TABLE 1.2: Tax Rates and Income Brackets for Joint Returns (2018) Tax Rates 10% 12% 22% 24% 32% 35% 37% Taxable Income Joint Returns $0 to $19,050 $19,051 to $77,400 $77,401 to $165,000 $165,001 to $315,000 $315,001 to $400,000 $400,001 to $600,000 Over $600,000 Iarrow_forwardTable 1.4 Use the following tax rates and income brackets to answer the following question(s). Tax Rate Individual Returns 10% $0 to $8,350 15% $8,351 to $33,950 $33,951 to $82,250 $82,251 to $171,550 $171,551 to $372,950 Over $372,951 25% 28% 33% 35% Joint Returns $0 to $16,700 $16,701 to $67,900 $67,901 to $137,050 $137,051 to $208,850 $208,851 to $372,950 $16,750 $18,836 $22,425 $25,116 Over $372,951 Josh earned $89,700 in taxable income and files an individual tax return. What is the amount of Josh's taxes for the year?arrow_forwardRequired Answer each of the following questions by providing supporting computations. 1. Assume that the company’s income tax rate is 30% for all items. Identify the tax effects and after-tax amounts of the three items labeled pretax. 2. Compute the amount of income from continuing operations before income taxes. What is the amount of the income tax expense? What is the amount of income from continuing operations? 3. What is the total amount of after-tax income (loss) associated with the discontinued segment? 4. What is the amount of net income for the year?arrow_forward

- Using the tax rate schedule given here LOADING..., perform the following: a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $ 15 000; $ 60 000; $ 90 000; $ 150 000; $ 250 000; $ 450 000; and $1 million. b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis) $0 to $9,875 $0 (10% amount over $0) 9,876 to 40, 125 988 + (12% amount over 9, 876) 40, 126 to 85, 525 4,618 + (22% amount over 40, 126) 85,526 to 163, 300 14, 606 + (24% amount over 85, 526) 163, 301 to 207, 350 33, 272 + (32% amount over 163, 301) 207, 351 to 518, 400 47,368 (35% amount over 207, 351) 518,401 to Unlimited 156, 235 (37% amount over 518, 401)arrow_forwardneed answer in step by steparrow_forwardollect the latest annual report of an ASX listed company for the last 2 financial years. Please read the financial statements (balance sheet, income statement, cash flow statement) and notes attached to financial statements on income tax issues very carefully. Please remember some aspects of your firm’s treatment of its tax – can be a very complicated area, particularly for some firms. Based on your understanding of the topic “accounting for income tax” and based on your reading of the collected annual reports, do the following tasks.i Briefly explain the concepts of accounting profit, taxable profit, temporary difference, taxable temporary difference, deductible temporary difference, deferred tax assets and deferred tax liability.ii Briefly explain the recognition criteria of deferred tax assets and deferred tax liability.iii What is your firm’s tax expense in its latest financial statements?iv Is this figure the same as the company tax rate times your firm’s accounting income?…arrow_forward

- I am working on creating an excel sheet using tax brackets. Can you please assist me with an excel formula that would automatically calculate the tax with the following bracket: Cumulative Tax Income Less than 22,000 22,000 89,450 190,750 364,200 462,500 693,750 Rate 10% 12% 22% 24% 32% 35% 37% $2,200 10,294 32,580 74,208 105,664 186,602 My objective is to determine net income after taxes. I need to determine the formula so I can automatically calculate tax based on the respective tax rates when typing in their income. I have figured out the other part, but am not sure with the IF/Then formula. Thank you! Taxable Income 72,300 Federal Income Tax ??????arrow_forwardNeed Help with this Questionarrow_forwardExercise 3-23 (Algorithmic) (LO. 6) Compute the 2023 tax liability and the marginal and average tax rates for the following taxpayers. Click here to access the 2023 tax rate schedule. If required, round the tax liability to the nearest dollar. When required, round the average rates to four decimal places before converting to a percentage (l.e., .67073 would be rounded to .6707 and entered as 67.07%). a. Chandler, who files as a single taxpayer, has taxable income of $157,600. Tax liability: Marginal rate: Average rate: 14,934 X 19.78 X % % b. Lazare, who files as a head of household, has taxable income of $72,000. Tax liability: Marginal rate: Average rate: % %arrow_forward

- Use the following information to calculate the federal average tax rate (ignore tax credits) for a taxpayer who earned $115,000 from employment, and where bonds were sold for $20,000 during the year that originally cost $10,000: Taxable income Up to $47,630 On the next $47,629 On the next $52,408 On the next $62,704 Over $210,371 Select one: Tax Rate 15% 20.5% Based on the above, the average tax rate (ATR) is closest to: a. 19.15% b. 19,45% c. 20.5% d. 26.0% 26% 29% 33%arrow_forwardFirst, explain the difference between marginal and average tax rates. Looking at a recent statement for Nvidia what is their marginal tax bracket? Provide a link to a recent income statement and current tax rates that you used.arrow_forwardHelparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education