Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

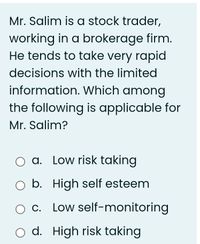

Transcribed Image Text:Mr. Salim is a stock trader,

working in a brokerage firm.

He tends to take very rapid

decisions with the limited

information. Which among

the following is applicable for

Mr. Salim?

O a. Low risk taking

O b. High self esteem

O C. Low self-monitoring

O d. High risk taking

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Similar questions

- What is thin capitalization rules?arrow_forwardTrue or false 1. Interest Rate Parity allows a company to lock in profits by borrowing in the low interest rate currency and investing in the high interest rate currency? 2. When calculating Days Sales Oustanding, it is important to include all credit and cash sales in the equation.arrow_forwardWhat do you mean when you say "financial planning"? Explain the importance of financial planning in financial management.arrow_forward

- Assume that you have been approached by a competitor in Congo to engage in a joint venture. The competitor would provide the classroom facilities (so you would not need to rent classroom space), while your employees would teach the classes. You and the competitor would split the profits. Discuss the steps in portfolio management process and how your potential return and your risk would change if you pursue the joint venture. b) The Asset/liability problem for commercial banks occurs because, while trying to generate income, banks face a number of risks. You are required to identify three Financial Risks faced by banks and describe how banks manage these risks.arrow_forwardWhich of the following ratio that gives an idea of company's ability to payback its short term liabilities with its short term assets? a. Current Ratio b. Return on Equity c. Quick Ratio d. Gross profit ratioarrow_forward27.Options buyers who are delta-hedging (riskless hedge) would do which of the following in the underlying (asset) market. A. buy when the underlying market is falling and sell when it is rising. B. sell when the underlying market is falling and buy when it is rising. C. buy whether the underlying market is falling or rising. D. sell whether the underlying market is falling or rising.arrow_forward

- You are working as an adviser in a large financial institution. Your clients Simon, Juliet and Andre are the directors of Future Energy Ltd a reputable and successful company in the renewable energy market.Future Energy Ltd has secured major contracts to install solar panels and batteries to government buildings in Singapore, Canberra, Sydney and Melbourne.To fulfil these contracts, Future Energy Ltd needs to raise $ 9.5 million. The directors seek your urgent advice.RequiredUsing the MOA template, advise the directors how Future Energy Ltd should raise the $9.5 mil. In your opinion, will a disclosure document be necessary? Why or why not? Please support your answer with relevant sections of the Corporations Act 2001 and/or case law.arrow_forwardIn 2021, Joshua gave $9,300 worth of XYZ stock to his son. In 2022, the XYZ shares are worth $30,300. What was the gift tax in 2021?arrow_forwardPlease help explain 23 and 24arrow_forward

- 17) Which of the following is the significance of Capital Budgeting? a. Irreversible b. All the options c. Long term effect d. Growtharrow_forwardAnalyse the role of Joint Ventures as a means to achieve strategies for a large corporation with a suitable example.arrow_forwardWhich of the following is the most important factor in determining or choosing the type of financing? a. Current interest rates. b. Availability of funds. c. The venture’s assets. d. A, B & C.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON