FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

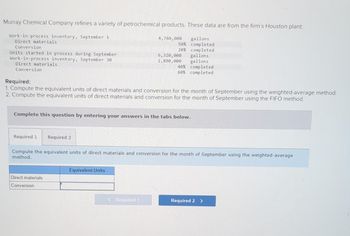

Transcribed Image Text:Murray Chemical Company refines a variety of petrochemical products. These data are from the firm's Houston plant:

Work-in-process inventory, September 1

Direct materials

Conversion

Units started in process during September

Work-in-process inventory, September 30

Direct materials

Conversion

Required 1 Required 2

4,760,000 gallons

50% completed

20% completed

Required:

1. Compute the equivalent units of direct materials and conversion for the month of September using the weighted-average method.

2. Compute the equivalent units of direct materials and conversion for the month of September using the FIFO method.

Direct materials

Conversion

6,320,000

2,890,000

Complete this question by entering your answers in the tabs below.

Equivalent Units

40%

60%

Required 1

gallons

gallons

completed

completed

Compute the equivalent units of direct materials and conversion for the month of September using the weighted-average

method.

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Bottling Department of Mountain Springs Water Company had 4,100 liters in beginning work in process that were 30% complete. During the period, 56,800 liters were completed. The ending work in process inventory had 2,800 liters that were 60% complete. Assume that Mountain Springs uses the FIFO cost flow method and that materials are added at the beginning of the process. What are the conversion equivalent units of production for the period?arrow_forwardThe Bottling Department of Mountain Springs Water Company had 4,400 liters in beginning work in process inventory (25% complete). During the period, 55,400 liters were completed. The ending work in process inventory was 3,000 liters (65% complete). All inventories are costed by the first-in, first-out method. What are the equivalent units for conversion costs under the FIFO method? what are the equivalent units for conversion costsarrow_forwardNeed answer the questionarrow_forward

- Subject: acountingarrow_forwardThe Bottling Department of Mountain Springs Water Company had 5,000 liters in beginning work in process inventory (20% complete). During the period, 58,000 liters were completed. The ending work in process inventory was 3,000 liters (90% complete). What are the equivalent units for conversion costs under the FIFO method? equivalent units for conversion costsarrow_forwardHook Bait Incorporated processes king salmon for various distributors. Two departments are involved — processing and packaging. Data relating to tons of king salmon processed in the processing department during June 2020 are provided below: Tons of King Salmon Percent Completed Materials Conversion Work-in-process inventory — June 1 3,400 85 87 Work-in-process inventory — June 30 4,700 60 37 Started processing during June 9,600 Total equivalent units for materials under the weighted-average method are calculated to be: Multiple Choice 10,496 equivalent units. 8,010 equivalent units. 11,120 equivalent units. 7,865 equivalent units. 10,039 equivalent units.arrow_forward

- The Converting Department of Soft Touch Towel and Tissue Company had 840 units in work in process at the beginning of the period, which were 60% complete. During the period, 17,600 units were completed and transferred to the Packing Department. There were 960 units in process at the end of the period, which were 75% complete. Direct materials are placed into the process at the beginning of production. Soft Touch Towel and Tissue Company Number of Equivalent Units of Production Whole Units Direct Materials Conversion Equivalent Equivalent Units Units Inventory in process, Beginning Started and Completed Transferred to Packing Department Inventory in process ending Tatalarrow_forwardStone Company produces carrying cases for CDs. It has compiled the following information for the month of June: Physical Units Percent Complete for Conversion Beginning work in process 68,000 55% Ending work in process 91,000 70% Stone adds all materials at the beginning of its manufacturing process. During the month, it started 178,000 units. Required: Using the FIFO method, reconcile the number of physical units. Using the FIFO method, calculate the number of equivalent units.arrow_forwardDover Chemical Company manufactures specialty chemicals by a series of three processes, all materials being introduced in the Distilling Department. From the Distilling Department, the materials pass through the Reaction and Filling departments, emerging as finished chemicals. The balance in the account Work in Process—Filling was as follows on January 1: Work in Process—Filling Department (4,000 units, 70% completed): Direct materials (4,000 x $12.50) $50,000 Conversion (4,000 x 70% x $8.10) 22,680 $72,680The following costs were charged to Work in Process—Filling during January: Direct materials transferred from Reaction Department: 51,600 units at $12.30 a unit $634,680Direct labor 215,540Factory overhead 207,080During January, 51,200 units of specialty chemicals were completed. Work in Process—Filling Department on January 31 was 4,400 units, 30% completed. Required: Question Content Area1. Prepare a cost of production report for the…arrow_forward

- Tamar Company manufactures a single product in two departments: Forming and Assembly. Information for the Forming process for May follows. Units Direct Materials Conversion Percent Complete Percent Complete Beginning work in process inventory 6,000 100% 40% Units started this period 43,200 Units completed and transferred out 44,400 Ending work in process inventory 4,800 100% 80% Beginning work in process inventory Direct materials $ 39,600 Conversion 443,880 $ 483,480 Costs added this period Direct materials 993,600 Conversion 4,331,880 5,325,480 Total costs to account for $ 5,808,960 Assume that Tamar uses the FIFO method of process costing. The units started and completed for may total 19,200.Required:1. Prepare the Forming department’s production cost report for May using FIFO.2. Prepare the May 31 journal entry to transfer the cost of units from forming to Assembly.arrow_forwardHook Bait Incorporated processes king salmon for various distributors. Two departments are involved — processing and packaging. Data relating to tons of king salmon processed in the processing department during June 2020 are provided below: Tons of King Salmon Percent Completed Materials Conversion Work-in-process inventory — June 1 1,500 90 80 Work-in-process inventory — June 30 2,800 60 40 Started processing during June 7,800 Total equivalent units for materials under the FIFO method are calculated to be: Multiple Choice 6,830 equivalent units. 8,180 equivalent units. 6,980 equivalent units. 7,140 equivalent units. 7,620 equivalent units.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education