FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

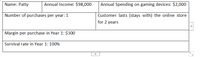

Please calculate the expected profit in Year 1 if Patty was to become a new customer of this online store.

Transcribed Image Text:Name: Patty

Annual Income: $98,000

Annual Spending on gaming devices: $2,000

Number of purchases per year: 1

Customer lasts (stays with) the online store

for 2 years

Margin per purchase in Year 1: $300

Survival rate in Year 1: 100%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You decide to do some remodeling in the kitchen. Your parents agree to lend you the money, but you insist on paying them interest. The agreement is that they will lend you $8000.00 at a simple interest rate of 2% per year. Once the interest amounts to $480, you agree to pay them back the $8000 plus the $480 interest. After how many months will you have to pay them back? Please answer step by steparrow_forwardPlease correct answer and don't use hand ratingarrow_forwardSubject: acountingarrow_forward

- You are considering a retirement savings. For this you will need to determine following information. Average starting salary of you major. $73,000 Your annual retirement savings amount. 8% of annual income Your age when you start working. 23 years old Your age when you plan to retire. 58 Retirement account investment vehicle. This will determine the growth rate. ? idk what this is... When I retire I want to open a ice cream shop (this might help answer the question) Create an excel table with your age column, annual contribution, annual account balance. Re-do the calculation with monthly contribution and find your account balance at your retirement. Submit excel table with all your information.arrow_forwardYou are a real estate agent thinking of placing a sign advertising your services at a local bus stop. Thesign will cost $4,300 and will be posted for one year. You expect that it will generate additionalrevenue of $817 a month. What is the payback period?arrow_forwardLet’s learn more about Will and Stephanie and help them determine what the best insurance options are for them.Will recently decided that he wants to live off campus next school year. He’s going to start looking for apartments in the next week. In the meantime, he wants to consider whether he needs renter’s insurance or not. Here’s some information about Will: •Things he owns that he’ll have with him next year: oLaptop ($1,500) Stereo ($500) oRecreation equipment ($500) oFurniture ($250) oMiscellaneous ($250) •Coverage Optionso Policy 1 - $4,000 of coverage, $20 a month (10% discount if he prepays a full year) oPolicy 2 - $3,000 of coverage, $18 a month (No discount if he prepays a full year) oPolicy 3 - $2,000 of coverage, $15 a month (10% discount if he prepays a full year) How much coverage should Will look for to protect all of his assets? A.$1,500 B.$2,000 C.$3,000 D.$4,000arrow_forward

- A student wants to save for her retirement. At the end of every year, she deposits 475 in a brokerage account with an expected annual return of 4.3%. How much money will she have in the account in 30 years? Enter your answer as a number with 2 places of precision (i.e. 1.23). Do not include dollar signs or commas.arrow_forwardHere is the deal: You can pay your college tuition at the beginning of the academic year or the same amount at the end of the academic year. You either already have the money in an interestbearing account or will have to borrow it. Deal, or no deal? Explain your financial reasoning. Relate your answer to the time-value of money, present value, and future valuearrow_forwardUse RIA Checkpoint to answer the following questions. 5. Frank and Farrah, who are twins, ask you to research an issue for them. Both are starting new jobs as staff accountants. Farrah decides to start saving $400 per month and intends to keep saving $400 per month for 20 years. Frank, on the other hand, desperately wants a new sports car and thus decides he is going to wait five years before starting his $400 per month savings plan. Frank figures $400 per month for five years is only a difference of $24,000 so it will not make much of a difference if he waits five years before starting to save. What difference will delaying his savings really make? Assuming a 6 percent rate of return, using the Savings tools in Checkpoint, what is the difference in the future value of Farrah’s and Frank’s savings plans? (Assume the starting amount = zero). a. $187,065. b. $89,574. c. $107,253. d. $66,935. e. None of the above. 6. Edward received two gifts in 2023. A car valued at $30,000 from his…arrow_forward

- Vijayarrow_forwardJessica just graduated from college with a degree in philosophy and has landed herself a great job – at McDonald’s. Now it’s time for her to begin paying back her college loan. For the next 12 years she will be making a monthly loan payment of $232.40. The loan has an APR of 4.75%. What was the amount of Jessica’s college loan? How much interest will Jessica have paid by the end of the loan?arrow_forwardLindsay is 29 years old and has a new job in web development. She wants to make sure that she is financially sound by the age of 55, so she plans to invest the same amount into a retirement account at the end of every year for the next 26 years. (a) Construct a data table in Excel that will show Lindsay the balance of her retirement account for various levels of annual investment and return. If Lindsay invests $10,000 at return of 6%, what would be the balance at the end of the 26th year? Note that because Lindsay invests at the end of the year, there is no interest earned on the contribution for the year in which she contributes. Round your answer to a whole dollar amount. $ 10,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education