Concept explainers

The auditors of Steffey Ltd., decided to study the cash receipts and disbursements for the month of July of the current year under audit. They obtained the bank reconciliations and the cash journals prepared by the company accountants, which revealed the following:

June 30: Bank balance, $355,001; deposits in transit, $86,899; outstanding checks, $42,690; general ledger cash balance, $399,210.

July 1: Cash receipts journal, $650,187; cash disbursements journal, $565,397. July 31: Bank balance, $506,100; deposits in transit, $51,240; outstanding checks, $73,340; general ledger cash balance, $484,000. Bank statement record of deposits: $835,846; of payments: $684,747.

Required:

-

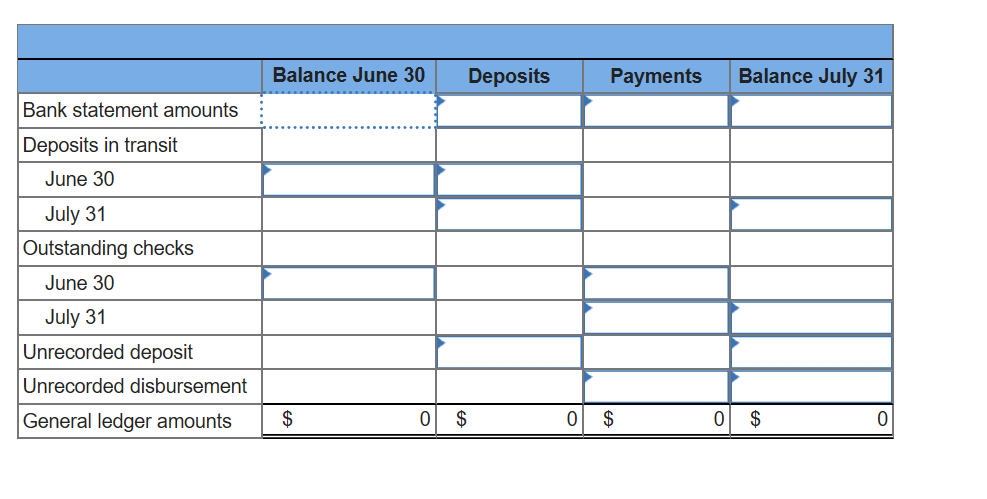

Prepare a four-column proof of cash covering the month of July of the current year. (Negative amounts or amounts to be deducted should be indicated by a minus sign.)

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- A company's general ledger shows a cash balance of $2,350. Comparing the company's cash records with the monthly bank statement reveals several additional cash transactions such as deposits outstanding of $1,750, note collected by the bank on the company's behalf of $1,400, and interest earned of $33. The company also finds an error by the bank of an additional deposit of $140. Calculate the correct balance of cash. Cash balançearrow_forwardUsing the following information: The bank statement balance is $3,159. The cash account balance is $3,414. Outstanding checks amounted to $511. Deposits in transit are $641. The bank service charge is $116. A check for $43 for supplies was recorded as $34 in the ledger. Prepare a bank reconciliation for Miller Co. for August 31.arrow_forwardThe following data were accumulated for use in reconciling the bank account of Mathers Co. for July: Cash balance according to the company's records at July 31, $32,110. Cash balance according to the bank statement at July 31, $31,350. Checks outstanding, $2,870. Deposit in transit, not recorded by bank, $4,150. A check for $170 in payment of an account was erroneously recorded in the check register as $710. Bank debit memo for service charges, $20. a. Prepare a bank reconciliation, using the format shown in Exhibit 14. Mathers Co. Bank Reconciliation July 31 Cash balance according to bank statement $ Add deposit in transit, not recorded by bank Deduct outstanding checks Adjusted balance $ Cash balance according to company's records $ Add error in recording check as $710 instead of $170 Deduct bank service charge Adjusted balance $ Feedback a. Set up two columns: one for the company cash account section and the other for…arrow_forward

