FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

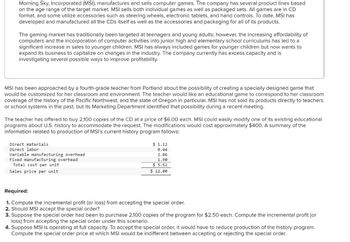

Transcribed Image Text:Morning Sky, Incorporated (MSI), manufactures and sells computer games. The company has several product lines based

on the age range of the target market. MSI sells both individual games as well as packaged sets. All games are in CD

format, and some utilize accessories such as steering wheels, electronic tablets, and hand controls. To date, MSI has

developed and manufactured all the CDs itself as well as the accessories and packaging for all of its products.

The gaming market has traditionally been targeted at teenagers and young adults; however, the increasing affordability of

computers and the incorporation of computer activities into junior high and elementary school curriculums has led to a

significant increase in sales to younger children. MSI has always included games for younger children but now wants to

expand its business to capitalize on changes in the industry. The company currently has excess capacity and is

investigating several possible ways to improve profitability.

MSI has been approached by a fourth-grade teacher from Portland about the possibility of creating a specially designed game that

would be customized for her classroom and environment. The teacher would like an educational game to correspond to her classroom

coverage of the history of the Pacific Northwest, and the state of Oregon in particular. MSI has not sold its products directly to teachers

or school systems in the past, but its Marketing Department identified that possibility during a recent meeting.

The teacher has offered to buy 2,100 copies of the CD at a price of $6.00 each. MSI could easily modify one of its existing educational

programs about U.S. history to accommodate the request. The modifications would cost approximately $400. A summary of the

information related to production of MSI's current history program follows:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Total cost per unit

Sales price per unit

$ 1.12

0.44

2.06

1.90

$ 5.52

$ 12.00

Required:

1. Compute the incremental profit (or loss) from accepting the special order.

2. Should MSI accept the special order?

3. Suppose the special order had been to purchase 2,100 copies of the program for $2.50 each. Compute the incremental profit (or

loss) from accepting the special order under this scenario.

4. Suppose MSI is operating at full capacity. To accept the special order, it would have to reduce production of the history program.

Compute the special order price at which MSI would be indifferent between accepting or rejecting the special order.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPolaris Industries wishes to purchase a multiple-use in-plan ”road test” simulator that can be used for ATVs, motorcycles, and snowmobiles. It takes digital data from relatively short drives on a desired surface - from smooth to exceptionally harsh - and simulates the ride over and over while the vehicle is mounted to a test stand under load. It can run continuously if desired and provides opportunities to redesign in areas of poor reliability. It costs $128,000 and its market value decreases 30% each year. Operating costs are modest; however, maintenance costs can be significant due to the rugged use. O&M in the first year is expected to be 10,000, increasing 25% each subsequent year. MARR is 15%. What is the optimum replacement interval? Show screen shots of any formulas used in Excel.arrow_forwardst K Yard Growers Corp manufactures garden tools in a factory in Taneytown, Maryland. Recently, the company designed a collection of tools for professional use rather than consumer use. Management needs to make a good decision about whether to produce this line in their existing space in Maryland, where space is available or to accept an offer from a manufacturer in Taiwan. Data conceming the decision are (Click the icon to view the data.) Read the requirements Requirement 1. Should Yard Growers Corp manufacture the 680,000 garden tools in the Maryland facility or purchase them from the supplier in Taiwan? Explain The cost of manufacturing 680,000 garden tools in the Maryland facility is 680,000 garden tools from the Taiwan supplier is and the cost of purchasing Yard Growers Corp purchase the garden tools from the Talwan supplier because it is than the relevant costs to manufacture the garden tools in Maryland SKIP REQUIREMENT 2 Requirement 3. What are some of the qualitative factors…arrow_forward

