FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

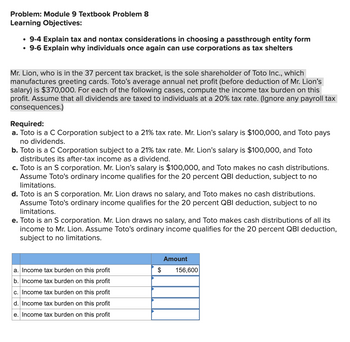

Transcribed Image Text:Problem: Module 9 Textbook Problem 8

Learning Objectives:

• 9-4 Explain tax and nontax considerations in choosing a passthrough entity form

• 9-6 Explain why individuals once again can use corporations as tax shelters

Mr. Lion, who is in the 37 percent tax bracket, is the sole shareholder of Toto Inc., which

manufactures greeting cards. Toto's average annual net profit (before deduction of Mr. Lion's

salary) is $370,000. For each of the following cases, compute the income tax burden on this

profit. Assume that all dividends are taxed to individuals at a 20% tax rate. (Ignore any payroll tax

consequences.)

Required:

a. Toto is a C Corporation subject to a 21% tax rate. Mr. Lion's salary is $100,000, and Toto pays

no dividends.

b. Toto is a C Corporation subject to a 21% tax rate. Mr. Lion's salary is $100,000, and Toto

distributes its after-tax income as a dividend.

c. Toto is an S corporation. Mr. Lion's salary is $100,000, and Toto makes no cash distributions.

Assume Toto's ordinary income qualifies for the 20 percent QBI deduction, subject to no

limitations.

d. Toto is an S corporation. Mr. Lion draws no salary, and Toto makes no cash distributions.

Assume Toto's ordinary income qualifies for the 20 percent QBI deduction, subject to no

limitations.

e. Toto is an S corporation. Mr. Lion draws no salary, and Toto makes cash distributions of all its

income to Mr. Lion. Assume Toto's ordinary income qualifies for the 20 percent QBI deduction,

subject to no limitations.

a. Income tax burden on this profit

b. Income tax burden on this profit

c. Income tax burden on this profit

d. Income tax burden on this profit

e. Income tax burden on this profit

$

Amount

156,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Leona, whose marginal tax rate on ordinary income is 37 percent, owns 100 percent of the stock of Henley Corporation. This year, Henley generates $1 million of taxable income. If Henley wants to pay all of its after-tax earnings to Leona as a dividend, calculate the amount of the dividend payment. Calculate Leona’s tax due on the dividend computed in part a, and her after-tax cash flow from the dividend receipt. Compute the combined corporate and individual tax burden on Henley’s $1 million of current year income, and the effective combined tax rate on this income.arrow_forwardSubject -account Please help me. Thankyou.arrow_forwardCc.50.arrow_forward

- n each of the following cases, discuss how the taxpayers might respond to a tax rate increase in a manner consistent with the income effect. a. Mr. Edwards earns $32,000 a year as an employee, and Mrs. Edwards doesn’t work.b. Mr. Frank earns $22,000 a year as an employee, and Mrs. Frank earns $10,000 a year as a self-employed worker.c. Mr. George earns $22,000 a year as an employee, and Mrs. George earns $10,000 a year as an employee.arrow_forwardSubject: accountingarrow_forwardDo not give image formatarrow_forward

- Gopher Corporation began the year with a large amount of accumulated earnings and profits and ended the year reporting taxable income of $100,000. Gopher wants to distribute its after-tax earnings to its sole shareholder, Sven Anderson. The dividend would meet the requirements to be a qualified dividend, and Sven is subject to a tax rate of 15 percent on dividend income. What is the amount of the dividend distribution and how much income does Sven realize after taxes? Answer is not complete. Corporate income Corporate tax Dividend distribution to Seven Shareholder tax Total after tax income $100,000 $105,000 x $ 15,000arrow_forwardTroy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer. Troy receives a salary of $60,000 per year. He also receives a bonus equal to 10% of all collections from clients he serviced during the year (which he receives in January of the following year). Determine the tax consequences of the following events to the corporation and to Troy: a. On December 31, 2023, Troy was visiting a customer. The customer gave Troy a $10,000 check payable to the corporation for appraisal services Troy performed during 2023. Troy did not deliver the check to the corporation until January 2024. The corporation recognizes the income in: Troy recognizes the bonus related to this collection in: Question Content Area b. Assume Eagle Corporation is an accrual basis taxpayer. On December 31, 2023, Troy was visiting a customer. The customer gave Troy a $10,000 check payable to the corporation for appraisal services Troy performed during 2023. Troy deposited the…arrow_forwardHh1. Accountarrow_forward

- Gerry is a resident of Quebec and has been with the same employer, XYZ company for the last 3 years. Facts: Gerry’s gross salary in 2022:$96,000 ignore non-refundable tax credits for this problem Using Table A, 2022 tax rates, calculate Gerry’s taxes payable Gerry’s Taxes Payable Calculate Gerry’s average tax rate and marginal tax rate: Tax calculation Average tax rate Marginal tax rate Table Aarrow_forwardPrior to the effect of tax credits, Paco's regular income tax liability is $145,000 and his tentative AMT is $120,000. Paco has nonrefundable business tax credits of $32,000. Paco's tax liability is $113,000. True Falsearrow_forwardAsok's AGI for 2023 is $133,250. Included in this AGI is a $45,000 25% long-term capital gain and a $13,000 0%/15%/20% long-term capital gain. Asok is single and uses the standard deduction. Compute his taxable income, the tax liability, and the tax savings from the alternative tax on net capital gain. Click here to access the tax rate schedules to use for this problem. When computing the tax on the gain, calculate each part separately, rounding interim calculations to two decimal places. Then, round your final answer for the tax to the nearest dollar. Hint: The 25% gain is calculated at two different rates. • Asok's taxable income: $ • His regular tax liability: $ 120,850 X 23,084 X • His tax liability using the alternative tax approach: $ • The tax savings from using the alternative tax approach: $ 21,914 X 1,170arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education