Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

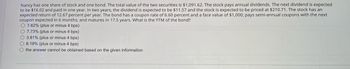

Transcribed Image Text:Nancy has one share of stock and one bond. The total value of the two securities is $1,091.62. The stock pays annual dividends. The next dividend is expected

to be $16.02 and paid in one year. In two years, the dividend is expected to be $11.57 and the stock is expected to be priced at $210.71. The stock has an

expected return of 12.67 percent per year. The bond has a coupon rate of 6.60 percent and a face value of $1,000; pays semi-annual coupons with the next

coupon expected in 6 months; and matures in 17.5 years. What is the YTM of the bond?

7.62% (plus or minus 4 bps)

O 7.73% (plus or minus 4 bps)

3.81% (plus or minus 4 bps)

8.19% (plus or minus 4 bps)

the answer cannot be obtained based on the given information

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Assume that Peter purchased a 25-year, 7.24 percent coupon (annual payments) bond at par ($1,000). He sold the bond after 4 years for $1,095.55. He reinvested the coupon payments at the 4.75 percent compounded annually. Calculate the bond's total yield.arrow_forwardJacob purchased a bond for $880 with a 9% coupon. He sold the bond after one year when it was paying him a current yield of 10%. What is the holding period return? 9.0% 9.5% 10.0% 11.0% 12.5%arrow_forwardThe nominal rate of return is % earned by an investor in a bond that was purchased for $951, has an annual coupon of 9%, and was sold at the end of the year for $1020? Assume the face value of the bond is $1,000.arrow_forward

- Last year Janet purchased a $1,000 face value corporate bond with a 10% annual coupon rate and a 20-year maturity. At the time of the purchase, it had an expected yield to maturity of 10.16%. If Janet sold the bond today for $1,045.92, what rate of return would she have earned for the past year? Do not round intermediate calculations. Round your answer to two decimal places. Please show calculations using calculator.arrow_forwardDavid Hoffman purchases a $1,000 20-year bond with an 8% coupon (annual payments). Yields on comparable bonds are 10%. Bob expects that two years from now, yields on comparable bonds will have declined to 9%. Find his expected yield, assuming the bond is sold in two years.arrow_forwardLast year Janet purchased a $1,000 face value corporate bond with a 7% annual coupon rate and a 10-year maturity. At the time of the purchase, it had an expected yield to maturity of 8.1%. If Janet sold the bond today for $1,086.18, what rate of return would she have earned for the past year? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- Linda is interested in purchasing a corporate bond that was issued with an 8% annual coupon a semiannual interest payment of $40, and maturity in fifteen years. What is the par value of this bond?arrow_forward(6) Maureen purchased a laddered portfolio of par-value bonds with semiannual coupons for $20,918. The bonds had common face amount X and coupon rate 6.8%. There was one bond redeemable at the end of each year for ten years. Maureen's yield on the portfolio was an annual effective rate of 8%. Find X.arrow_forwardSara owns one bond A and one bond B. The total value of these two bonds is $1,860.00. Bond A pays semi-annual coupons, matures in 12 years, has a face value of $1,000.00, and pays its next coupon in 6 months. Bond B pays annual coupons, matures in 3 years, has a face value of $1,000.00, has a yield-to- maturity of 10.64 percent, and pays its next coupon in one year. Both bonds have a coupon rate of 9.30 percent. What is the yield-to-maturity for bond A? O 10.54% (plus or minus 2 bps) O 10.92% (plus or minus 2 bps) O 5.92% (plus or minus 2 bps) O 8.87% (plus or minus 2 bps) O none of the answers are within 2 bps of the correct answerarrow_forward

- Last year Janet purchased a $1,000 face value corporate bond with a 10% annual coupon rate and a 15-year maturity. At the time of the purchase, it had an expected yield to maturity of 10.34 %. If Janet sold the bond today for $1,164.56, what rate of return would she have earned for the past year? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardSara has one share of stock and one bond. The total value of the two securities is $1,123.21. The stock pays annual dividends. The next dividend is expected to be $14.95 and paid in one year. In two years, the dividend is expected to be $13.42 and the stock is expected to be priced at $299.76. The stock has an expected return of 13.82 percent per year. The bond has a coupon rate of 6.20 percent and a face value of $1,000; pays semi-annual coupons with the next coupon expected in 6 months; and matures in 17.5 years. What is the YTM of the bond? O7.68% (plus or minus 4 bps) 3.79% (plus or minus 4 bps) O7.57% (plus or minus 4 bps) 8.35% (plus or minus 4 bps) the answer cannot be obtained based on the given informationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education