- In your audit of Ginko Company, you have received a cash confirmation and a cutoff statement from the bank on Ginko’s one bank account. Prepare a list of substantive procedures for Ginko’s casharrow_forwardThe following data were accumulated for use in reconciling the bank account of Creative Design Co. for August 20Y6: Cash balance according to the company's records at August 31, $21,880. Cash balance according to the bank statement at August 31, $23,260. Checks outstanding, $4,440. Deposit in transit, not recorded by bank, $3,570. A check for $170 in payment of an account was erroneously recorded in the check register as $710. Bank debit memo for service charges, $30. a. Prepare a bank reconciliation, using the format shown in Exhibit 13. Creative Design Co.Bank ReconciliationAugust 31, 20Y6 Cash balance according to bank statement $fill in the blank edbfa3fe702204a_1 Adjustments: - Select - - Select - Total adjustments fill in the blank edbfa3fe702204a_6 Adjusted balance $fill in the blank edbfa3fe702204a_7 Cash balance according to company's records $fill in the blank edbfa3fe702204a_8 Adjustments: $- Select - -…arrow_forwardThe information below was taken from the bank transfer schedule prepared during the audit of Fox Co.'s financial statements for the year ended December 31, 2005. Assume all checks are dated and issued on December 30, 2005. Check No. 101 202 303 404 Bank Accounts From National Federal County State Federal American Dec. 31 State Republic Jan. 2 To Disbursement Date Per Books Per Bank Dec. 30 Jan. 4 Jan. 2 Jan. 3 Jan. 3 Jan. 2 Receipt Date Per Books Dec. 30 Dec. 30 Jan. 2 Jan. 2 Per Bank Jan. 3 Dec. 31 Which of the following checks illustrate deposits/transfers in transit at December 31, 2005? Jan. 2 Dec. 31arrow_forward

- The balance in Happ Incorporated's general ledger Cash account was $14,190 at August 31, before reconciliation. The August 31 balance shown in the bank statement was $12,730. Reconciling items included deposits in transit, $1,360; bank service charges, $150; NSF check written by a customer and returned with the bank statement, $610; outstanding checks, $540; and interest credited to the account during September but not recorded on the company's books, $120. Required: Prepare a bank reconciliation as of August 31 for Happ Incorporated Balance per bank Add: Deduct: Reconciled balance. HAPP INCORPORATED Bank Reconciliation August 31 Balance per books Add: Deduct: Reconciled balancearrow_forwardIn the course of our audit of Ettedanreb Corporation’s cash in bank for the year ended December 31, 2016, you ascertained the following information: November 30 December 31 Cash per book 60,350 ? Cash per bank statement 535,410 689,085 Undeposited checks 41,005 64,400 Outstanding checks 138,590 150,560 Bank service charges 3,600 3,000 Insufficient fund check 41,250 Company’s notes receivable collected by bank 359,075 404,500 The bank statement and the company’s records show the following totals: Cash disbursements per bank statement 1,091,865 Cash receipts per cash records ? Cash disbursements per cash records ? Cash receipts per bank statement 1,245,540 Additional information: The insufficient fund check was redeposited in the same month. No entries are made to take up the return…arrow_forwardThe cash account for Stone Systems at July 31 indicated a balance of $17,750. The bank statement indicated a balance of $33,650 on July 31. Comparing the bank statement and the accompanying canceled checks and memos with the records reveals the following reconciling items:a. Checks outstanding totaled $17,865.b. A deposit of $9,150, representing receipts of July 31, had been made too late to appear on the bank statement.c. The bank had collected $6,095 on a note left for collection. The face of the note was $5,750.d. A check for $390 returned with the statement had been incorrectly recorded by Stone Systems as $930. The check was for the payment of an obligation to Holland Co. for the purchase of office supplies on account.e. A check drawn for $1,810 had been incorrectly charged by the bank as $1,180.f. Bank service charges for July amounted to $80. Instructions 1. Prepare a bank reconciliation.2. Journalize the necessary entries. The accounts have not been closed.3. If a balance sheet…arrow_forward

- Using the following information: (a) The bank statement balance is $5,389. (b) The cash account balance is $5,686. (c) Outstanding checks amounted to $736. (d) Deposits in transit are $961. (e) The bank service charge is $63. (f) A check for $50 for supplies was recorded as $41 in the ledger. Required: Prepare a bank reconciliation for Candace Co. for May 31. Be sure to complete the statement heading. Refer to the Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. “Deduct” or “Add” will automatically appear if it is required. Enter all amounts as positive values.arrow_forwardBank reconciliation and entriesThe cash account for Stone Systems at July 31, 20Y5, indicated a balanceof $17,750. The bank statement indicated a balance of $33,650 on July 31,20Y5. Comparing the bank statement and the accompanying canceledchecks and memos with the records reveals the following reconcilingitems: A. Checks outstanding totaled $17,865.B. A deposit of $9,150, representing receipts of July 31, had beenmade too late to appear on the bank statement.C. The bank had collected $6,095 on a note left for collection. Theface of the note was $5,750.D. A check for $390 returned with the statement had been incorrectly recorded by Stone Systems as $930. The check was forthe payment of an obligation to Holland Co. for the purchase ofoffice supplies on account.E. A check drawn for $1,810 had been incorrectly charged by thebank as $1,180.F. Bank service charges for July amounted to $80. Instructions1. Prepare a bank reconciliation.2. Journalize the necessary entries.3. If a balance sheet…arrow_forwardIn the audit of a client with a fiscal year ending December 31, the CPAs obtain a January 10 bank statement directly from the bank. Explain how this cutoff bank statement will be used a. In the review of the December 31 bank reconciliation.b. To obtain other audit information.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education