FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

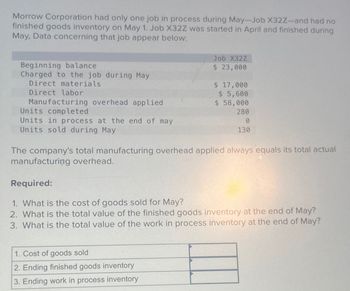

Transcribed Image Text:Morrow Corporation had only one job in process during May-Job X32Z-and had no

finished goods inventory on May 1. Job X32Z was started in April and finished during

May, Data concerning that job appear below:

Beginning balance

Charged to the job during May

Direct materials

Direct labor

Manufacturing overhead applied

Units completed

Units in process at the end of may

Units sold during May

Job X32Z

$ 23,000

$ 17,000

$ 5,600

$ 58,000

280

0

130

The company's total manufacturing overhead applied always equals its total actual

manufacturing overhead.

1. Cost of goods sold

2. Ending finished goods inventory

3. Ending work in process inventory

Required:

1. What is the cost of goods sold for May?

2. What is the total value of the finished goods inventory at the end of May?

3. What is the total value of the work in process inventory at the end of May?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- AAAarrow_forwardKansas manufacturing company uses a job-order costing system and started the month of October with a zero balance in its work in process and finished goods inventory accounts. During October, Kansas worked on three jobs and incurred the following direct costs on those jobs: Job B18 Job B19 Job C11 Direct materials $13,000 $25,000 $16,000 Direct labor $8,000 $10,000 $5,000 Kansas applies manufacturing overhead at a rate of 200% of direct labor cost. During October, Kansas completed Jobs B18 and B19 and sold Job B19. What is Kansas' work in process inventory balance at the end of October? $31,000 $30,500 $33,000 $43,000 None of the above. Please show your workarrow_forwardHow much is total cost of goods manufactured?arrow_forward

- Shen Company reports the costs incurred below for the month ended May 31. The company has no beginning Work in Process Inventory. Overhead is applied using a predetermined overhead rate of 120% of direct materials costs. Job 4 was completed and Job 5 is still in process at month-end. Prepare a schedule of cost of goods manufactured for the month. Direct materials used Direct labor used Job 4 $ 1,500 2,100 Job 5 $1,000 200 SHEN COMPANY Schedule of Cost of Goods Manufactured For Month Ended May 31 Direct materials used Direct labor Factory overhead applied Total manufacturing costs Add: Work in process inventory, beginning Total cost of work in process Less: Work in process inventory, ending Cost of goods manufactured $ $ 2,500 2,300 4,800 4,800 4,800arrow_forwardLouisiana Metals uses a job costing system. The company applies manufacturing overhead using a predetermined rate based on direct labor cost. The following debits (credits) appeared in the Work-in-Process Inventory for June. June 1 For the month For the month For the month For the month Balance Direct labor Direct materials Manufacturing overhead To finished goods Beginning inventory ??? $ 33,000 43, 200 19,800 (78,700) Job LM-12, the only job still in production at the end of June, has been charged $13,200 in direct materials cost and $12,400 in direct labor cost. Required: What was the beginning balance in Work-in-Process Inventory?arrow_forwardGadubhaiarrow_forward

- Custom Cabinets Inc. (CCI) uses a job-order costing system. During February and March, only 3 jobs were worked on. Job 1602 was completed on March 15th. The other two jobs were still in process at March 31st, CCI's year-end. Here is a summary of the data from the job cost sheets for the 3 jobs: Job 1602 Job 1603 Job 1604 February costs incurred: Direct materials $ 16,000 $ 9,000 $ - Direct labour 13,500 7,300 - Manufacturing overhead 21,600 11,680 - March costs incurred: Direct materials - 8,400 21,000 Direct Labour 4,000 5,800 10,300 Manufacturing overhead ? ? ? Manufacturing overhead is applied to jobs on the basis of direct labor cost. Balances in the inventory accounts at the end of…arrow_forwardA manufacturer began operations on April 1 and reports the information below. All jobs are sold for 20% above cost. Manufacturing costs Job number 1 2 3 4 5 April $ 880 730 May $ 2,200 1,280 1,920 2,710 In process Job Status at May 31 Completed and sold during May Completed but not sold 555 480 3,680 Completed and sold during May In process 1. Compute the May 31 balance in (a) Work in Process Inventory and (b) Finished Goods Inventory. 2. Compute gross profit for May.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education