Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Answer? ? General Accounting question

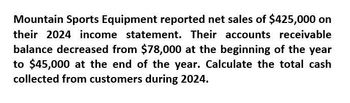

Transcribed Image Text:Mountain Sports Equipment reported net sales of $425,000 on

their 2024 income statement. Their accounts receivable

balance decreased from $78,000 at the beginning of the year

to $45,000 at the end of the year. Calculate the total cash

collected from customers during 2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- kany company reported net income of $78,000 and sales of $219,000at December 31, 2020, Kathy also reported beginning and ending accounts receivable at $20,000 and $25,000, respectively. Kathy will report cash collected from customers in its 2020 statement of cash flows (direct method) in the amount of:arrow_forwardGeneral Accountingarrow_forwardFinancial Accountingarrow_forward

- Financial accounting questionarrow_forwardCalculate the cash operating cycle of Stone Limited for the year ended 30 April, 2018 and 2019.arrow_forwardSplish Company reported 2020 net income of $154,400. During 2020, accounts receivable increased by $15,690 and accounts payable increased by $9,962. Depreciation expense was $48,400. Prepare the cash flows from operating activities section of the statement of cash flows. (Show amounts that decrease cash flow with either a - sign eg. -15,000 or in parenthesis e.g. (15,000).) SPLISH COMPANY Cash Flow Statement Adjustments to reconcile net income to %24arrow_forward

- ILoveFinance, Inc., provided the following financial information for the quarter ending September 30, 2019: Net income $141,463 Depreciation and amortization $33,414 Increase in receivables $12,709 Increase in accounts payables $2,411 Decrease in marketable securities $1,225 Increase in inventory $1,336 What is the cash flow from operating activities generated during this quarter by the firm? O $163,243 O $98,756 O-$164,468 O-$98,756arrow_forwardSimbop Company reported 2020 net income of $151,000. During 2020, accounts receivable increased by $15,010 and accounts payable increased by $9,966. Depreciation expense was $39,300.Prepare the cash flows from operating activities section of the statement of cash flows.arrow_forwardGiven the following data from company def, using the direct method of cash flows the company would have determined its cash inflow to be: $30,000.00 Accounts receivable, at 12/31/2018 $20,000.00 Accounts receivable, at 12/31/2019 $507,000.00 Sales for year 2019 $357,000.00 Gross Profit A) 497,000 B) 367,000 C) 347,000 D) 517,000arrow_forward

- Skysong Corporation had the following 2025 income statement. Sales revenue $186,000 Cost of goods sold 127,000 Gross profit 59,000 Operating expenses (includes depreciation of $22,000) 45,000 Net income $14,000 The following accounts increased during 2025: Accounts Receivable $13,000, Inventory $12,000, and Accounts Paya Prepare the cash flows from operating activities section of Skysong's 2025 statement of cash flows using the direct n SKYSONG CORPORATION Statement of Cash Flows-Direct Method (Partial) For the Year Ended December 31, 2025 Cash Flows from Operating Activities Cash Received from Customers Cash Payment to Suppliers Cash Payment for Operating Expenses $ $ Net Cash Provided by Operating Activities $arrow_forwardplease answer thanksarrow_forwardUtica Company's net accounts receivable was $250,000 at December 31, 2016, and $300,000 at December 31, 2017. Net cash sales for 2017 were $100,000. The accounts receivable turnover for 2017 was 5.0, What was Utica's total net sales for 2017?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning