Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

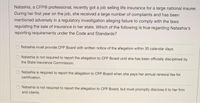

Transcribed Image Text:Natashia, a CFP® professional, recently got a job selling life insurance for a large national insurer.

During her first year on the job, she received a large number of complaints and has been

mentioned adversely in a regulatory investigation alleging failure to comply with the laws

regulating the sale of insurance in her state. Which of the following is true regarding Natashia's

reporting requirements under the Code and Standards?

Natashia must provide CFP Board with written notice of the allegation within 30 calendar days.

Natashia is not required to report the allegation to CFP Board until she has been officially disciplined by

the State Insurance Commission.

Natashia is required to report the allegation to CFP Board when she pays her annual renewal fee for

certification.

Natashia is not required to report the allegation to CFP Board, but must promptly disclose it to her firm

and clients.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- September 29, 2022 Mr. Ahmed Zinna 16 Southside Drive Charlotte, NC 28204 Dear Mr. Zinna: This letter is in response to your inquiry regarding the tax consequences of the proposed capital improvement projects at your Calvin Street and Stowe Avenue locations. As I understand your proposal, you plan to incur certain expenditures that are intended to make your stores more accessible to disabled individuals in accordance with the Americans with Disabilities Act. The capital improvements you are planning (e.g., ramps, doorways, and restrooms that are accessible) qualify for the disabled access credit if the costs are incurred for a facility that was placed in service before The projected expenditures of s location qualify for the credit. for your Stowe Avenue % of the eligible expenditures that exceed s In addition, the credit is calculated at the rate of but do not exceed s . You should also the amount of the . Thus, the maximum credit in your situation would be s be aware that the basis…arrow_forwardAn independent CPA who conducts audits of entities that receive federal financial assistance has what responsibility related to a peer review? O Does not have to have one unless he/she belongs to the AICPA Private Companies Practice Section. O Must have one every year. O Must have one at least every two years. Must have one at least every three years. 45 Oarrow_forwardHilda received a research grant from the University of Timberland in amounts of $10,000 for her time and $3,000 for related supplies and expenses. She purchased a $28,000 Audi the day after depositing the school’s check. Hilda is a candidate for a PhD in philosophy and ethics. What is her gross income from the grant? Where did you locate your answer? If you located a case, Administrative Interpretation(s) or IRC section, is the authority still valid?arrow_forward

- Nadine visits Urban Air, a trampoline park. Before Nadine can enter the trampoline park, Urban Air requires her to sign a release stating that Urban Air will not be held responsible for any injury of any kind that Nadine incurs while on Urban Air property, no matter what the cause of the injury is. While Nadine is jumping on a trampoline, her boyfriend Trevor joins her. Trevor’s ex-girlfriend Valarie, who is an Urban Air employee, becomes enraged and pushes Nadine off the trampoline. Nadine breaks an arm in the incident. Who can Nadine sue for her injuries? a) Urban Air only b) Nadine cannot sue anyone because she signed a release of liability form. c) Valarie and Urban Air Select correct answerarrow_forwardMarysol works for an accounting firm. One of her client's work papers was selected for review by a state CPA's society voluntary quality review panel. Is Marysol required to obtain the client's permission before allowing the panel to review the work papers? Explain rules or regulations governing when work papers can be shared.arrow_forwardWhat choices do the Carpenters have in the face of the IRS’s decision about their tax liability?arrow_forward

- Marika Katz bought a new Blazer and insured it with only compulsory insurance 10/20/5. Driving up to her summer home one evening, Marika hit a parked car and injured the couple inside. Marika’s car had damage of $9,600, and the car she struck had damage of $7,900. After a lengthy court suit, the couple struck were awarded personal injury judgments of $15,900 and $6,900, respectively. What will the insurance company pay for this accident? What is Marika’s responsibility?arrow_forwardRead the following cases. Required: For each case, select whether the action or situation shows a violation of the AICPA Code of Professional Conduct, and select the relevant rule. a. CPA Jerry Cheese became the new auditor for Python Insurance Company. Cheese knew a great deal about insurance accounting but had never conducted an audit of an insurance company. Consequently, Cheese hired CPA Tate Gilliam, who had six years of experience with the State Department of Insurance Audit. Gilliam managed the audit, and Cheese was the partner in charge. b. CPA Mackenzie Palin practices public accounting and is a director of Comedy Company. Palin's firm performs consulting and tax services for Comedy. Palin prepared unaudited financial statements on Comedy's letterhead and submitted them to First National Bank in support of a loan application. Palin's accounting firm received a fee for this service. c. CPA Ellery Idle audited the financial statements of Monty Corporation and gave an unmodified…arrow_forwardAOL, LLC, mistakenly made public the personal information of 650,000 of its members. The members filed a suit in California, alleging violations of federal law and California state law. The member agreement between AOL and its members included a provision declaring Virginia as the location of any court dispute. AOL asked the court to dismiss the suit on the basis of that "forum-selection" clause in its member agreement. Under a previous decision of the United States Supreme Court, a forum-selection clause is unenforceable "if enforcement would contravene a strong public policy of the forum in which suit is brought." California courts previously have declared in other cases that clauses similar to the AOL clause contravene a strong public policy. If the court applies the doctrine of stare decisis, will it dismiss the suit? Explain. [Doe 1 v. AOL LLC, 552 F.3d 1077 (9th Cir. 2009)] (See The Common Law Tradition.)arrow_forward

- The Director of Insurance may revoke, suspend, or refuse to issue a producer license for failing to pay all the following EXCEPT: California taxes child support Director-levied civil penalties license renewal feesarrow_forwardIn reviewing of subsequent events, you learned of heavy damage to the client’s warehouse due to a fire occurred after year-end. The loss will partly be reimbursed by insurance. The newspaper described the event in detail. The client made adjustment to related inventories and buildings to reflect the loss. Assume im a auditor, and I am giving opinion. Since the client made adjustments to related inventories and buildings to reflect the loss after a heavy damage. However, it is a non-adjustable subsequent event, the company is not supposed to adjust the entries. Also, they haven’t claimed to make any footnotes to explain the crisis, which is inadequately disclosed, which both are accounting disagreements, since it is heavy damage, so both are supposed to be highly material, so adverse opinions should be issued. If the client did disclose the footnotes to explain the crisis, adverse opinions with explanatory opinion should be issued. Is adverse opinion with explanatory paragraph…arrow_forwardTammy Potter, a new partner with the regional CPA firm of Tower & Tower, was recently appointed to the board of directors of a local civic organization. The chairman of the board of the civic organization is Lewis Edmond, who is also the owner of a real estate development firm, Tierra Corporation. Potter was quite excited when Edmond indicated that his corporation needed an audit and he wished to discuss the matter with her. During the discussion, Potter was told that Tierra Corporation needed the audit to obtain a substantial amount of additional financing to acquire another company. Presently, Tierra Corporation is successful, profitable, and committed to growth. The audit fee for the engagement should be substantial. Because Tierra Corporation appeared to be a good client prospect, Potter tentatively indicated that Tower & Tower wanted to do the work. Potter then mentioned that Tower & Tower’s quality control policies require an investigation of new clients and approval…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education