- MSI has been approached by a fourth-grade teacher from Portland about the possibility of creating a specially designed game that would be customized for her classroom and environment. The teacher would like an educational game to correspond to her classroom coverage of the history of the Pacific Northwest, and the state of Oregon in particular. MSI has not sold its products directly to teachers or school systems in the past, but its Marketing Department identified that possibility during a recent meeting. The teacher has offered to buy 2,100 copies of the CD at a price of $7.00 each. MSI could easily modify one of its existing educational programs about U.S. history to accommodate the request. The modifications would cost approximately $370. A summary of the information related to production of MSI's current history program follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per unit Sales price per unit $ 1.17 0.49 2.05 1.80 $…arrow_forwardMohave Corp. makes several varieties of beach umbrellas and accessories. It has been approached by a company called Lost Mine Industries about producing a special order for a custom umbrella called the Ultimate Shade (US). The special-order umbrellas with the Lost Mine Company logo would be distributed to participants at an upcoming convention sponsored by Lost Mine. Lost Mine has offered to buy 3,200 of the US umbrellas at a price of $33 each. Mohave currently has the excess capacity necessary to accept the offer. The following information is related to the production of the US umbrella: Direct materials $ 13.00 Direct labor 7.00 Variable manufacturing overhead 9.50 Fixed manufacturing overhead 2.50 Total cost $ 32.00 Regular sales price $ 41.00 Required:1. Assume that Mohave is operating at full capacity. Calculate the special-order price per unit at which Mohave would be indifferent between accepting or rejecting the special order.arrow_forwardThe owner of Barb’s Burgers has suggested the firm should invest in more moderntechnology and created a list of potential changes she thinks may be helpful as aninvestment. She has asked you to analyze the four potential choices and comment onwhat this would change in terms of cost: Allow Barb’s Burgers to be delivered via the pre-existing food delivery systems.For example, allow people from Doordash/Uber Eats to pick-up orders and deliverthem. This would require the firm to make some minor changes and result in fewerparking spaces for customers dining at the restaurant. • Question: Argue how each of these is likely to change the cost of the firm once implemented (i.e. are any of these a fixed cost or a variable cost). How this adjust the amount of labour and/or capital currently necessary for the firm? Would the technology be a general technology, labour-saving, or capital-saving? Also mention the parking space.arrow_forward

- A country club wants to exam the effects of a new marketing campaign that attempts to get more people within the community to become members. In many communities, when people buy a house in the area, they receive a “Welcome Wagon” gift basket containing coupons to local restaurants. The idea of the marketing campaign is to include a free two month membership to the country club in the gift basket with the hope that once “new” residents try the country club then at least a certain proportion will want to become real members. One member of the Club’s Executive Council believes that at least 81% of the people who receive the coupons for the free membership will use the coupon. In a sample of 192 new residents who received the coupon for the two month free membership, there were 138 people who actually took advantage of the free two month membership. When testing the hypothesis that at least 81% of the people that receive the coupon actually use it, what is the test statistic?arrow_forwardYou are considering adding a new software title to those published by your highly successful software company. If you add the new product, it will use capacity on your disk duplicating machines that you had planned on using for your flagship product, “Battlin’ Bobby.” You had planned on using the unused capacity to start selling “BB” on the West coast in two years. You would eventually have had to purchase additional duplicating machines 10 years from today, but using the capacity for your new product will require moving this purchase up to 2 years from today. If the new machines will cost $113,000 and can be expensed under Section 179, your marginal tax rate is 21 percent, and your cost of capital is 14 percent, what is the opportunity cost associated with using the unused capacity for the new product? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward4. Suppose that MSI is operating at full capacity. To accept the special order, it would have to reduce production of the history program.Compute the special order price at which MSI would be indifferent between accepting or rejecting the special order MSI has been approached by a fourth-grade teacher from Portland about the possibility of creating a specially designed game thatwould be customized for her classroom and environment. The teacher would like an educational game to correspond to her classroomcoverage of the history of the Pacific Northwest, and the state of Oregon in particular. MSI has not sold its products directly to teachersor school systems in the past, but its Marketing Department identified that possibility during a recent meeting.The teacher has offered to buy 2,000 copies of the CD at a price of $6.00 each. MSI could easily modify one of its existing educationalprograms about U.S. history to accommodate the request. The modifications would cost approximately…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education