Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

calculate the number of years he can withdraw money from the account.

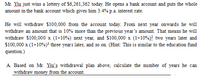

Transcribed Image Text:Mr. Yiu just wins a lottery of $6,261,362 today. He opens a bank account and puts the whole

amount in the bank account which gives him 3.4% p.a. interest rate.

He will withdraw $100,000 from the account today. From next year onwards he will

withdraw an amount that is 10% more than the previous year's amount. That means he will

withdraw $100,000 x (1+10%) next year, and $100,000 x (1+10%)? two years later and

$100,000 x (1+10%)³ three years later, and so on. (Hint: This is similar to the education fund

question.)

A. Based on Mr. Yiu's withdrawal plan above, calculate the number of years he can

withdraw money from the account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Deciding between traditional and Roth IRAs. Elijah James is in his early 30s and is thinking about opening an IRA. He can’t decide whether to open a traditional/deductible IRA or a Roth IRA, so he turns to you for help. To support your explanation, you decide to run some comparative numbers on the two types of accounts; for starters, use a 25-year period to show Elijah what contributions of $5,500 per year will amount to (after 25 years) if he can earn, say, 10 percent on his money. Will the type of account he opens have any impact on this amount? Explain. Assuming that Elijah is in the 22 percent tax bracket (and will remain there for the next 25 years), determine the annual and total (over 25 years) tax savings he’ll enjoy from the $5,500-a-year contributions to his IRA. Contrast the (annual and total) tax savings he’d generate from a traditional IRA with those from a Roth IRA. Now, fast-forward 25 years. Given the size of Elijah’s account in 25 years (as computed in part a),…arrow_forwardPLEASE SHOW ALL WORK Richard deposits $ 5400 and got back an amount of $ 6000 after a year. Find the simple interest he got.arrow_forwardPerpetuities are also called annuities with an extended or unlimited life. Based on your understanding of perpetuities, answer the following questions. Which of the following are characteristics of a perpetuity? Check all that apply. In a perpetuity, returns—in the form of a series of identical cash flows—are earned. A perpetuity continues for a fixed time period. A perpetuity is a series of regularly timed, equal cash flows that is assumed to continue indefinitely into the future. The principal amount of a perpetuity is repaid as a lump-sum amount. Your grandfather wants to establish a scholarship in his father’s name at a local university and has stipulated that you will administer it. As you’ve committed to fund a $15,000 scholarship every year beginning one year from tomorrow, you’ll want to set aside the money for the scholarship immediately. At tomorrow’s meeting with your grandfather and the bank’s representative, you will need to deposit…arrow_forward

- In order to calculate a person’s savings ratio, the amount saved each month is divided by net income. Why is this False? Explain your answer and cite sources pleasearrow_forward1. What is the total balance in the account after 40 years? 2. How much of the total did Pamela contribute herself? 3. How much money did Pamela make through compounded return in this investment account?arrow_forwardHe also wants to know how the portion of the home payment that comprises interest changes over the years assuming he takes out an FRM.arrow_forward

- what is the double entry when making weekly payments to a rotating savings arrangement?arrow_forwardSelect all the statements on perpetuities that are correct. a. The present value of a perpetuity increases if the interest rate increases. b. If I multiply the present value of a perpetuity with the interest rate then I get the value of a single payment of the cashflow stream. c. The present value value of a perpetuity is independent of the interest rate. d. The present value of a perpetuity is infinite as all the payments add up to infinity. e. A perpetuity describes a constant cashflow at the end of each year that continues infinitely long.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education