Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

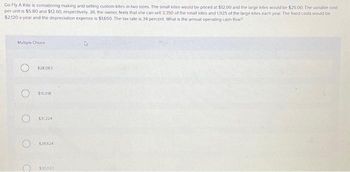

Transcribed Image Text:Go Fly A Kite is considering making and selling custom kites in two sizes. The small kites would be priced at $12.00 and the large kites would be $25.00 The variable cost

per unit is $5.80 and $12.60, respectively. Jill, the owner, feels that she can sell 3,350 of the small kites and 1,925 of the large kites each year. The fixed costs would be

$2,120 a year and the depreciation expense is $1,650. The tax rate is 34 percent. What is the annual operating cash flow?

Multiple Choice

$28,063

$15,018

O $31224

$28.624

$30,023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Multiple Choice $10,280 $5,630 $9,350 $4,650arrow_forwardTax Rate Single 10% up to $9275 15% $9276 to $37,650 25% $37,651 to $91,150 28% $91,151 to $190,150 33% $190,151 to $413,350 35% $413,351 to $415,050 39.6% more than $415,050 Standard Deduction $6300 Exemptions (per person) $4050 You would like to have $550,000 in 39 years by making regular deposits at the end of each month in an annuity that pays 6% compounded monthly. The table below shows the 2016 marginal tax rates, standard deduction, and exemptions for a single person. Complete parts (a) through (c). a. Determine the deposit at the end of each month. In order to have 550,000 in 39 years, you should deposit ____ each month. (Round up to the nearest dollar.) b. Assume that the annuity in part (a) is a tax-deferred IRA belonging to a man whose gross income in 2005 was $52,000. Use the table on the left to calculate his 2005 taxes first with and then without the IRA. Assume the man…arrow_forward4arrow_forward

- Neelon Corporation has two divisions: Southern Division and Northern Division. The following data are for the most recent operating period: Southern Northern Division Division $ 212,300 $ 129,400 $ 72,182 $ 46,584 $70,300 $ 98,100 $ 42,460 $ 25,880 Total Company $ 341,700 $ 118,766 $ 168,400 $ 68,340 Sales Variable expenses Traceable fixed expenses Common fixed expense The common fixed expenses have been allocated to the divisions on the basis of sales. The Northern Division's break-even sales is closest to:arrow_forwardSnavely, Incorporated, manufactures and sells two products: Product E1 and Product A7. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product E1 Product A7 Total direct labor-hours Product E1 Product A7 The direct labor rate is $24.10 per DLH. The direct materials cost per unit for each product is given below: Direct Materials Cost per Unit $ 282.00 $ 204.00 Activity Cost Pools Labor-related Machine setups Order size Expected Production 900 600 The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Direct Labor- Total Direct Hours Per Unit Labor-Hours 1,800 2.0 1.0 600 2,400 Activity Measures DLHs setups MHS Estimated Overhead Cost $ 132,400 62,430 976,450 $ 1,171,280 Expected Activity Product E1 Product A7 1,800 1,000 3,700 600 600 3,400 Total 2,400 1,600 7,100 The total overhead applied to Product E1 under…arrow_forward20Y8 2ΟΥ7 20Y6 20Y5 Net income 20Y4 $1,120,400 $965,900 $811,700 Interest expense $693,800 $588,000 380,900 347,700 300,300 229,000 Income tax expense 182,300 358,528 270,452 227,276 180,388 141,120 Total assets (ending balance) 6,308,280 6,633,962 4,788,646 4,965,740 3,765,686 Total stockholders' equity (ending balance) 2,021,243 2,424,789 1,550,109 1,918,695 1,151,217 Average total assets 6,471,121 5,711,304 4,877,193 4,138,117 3,517,352 Average stockholders' equity 2,223,016 1,987,449 1,734,402 1,534,956 You have been asked to evaluate the historical performance of the company over the last five years. 1,342,466 Selected industry ratios have remained relatively steady at the following levels for the last five years: 20Y4-20Y8 Return on total assets 22.9% Return on stockholders' equity 47.2% Times interest earned 4.6 Ratio of liabilities to stockholders' equity 2.1 Required: 1. Determine the following for the years 20Y4 through 20Y8. Round to one decimal place: a. Return on total…arrow_forward

- Bobzien, Incorporated, manufactures and sells two products: Product B7 and Product Z5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product B7 Product Z5 Total direct labor-hours Expected Production 300 800 Activity Cost Pools Labor-related Production orders Order size Direct Labor- Hours Per Activity Measures DLHs orders MHs The direct labor rate is $15.10 per DLH. The direct materials cost per unit is $136.20 for Product B7 and $204.40 for Product Z5. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Expected Activity Estimated Overhead Cost Unit 5.0 3.0 $ 39,585 26,884 462, 768 $ 529,237 Total Direct Labor- Hours 1,500 2,400 3,900 Product B7 Product Z5 1,500 2,400 500 600 4,600 4,700 Total 3,900 1,100 9,300 The unit product cost of Product Z5 under activity-based costing is…arrow_forwardDallavalle Corporation manufactures and sells one product. The following information pertains to the company's first year of operations: Variable costs per unit: Direct materials $ 93 Fixed costs per year: $ 320,000 $2,144,000 $1,364,000 Direct labor Fixed manufacturing overhead Fixed selling and administrative expenses The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 32,000 units and sold 31,000 units. The company's only product is sold for $238 per unit. Assume that the company uses an absorption costing system that assigns $10 of direct labor cost and $67 of fixed manufacturing overhead to each unit that is produced. The unit product cost under this costing system is:arrow_forwardKurtulus Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work in process inventory: Units in beginning work in process inventory Materials costs Conversion costs Percent complete with respect to materials Percent complete with respect to conversion Units started into production during the month Units transferred to the next department during the month Materials costs added during the month Conversion costs added during the month Ending work in process inventory: Units in ending work in process inventory Percent complete with respect to materials Percent complete with respect to conversion 700 $ 7,100 $ 2,400 55% 25% 6,600 5,800 $ 110,200 $ 83,300 1,500 70% 55% The cost of ending work in process inventory in the first processing department according to the company's cost system is closest to: (Round "Cost per equivalent unit" to 3 decimal places. Round "Cost…arrow_forward

- Marwick Corporation issues 12%, 5 year bonds with a par value of $1,030,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%. Wwhat is the bond's issue (selling) price, assuming the following Present Value factors: Present Value of an Annuity (series of payments) Present value of 1 1n= i= (single sum) 12% 3.6048 0.5674 10 6% 7.3601 0.5584 5. 10% 3.7908 0.6209 10 5% 7.7217 0.6139 Multiple Choice $1,030,000 $819,244 $1,507,201 Mc Graw Hill O Type here to search 9:11 PM 96% 3/21/2022 PriSc Insert దుటపర్ F6 FB F9 F10 FIL F12arrow_forwardMultiple Choice $161 per unit $82 per unit $87 per unit $78 per unitarrow_forwardOn November 1, Alan Company signed a 120-day, 11% note payable, with a face value of $14,400. What is the maturity value (principal plus interest) of the note on March 1? (Use 360 days a year.) Multiple Choice $14,928 $14,576 $14,664 $14,400 Mc raw Hill Type here to search 9:10 PM 96% 3/21/202arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education