FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Calculate expected gross margin if Jan produces 50,000, 65,000, or 70,000 books. (Make sure you include the production-volume variance as part of cost of goods sold.)

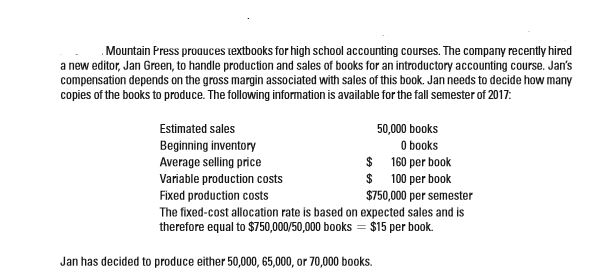

Transcribed Image Text:Mountain Press proauces textbooks for high school accounting courses. The company recently hired

a new editor, Jan Green, to handle production and sales of books for an introductory accounting course. Jan's

compensation depends on the gross margin associated with sales of this book. Jan needs to decide how many

copies of the books to produce. The following information is available for the fall semester of 2017:

Estimated sales

50,000 books

O books

$ 160 per book

$ 100 per book

$750,000 per semester

The fixed-cost allocation rate is based on expected sales and is

therefore equal to $750,000/50,000 books = $15 per book.

Beginning inventory

Average selling price

Variable production costs

Fixed production costs

Jan has decided to produce either 50,000, 65,000, or 70,000 books.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the contribution margin dollars if volume is 200,000 units, price is $10 per unit, and variable costs are 60 percent of revenue.arrow_forwardSanjuarrow_forwardA product is priced to sell for $12 with average variable costs of $8. The company expects to ear a profit of $400,000 with its total fixed costs of $120,000. Calculate the minimum number of units that must be sold in order to reach this target return.arrow_forward

- Compute (a) the margin of safety in dollars and (b) the margin of safety ratio with the given details below: Aactual sales for the product= 1,000,000 Break-even sales = 840,000.arrow_forwardValaarrow_forwardSooner Industries charges a price of $88 and has fixed cost of $301,000. Next year, Sooner expects to sell 15,600 units and make operating income of $172,000. What is the variable cost per unit? What is the contribution margin ratio? Note: Round your variable cost per unit answer to the nearest cent. Enter the contribution margin ratio as a percentage, rounded to two decimal places.arrow_forward

- Mulhiarrow_forwardCalculate per-unit costs and compare to last year. Are the reduced unit costs for Product A due to scale or scope? Product A last year Product B last year Units Production Cost Marketing Cost 100 50 200 80 2.5 4 Units Production Cost Marketing Cost Product A coming year 150 150 40 Product B coming year 200 80 2 3.2 a. The reduced per unit costs for product A are due to scale b. The reduced per unit costs for product A are due to scope c. We cannot be certain whether the reduced per unit costs for product A are due to scale or scope. d. The reduced per unit costs for product A are due to both scale and scopearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education