MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

the link to the data is given below. please help asap i will upvote!!

https://drive.google.com/file/d/1ervh7Ki2Nd-Ly1SjtXyCm82i40M6sE5z/view?usp=sharing

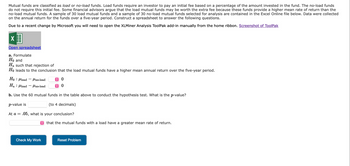

Transcribed Image Text:Mutual funds are classified as load or no-load funds. Load funds require an investor to pay an initial fee based on a percentage of the amount invested in the fund. The no-load funds

do not require this initial fee. Some financial advisors argue that the load mutual funds may be worth the extra fee because these funds provide a higher mean rate of return than the

no-load mutual funds. A sample of 30 load mutual funds and a sample of 30 no-load mutual funds selected for analysis are contained in the Excel Online file below. Data were collected

on the annual return for the funds over a five-year period. Construct a spreadsheet to answer the following questions.

Due to a recent change by Microsoft you will need to open the XLMiner Analysis ToolPak add-in manually from the home ribbon. Screenshot of ToolPak

X

Open spreadsheet

a. Formulate

Ho and

Ha such that rejection of

Ho leads to the conclusion that the load mutual funds have a higher mean annual return over the five-year period.

Ho: load Uno-load

Ha: load

no-load

b. Use the 60 mutual funds in the table above to conduct the hypothesis test. What is the p-value?

p-value is

(to 4 decimals)

At a = .05, what is your conclusion?

-

Check My Work

î

0

0

that the mutual funds with a load have a greater mean rate of return.

Reset Problem

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Inbox (12) - chriv11@morgan.edi X = Divide. www-awu.aleks.com/alekscgi/x/Isl.exe/10_u-IgNsIkasNW8D8A9PVVROTV9e4L4jq9c-vwln2qVwkjkNo-P U McGrawHillCampus_ALEKS_MATH X (6u²+12u75-18u77)÷(2u5=4) Simplify your answer as much as possible. Explanation Type here to search O EXPONENTS AND POLYNOMIALS Dividing a polynomial by a monomial: Multivariate ALEKS - Christian Rivers - Learn Check X X HH M Carrow_forwardConstruct a Divided Difference table, given y = 2x* – 9x3 + 4x²-10 @ x= 1, 2, 4, 6, 7, 8, 9, 11arrow_forwardPlease help!arrow_forward

- REDIT - MAth Assessinne X Cs google.com/forms/d/e/1FAlp0LSck09 bkclJ_DwCawx1 Two8YLuatZKvCSPsvU92zUZycG7KRg/formResponse Disc Spotify -Web Playe.. v KayiFamilyTV Top Movies - Upco.. **» MovieBoxPro Watch Anime Onlin... https://www.roblox. film links 9x 4x x2-5x+ 6 x² + x - 12 13x +38x x -3 x 2 x*-4 5x x -3 x 2 x*-4 (x + 4) (x-3) (x -2) (x + 4) (x-3) O Option 1 O Option 2 5x +44 x (x 3) (x-2) (x +4) X*3 x 2 x -4 5x +28x x 2 x*-4 (x-2) (x + 4)arrow_forwardanswer is 5arrow_forwardFind the regression line of the points: (1, 9), (2, 8), (8, 4), (9, 2)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman