Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

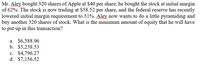

Transcribed Image Text:Mr. Aley bought 320 shares of Apple at $40 per share; he bought the stock at initial margin

of 62%. The stock is now trading at $58.52 per share, and the federal reserve has recently

lowered initial margin requirement to 51%. Aley now wants to do a little pyramiding and

buy another 320 shares of stock. What is the minimum amount of equity that he will have

to put up in this transaction?

a. $6,588.96

b. $5,238.53

c. $4,796.27

d. $7,156.52

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 2. You purchase 600 shares of Jenkins Corporation at $30 per share using an initial margin of 70%. The stock is now selling for $41 per share and you want to use the excess equity in your account to pyramid. You want to purchase 400 shares of Watson Corporation at $122 per share. If the minimum initial margin is 60%, what is the minimum amount of equity that you will have to put up in this transaction?arrow_forwardNeed Help with this Questionarrow_forwardYou founded a firm that currently has 10 million shares, of which you own 7 million. You are considering an IPO where you would sell 3 million shares for $22 each. If all of the shares sold are secondary, what is the maximum number of secondary shares you could sell and still retain more than 50% ownership of the firm? How much would the firm raise in that case? C What is the maximum number of secondary shares you could sell and still retain more than 50% ownership of the firm? shares. The maximum number of secondary shares you could sell is (Round to the nearest whole number.) How much would the firm raise in that case?arrow_forward

- Zang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity is $55 million. Zang currently has 3 million shares outstanding and will issue 2 million new shares. ESM charges a 5% spread. How much cash will Zang raise net of the spread Write out your answer completely.arrow_forward2. An analyst for Acme, R. Runner, has recommended that Peter the Anteater purchase shares in a private firm (a firm that is not traded on any exchange) called Dynamite Corp. Dynamite has 30% debt and 70% equity. R. Runner believes that Dynamite will generate a return of 10% over the next year. Since Y. Lee is new to the job, he decides to do a little research on his own. He finds a company, Explosions Unlimited, that has very similar business as Dynamite. Explosions has an equity beta of 1.05 and is composed of 40% debt and 60% equity. Should Peter the Anteater buy the stock? The expected return on the market is 12% and the expected risk-free rate is 5%.arrow_forwardZang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang’s current value of equity is $60 million. Zang currently has 4 million shares outstanding and will issue 1 million new shares. ESM charges a 7% spread. What is the correctly valued offer price, rounded to the nearest penny? How much cash will Zang raise net of the spread (use the rounded offer price)?arrow_forward

- Todd Winningham IV has $5,700 to invest. He has been looking at Gallagher Tennis Clubs Inc. common stock. Gallagher has issued a rights offering to its common stockholders. Six rights plus $64 cash will buy one new share. Gallagher's stock is selling for $82 ex- rights. a-1. How many rights could Todd buy with his $5,700? (Do not round intermediate calculations and round your answer to the nearest whole number.) Number of rights a-2. Alternatively, how many shares of stock could he buy with the same $5,700 at $82 per share? (Do not round intermediate calculations and round your answer to the nearest whole number.) Number of shares b. If Todd invests his $5.700 in Gallagher rights and the price of Gallagher stock rises to $90 per share ex-rights, what would his dollar profit on the rights be? (First compute profit per right.) (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Dollar profitarrow_forwardYour sister-in-law, a stockbroker at Invest Inc., is trying to sell you a stock with a current market price of $26. The stock's last dividend (Do) was $2.00, and earnings and dividends are expected to increase at a constant growth rate of 10 percent. Your required return on this stock is 20 percent. From a strict valuation standpoint, you should: a. Buy the stock; it is fairly valued. b. Buy the stock; it is undervalued by $3.00. c. Buy the stock; it is undervalued by $2.00. d. Not buy the stock; it is overvalued by $4.00. e. Not buy the stock; it is overvalued by $3.00.arrow_forwardRay is about to go public. Its present stockholders own 530,000 shares. The new public issue will represent 1,000,000 shares. The shares will be priced at $20 to the public with a 10% spread. The out-of-pocket costs in addition to the spread will be $570,000. What are the net proceeds to Ray?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education