FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

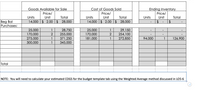

hi! can you create the inventory tracking for this?

Transcribed Image Text:Goods Available for Sale

Cost of Goods Sold

Ending Inventory

Price/

Price/

Price/

Units

Unit

Total

Units

Unit

Total

Units

Unit

Total

Beg Bal

Purchases:

14,000 $ 2.00 | $ 28,000

14,000 $ 2.00 $ 28,000

$

25,000

1

28,750

25,000

1

29,150

170,000

2

255,000

170,000

2

254,100

275,000

1

371,250

181,000

1

272,850

94,000

1

126,900

300,000

1

345,000

Total

NOTE: You will need to calculate your estimated COGS for the budget template tab using the Weighted Average method discussed in LO5-6

Transcribed Image Text:Balance Sheet

Income Statement

Statement of Cash Flows

Assets

Liab

Notes Pay

Events

Equity

Acct Rec

Inventory

Building

Аcct Pay

Div Pay

Wages Pay

Retain Earnings

Accum Depr

8,333.00 | $

Cash

Equipment

Land

Common Stock

ΑΡIC

Account Titles

Revenue

Expense

Net Income

Туре

Amount

Beginning Balances as of Dec 31, Year 1

1.Acquired $550,000 by signing a note payable with a local bank

2. Sold 25,000 shares of $22 Common Stock for $1,500,000

3. Purchased Equipment for $300,000

4. Purchased Inventory on Account - 25,000 Units at $1.15 per unit

5a. Sold 15,000 units at $3.50 on Account

17,500.00 | $ 28,000.00

257,000.00 | $

550,000

1,500,000

(300,000)

24

50,000.00 | $

250,000.00

118,000.00

200,000.00 $

100,000.00 | $

176,167.00

Financing

$4

$ 1,500,000

$4

$4

550,000

550,000

550,000 $

Financing

Investing

950,000

$4

28,750

300,000

(300,000)

$4

52,500

28,750

Non Cash

$4

Non Cash

$4

(29,150)

52,500

52,500

52,500

5b. COGS for Sales on Account

(29,150)

$4

(29,150)

$4

29,150 | $

Non Cash

70,000 |$

(117,250)

(70,000)

Operating

Operating

6. Collect $70,000 on AcCount

7. Paid $117,250 of Accounts Payable

8. Purchased Inventory on Account - 170,000 Units at $1.50 per unit

9a. Sold 175,000 units at $3.50 on Account

9b. COGS for Sales on Account

10. Collect $472,500 on Account

11. Paid $218,600 of Accounts Payable

12. Purchased Inventory on Account - 275,000 Units at $1.35 per unit

13a. Sold 200,000 units at $3.50 on Account

70,000

$4

$4

$ (117,250)

(117,250)

255,000

$4

612,500

255,000

Non Cash

$4

$4

612,500

(254,100)

612,500

612,500

(254,100)

Non Cash

(254,100)

254,100 $

Non Cash

472,500 $

(218,600)

Operating

Operating

Non Cash

Non Cash

$4

(218,600)

(472,500)

472,500

$4

$ (218,600.00)

371,250

$4

371,250

$4

$4

$4

(272,850)

700,000

700,000

700,000

700,000

272,850 $

$4

(735,000)

13b. COGS for Sales on Account

(272,850)

(272,850)

$4

Non Cash

735,000| $

14. Collect $735,000 on Account

15. Paid $494,150 of Accounts Payable

16. Purchased Inventory on Account - 300,000 Units at $1.15 per unit

17. Paid Sales & Marketing Expenses of $30,000

18. Paid Operating Expenses of $75,708

19. Record Wages Payable of $40,000

20. Paid Product Line Research & Development Expenses of $150,000

21. Paid Advertising Expenses of $87,500

24

%24

Operating

Operating

735,000

(494,150)

$4

(494,150.00)

(494,150)

345,000

$4

345,000.00

Non Cash

(30,000)

(75,708)

30,000 | $

75,708 |$

$4

(30,000)

$4

(75,708)

(30,000)

(75,708)

(40,000)

(150,000)

(87,500)

(30,000)

(75,708)

(40,000)

(150,000)

(87,500)

Operating

Operating

$4

$4

$4

40,000

$4

40,000 | $

$4

150,000 $

Operating

Operating

(150,000)

(150,000)

$4

(87,500)

$4

87,500 | $

$4

(87,500)

22. Made the yearly required payment on the note payable. The note carries a 7%

$

interest rate and requires payments of $50,000 plus interest each December 31.

38,500 | $

(88,500)

(50,000)

$

(38,500)

$

(38,500)

Operating

(88,500)

23. Record first year of Depreciation on Equipment Purchased in Year 2 with Salvage

Value of $38,000 & useful life of 7 Yrs

24. Declared a $10,000 cash dividend for stockholders

25. Paid a $10,000 cash dividend for stockholders

$

37,429.00

(37,429)

$

37,429 | $

(37,429)

Non Cash

10,000.00

(10,000)

Non Cash

$4

(10,000)

2,012,792 $

2$

$4

(10,000.00)

Financing

Net Change in Cash

$4

(10,000)

$ 1,755,792

$4

Balance at end of Yr 2

105,000 | $

471,900 $ 300,000 | $

50,000 | $

250,000

45,762 $

288,000 | $

500,000 $

40,000 $

750,000 $

1,050,000 $

515,930

1,365,000 $ 1,015,237 $

349,763

Total Assets

$

3,143,930

Total Liabilities & Equity

3,143,930

%2A A A

%24 4

%24

%24

%24

%24

%24

%24

%24

%24

%24 4

%24

%24

%24

%24

%24

%24

%24

%24

%24

%24

%24 4

%24 A

%2A 4

%24

%24

%24

%24

%24

%24

%24

%24

%24

%24

%24

%24

%24

%24 4

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The image below shows the Sales History worksheet. The following HLOOKUP function was entered into the Base Data worksheet which is in the same workbook as the Sales History worksheet: =HLOOKUP(A7,Sales History'!$A$2:$E$6,2,FALSE) The word North is entered into cell A7 on the Base Data worksheet. What will be the output of this function? 1 2 3 4 5 6 7 A 4% 5% 2020 2019 2018 2017 с D Annual Sales Growth by Region North South West East North #REF! error code -2% B 5% 4% -2% 1% -5% -4% -1% -3% 3% 2% -7% -6% E 0% -9% -8% -10% Farrow_forwardWhat are some advantages of using a software system versus recording transactions manually (by hand)?arrow_forwardGive me a conclusion paragraph about the impact of AI in Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education