Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

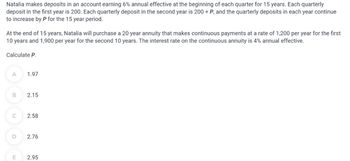

Transcribed Image Text:Natalia makes deposits in an account earning 6% annual effective at the beginning of each quarter for 15 years. Each quarterly

deposit in the first year is 200. Each quarterly deposit in the second year is 200 + P, and the quarterly deposits in each year continue

to increase by P for the 15 year period.

At the end of 15 years, Natalia will purchase a 20 year annuity that makes continuous payments at a rate of 1,200 per year for the first

10 years and 1,900 per year for the second 10 years. The interest rate on the continuous annuity is 4% annual effective.

Calculate P.

A

B

C

D

E

1.97

2.15

2.58

2.76

2.95

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Adriana Grandioso has made beginning-of-year deposits into an investment account for the past 21 years. Each deposit was $5635, and the account earned interest at a rate of 4.8% APR, compounded quarterly, each year. Having made her last deposit one year ago, Adriana now plans to transfer all of the accumulated funds today into a money-market account that earns an APR of 1.80% compounded quarterly. If Ms. Grandioso plans to withdraw $5000 from the account at the end of each quarter for the next 9 years (36 quarters), what will be the account balance total exactly nine years from now, immediately after she makes the last quarterly withdrawal?arrow_forwardShiro’s grandfather has just announced that he’s opened a saving account forShiro with a deposit of RM10,000. Moreover, he intends to make another ninesimilar deposit for the rest nine years at beginning of each year. If the savingsaccount pays 8 percent interest, determine the amount Shiro accumulated atthe beginning of 10 years.arrow_forwardAnthony plans to deposit $500,000 now and $10,000 every 6 months for 5 years into an account. Determine the amount in the account 2 years after the last deposit. The interest rate is 12% compounded quarterly.arrow_forward

- The Ward family wants to save money to travel the world. They purchase an annuity with a quarterly payment of $181 that earns 4.7% interest, compounded quarterly. Payments will be made at the end of each quarter. Find the total value of the annuity in 11 years.arrow_forwardadam made an investment of $33,000. The investment pays 7.75% p.a. compounded quarterly. He will be receiving equal monthly payments at the beginning of the month, into perpetuity. The first payment the investment makes to Adam will begin in exactly three years from today. What is the monthly payment Adam will be receiving?arrow_forwardAlina deposits $129 at the end of every six months into an account that earns 2.56% compounded monthly. Find the future value of the account in 10 years and 6 months. Round your answer to the nearest cent. future value = Sarrow_forward

- Jill makes monthly payments of $125 into a savings plan which pays 7.5% annual interest. At the end of 30 years find the following: The amount the account is worth and The total deposits Jill made.arrow_forwardJuanita has $100 deducted from her paycheck at the end of each month and put into a savings account earning 11% interest compounded monthly. She continues these deposits for 5 years. How much is in the account at the end of 5 years?arrow_forwardShelly deposits the $2000 she got as a birthday gift from her grandmother into an account earning 3.6% interest compounded monthly. She decides to also deposit $200 at the end of each month into the same account. How much will be in the account in 10 years?arrow_forward

- Rosa has a annuity worth $20, 000 to help pay for expenses while they are in a year-long (12-month) masters program. The annuity earns 5.4 % compounded monthly. Using the present value annuity formula, they find the will receive $1708 monthly during this time, sent to them at the start of the month. Fill in the table to track how much money remains in the annuity after each month. Round answers to 2 decimal places and use rounded answers in subsequent calculations. Time (Months) 0 2 3 Balance at start of month (after payment) $ $ $ Interest Earned during Time Period $ s $ Balance at end of month $ 20,000 $ $ $arrow_forwardSandra takes out a $ 22000 loan to be paid back in monthly payments of P over the next five years. The nominal interest rate is 9 % compounded monthly. After making the first payment one month from the date of the loan, she begins a habit of skipping two monthly payments after each payment of P. Determine the loan balance five years after taking out the loan.arrow_forward4 What is counter party risk? Which financial contracts does it apply to?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education