FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:GE. 10:13 O O 3

01:57:15 Remaining

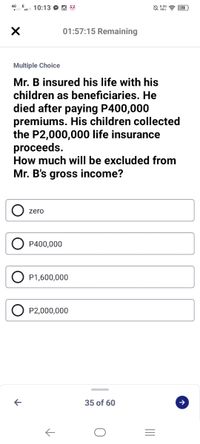

Multiple Choice

Mr. B insured his life with his

children as beneficiaries. He

died after paying P400,000

premiums. His children collected

the P2,000,000 life insurance

proceeds.

How much will be excluded from

Mr. B's gross income?

zero

P400,000

P1,600,000

P2,000,000

35 of 60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3arrow_forward7 Martha has a gross income of $63,822. She can make adjustments of $10,884 for business losses, $3,672 for business expenses, and $2,983 for contributions to her retirement plan. What is Martha's adjusted gross income?arrow_forwardAssume Darrin transfers ownership of the life insurance policy on his life to an Irrevocable Life Insurance Trust (ILIT) and retains the right to borrow against the policy. Assume Darrin dies five years later. Which of the following is correct regarding the treatment of the proceeds of the life insurance policy? O The proceeds will always be included in Darrin's federal gross estate. The proceeds will be included in Darrin's federal gross estate if he has any outstanding loans against the life insurance policy. O The proceeds will be included in Darrin's federal gross estate if Darrin continued paying the policy premiums after the life insurance policy was transferred to the ILIT. O The proceeds will never be included in Darrin's federal gross estate.arrow_forward

- Jackson and Ashley Turner (both 45 years old) are married and want to contribute to a Roth IRA for Ashley. In 2022, their AGI is $213,000. Jackson and Ashley each earned half of the income. How much can Ashley contribute to her Roth IRA if they file a joint return?arrow_forwardMonica has a Roth IRA to which she contributed $15,000. The IRA has a current value of $37,500. She is 54 years old and takes a distribution of $25,000. How much of the distribution will be taxable to Monica? $15,000 $10,000 $0 $25,000 $37,500arrow_forwardNorris has a deductible of $1,000. He damages his car in a accident and it will cost $3,300 to repair. How much does Norris have to pay? How much does this insurance pay?arrow_forward

- Val died on May 13, 2021. On July 3, 2018, she gave a $400,000 lite insurance policy on her own lite to son Ray. Because the value of the policy was rela- tively low, the transter did not cause any gift tax to be payable. a. What amount was included in Val's gross estate as a result of the 2018 gift? 6. What amount was included in Val's gross estate if the property given was land instead of a life insurance policy? C. Refer to Part a. What amount would have been included in Val's gross estate if she instead gave Ray the policy on April 30, 2017?arrow_forwardIf we assume that Ben's taxable income is $465,000 before taking his capital transactions into account, and he recognized a $44,000 long-term capital gain, a $12,000 short-term capital gain, and a $10,000 long-term capital loss what is his total 2022 income and Medicare contribution tax.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education