FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

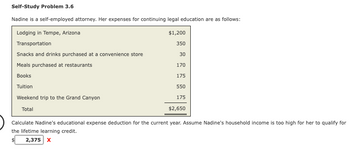

Transcribed Image Text:Self-Study Problem 3.6

Nadine is a self-employed attorney. Her expenses for continuing legal education are as follows:

Lodging in Tempe, Arizona

Transportation

Snacks and drinks purchased at a convenience store

Meals purchased at restaurants

Books

Tuition

Weekend trip to the Grand Canyon

Total

$1,200

350

30

170

175

550

175

$2,650

Calculate Nadine's educational expense deduction for the current year. Assume Nadine's household income is too high for her to qualify for

the lifetime learning credit.

2,375 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Woodstock has two college-age children, Schroeder, a freshman at State University, and Marcie, a junior at Peanuts University. Both Schroeder and Marcie are full-time students. Schroeder’s expenses during the 2020 fall semester are as follows: $3,125 tuition, $550 books and course materials, and $4,650 room and board. Marcie’s expenses for the 2020 calendar year are as follows: $9,150 tuition, $1,600 books and course materials, and $8,900 room and board. Tuition and the applicable room and board costs are paid at the beginning of each semester. Woodstock is married, files a joint tax return, claims both children as dependents, and has a combined AGI with his wife of $134,000 for 2020. Determine Woodstock’s available education tax credit for 2020.arrow_forwardSuzanna earns $4000 in her summertime job; the rest of the year she attends college fulltime. Suzanna may claim an exemption from FIT withholding if: a.she also has a taxable scholarship (used for housing) = $15,000. b.her unearned income (interest) = $1698. c.her aunt claims her as a dependent and she has no unearned income. d.her unearned income (dividends) = $1800.arrow_forwardStephanie is 12 years old and often assists neighbors on weekends by babysitting their children. Calculate the 2022 standard deduction Stephanie will claim under the following independent circumstances (assume that Stephanie's parents will claim her as a dependent). b. Stephanie reported $1,995 of earnings from her babysitting. Standard deductionarrow_forward

- Leslie Rodgers is 39 years old, single, and has decided to get a Masters of Divinity degree. During the year, Leslie incurs the following expenses: $7,200 in tuition and fees, $550 in books, and $3,800 in room and board at Western Theological Seminary in Holland, Michigan. 4) if Leslie's AGI is $44,600, what is the maximum education credit that can be claimed in 2020? If Leslie's AGI is $64,600, what is the maximum education credit that can be claimed in 2020? a)arrow_forwardAshvinbhaiarrow_forwardRebecca is an undergraduate at Big State University. She was awarded a $32,000 "full scholarship" which paid for her: • Tuition: $17,000 • Campus Housing: $6,500 • Books: $2,500 • Meals: $6,000 What amount of the scholarship must Rebecca include in her Gross Income? Group of answer choices. $6,000. $9,000. $12,500. $19,500.arrow_forward

- You interviewed a new client and these were the facts provided. Provide them with a brief explanation of tax reason for each Jerry was injured playing football and his parents paid for the physical therapy that cost them $ 4000 above what the health insurance paid, braces for Julie for the final year cost $2200. The parents have 2 health insurance plans, Stacy from her employer paid plan that covers her and the children. Charles has a self- emploved insurance plan that he pays $9000 a vear through his business.arrow_forwardChin, who is not married, provides a home for his 21-year-old daughter who attends college full-time at a community college. His daughter earns $12,400 this year. Chin’s grandma also lives with him, and he provides more than 50% of her support. What credit and how much is available to Chin? a. $0 credit allowed b. $3,000 child tax credit, $500 family tax credit c. $3,000 child tax credit, $0 family tax credit d. $0 child tax credit, $1,000 family tax creditarrow_forwardNikki works for the Shine Company, a retailer of upscale jewelry. How much taxable income does Nikki recognize under the following scenarios? (Round your answers to 2 decimal places. Leave no answer blank. Enter zero if applicable.) a) Nikki receives a 32 percent discount on jewelry restoration services offered by Shine Company. This year, Nikki had Shine Company repair a set of antique earrings (normal repair cost $905; discounted price $615.40).arrow_forward

- Bradley has two college-age children, Clint, a freshman (his first year in college) at State University, and Abigail, a junior at Northwest University (her third year of college). Both Clint and Abigail are full-time students. Bradley is in graduate school. Clint’s expenses for the year are as follows: $3,200 tuition and $500 books and course materials. Abigail’s expenses for the year are as follows: $7,200 tuition, $1,200 books and course materials, and $4,500 room and board. Bradley paid $5,000 of tuition for graduate school and $600 for books. Bradley is married, files a joint tax return, claims both children as dependents, and has a combined AGI with his wife of $139,000 for 2020. Bradley has determined that the available education credits are more beneficial than the available deductions. Determine the following: A. Clint: Which credit should he take? Total eligible expenses: Show calculation of maximum credit allowed: B. Abigail: Which credit should she take?…arrow_forwardLionel is an unmarried law student at State University Law School, a qualified educational institution. This year Lionel borrowed $36,500 from County Bank and paid interest of $2.190. Lionel used the loan proceeds to pay his law school tuition. Calculate the amounts Lionel can deduct for higher education expenses and interest on higher-education loans under the following circumstances: (Leave no answer blank. Enter zero if applicable.) b. Lionel's AGI before deducting interest on higher-education loans is $79.000. Higher education expenses Interest deduction c. Lionel's AGI before deducting interest on higher-education loans is $90,000. Higher education expenses Interest deductionarrow_forwardJulie paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start-up company. What amount of child and dependent care credit can Julie claim in 2022 in each of the following alternative scenarios? Required: Julie paid $2,000 to the day care center, and her AGI is $50,000 (all salary). Julie paid $2,000 to the day care center, and her AGI is $14,000 (all salary). Julie paid $4,000 to the day care center, and her AGI is $14,000 ($2,000 salary and $12,000 unearned income).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education