FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

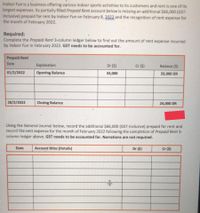

Transcribed Image Text:Indoor Fun is a business offering various indoor sports activities to its customers and rent is one of its

largest expenses. Its partially filled Prepaid Rent account below is missing an additional $66,000 (GST-

inclusive) prepaid for rent by Indoor Fun on February 8, 2022 and the recognition of rent expense for

the month of February 2022.

Required:

Complete the Prepaid Rent 3-column ledger below to find out the amount of rent expense incurred

by Indoor Fun in February 2022. GST needs to be accounted for.

Prepaid Rent

Date

Explanation

Dr ($)

Cr ($)

Balance ($)

01/2/2022

Opening Balance

33,000

33,000 DR

28/2/2022

Closing Balance

24,000 DR

Using the General Journal below, record the additional $66,000 (GST-inclusive) prepaid for rent and

record the rent expense for the month of February 2022 following the completion of Prepaid Rent 3-

column ledger above. GST needs to be accounted for. Narrations are not required.

Date

Account titles (Details)

Dr ($)

Cr ($)

Expert Solution

arrow_forward

Step 1

Journal entries refer to the concept of documenting all the transactions of a company in its books.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a. What is the finance charge for March? b. What is Carolyn's new balance? %24arrow_forwardAmount of annuity expected $900 Payment Annually Time 4 years Interest rate 6% Present value (amount needed now to invest to receive annuity) $3,118.59 Check the correctness of annuity payment by completing the following table. Note: Round the answers the nearest cent. Opening balance ces Interest Annuity Closing balance Year 1 Year 2 Year 3 Year 4 3,118.59arrow_forwardNonearrow_forward

- In cell E7, add a formula that calculates the monthly payment amount assuming that the payment is due at the beginning of the month. Subtract the “Downpayment” amount from the principle. (Use the PMT Function as Formula in Excel)arrow_forwardNarrative 14-1For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, whennecessary. Refer to Narrative 14-1. You purchase a home for $69,750 at 6.75% for 30 years. The property taxes are $2,450per year, and the hazard insurance premium is $256 semiannually. Find the monthly PITI payment. Group of answer choices 699.51 $594.73 $1,059.40 $246.83arrow_forwardComplete the following: (Use Table 7.1) Invoice Date goods are received Terms Last day of discount period Final day bill is due (end of credit period) June 18 1/10, n/30arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education