ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

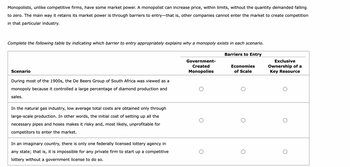

Transcribed Image Text:Monopolists, unlike competitive firms, have some market power. A monopolist can increase price, within limits, without the quantity demanded falling

to zero. The main way it retains its market power is through barriers to entry-that is, other companies cannot enter the market to create competition

in that particular industry.

Complete the following table by indicating which barrier to entry appropriately explains why a monopoly exists in each scenario.

Barriers to Entry

Scenario

During most of the 1900s, the De Beers Group of South Africa was viewed as a

monopoly because it controlled a large percentage of diamond production and

sales.

In the natural gas industry, low average total costs are obtained only through

large-scale production. In other words, the initial cost of setting up all the

necessary pipes and hoses makes it risky and, most likely, unprofitable for

competitors to enter the market.

In an imaginary country, there is only one federally licensed lottery agency in

any state; that is, it is impossible for any private firm to start up a competitive

lottery without a government license to do so.

Government-

Created

Monopolies

Economies

of Scale

Exclusive

Ownership of a

Key Resource

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose a monopolist faces a market demand that is the first two columns in the table below. Also, in the short run, assume that Total Fixed Cost equals $100 and the monopolist has Total Variable Cost according to the table. Find Total Revenue for each price and quantity combination, and then Marginal Revenue as price falls and quantity increases. Fill in the rest of the costs in the table and find profit at each price and quantity combination as the difference between Total Revenue and Total Cost. If profit is less than zero that indicates a loss. What is the maximum profit you found in this table? At what quantity and price combination is profit maximized for this monopolist? Next, verify this result by using Marginal Analysis to find the profit maximizing price and quantity combination. For each quantity, ask yourself if Marginal Revenue exceeds Marginal Cost. If it does, then profits would be increased by producing that quantity. As you go down the table to higher quantities, stop…arrow_forwardThere are two types of consumers: one half of consumers are type 1 (low type) and the other half are type 2 (high type). Type l's demand curve is q1 = 8 – P, while type 2's demand is given by q2 = 12 – P. Consider a monopolist selling its product to these consumers. Assume that the marginal cost is equal to zero. 1.1. Suppose that the firm can charge only one price, P, for each unit. (1) What is the market demand, Q? (Note: Q should be equal to q1 + q2.) What should be P that maximizes the monopoly's profit? For the profit- (2) maximizing P, will both types of consumers purchase the product, or only high type con- sumers purchase? (3) Given the price in (2), what is the resulting social surplus?arrow_forwardA monopolistic firm operates in two separate markets, Market A and Market B. The firm can sell its product at different prices in each market due to different demand conditions. In Market A, the firm faces a demand curve given by Q_A = 100 - P_A, where Q_A is the quantity demanded in Market A and P_A is the price charged in Market A. In Market B, the demand curve is Q_B = 80 - 2P_B, where Q_B is the quantity demanded in Market B and P_B is the price charged in Market B. The firm has a total production capacity of 120 units. What price should the firm charge in each market to maximize its total revenue?arrow_forward

- Imagine a monopolist could charge a different price to every customer based on how much he or she were willing to pay. How would this affect monopoly profits?arrow_forwardYour textbook covered 4 possible ways to deal with a natural monopoly. Which approach would be best for consumers? Group of answer choices Regulators would force the monopolist to set its price equal to its marginal cost. Let the natural monopoly charge enough to cover its average costs and earn a normal rate of profit. Regulators would allow the monopolist to continue with no government regulation. Regulators would split the monopolist into two competing firms.arrow_forwardBYOB is a monopolist in beer production and distribution in the imaginary economy of Hopsville. Suppose that BYOB cannot price discriminate; that is, it sells its beer at the same price per can to all customers. The following graph shows the marginal cost (MC), marginal revenue (MR), average total cost (ATC), and demand (D) for beer in this market. Place the black point (plus symbol) on the graph to indicate the profit-maximizing price and quantity for BYOB. If BYOB is making a profit, use the green rectangle (triangle symbols) to shade in the area representing its profit. On the other hand, if BYOB is suffering a loss, use the purple rectangle (diamond symbols) to shade in the area representing its loss. PRICE (Dollars per can) 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0 MC 0 0.5 1.5 ATC MR D 1.0 2.0 2.5 3.0 QUANTITY (Thousands of cans of beer) 3.5 4.0 Monopoly Outcome Profit Lossarrow_forward

- The following table shows the maximum amount five potential car buyers are willing to pay for each level of sales. Suppose that the cars are being sold by a car dealer operating as a monopoly (perhaps because there are no other car dealers in the market). Maximum Amount He or She Would Pay for the Car Buyer 1 $40,000 Buyer 2 $35,000 Buyer 3 $30,000 Buyer 4 $25,000 Buyer 5 $20,000 a) If the price of the car is $30,000, the revenue will be $............thousand.b) If the marginal cost of each car is $20,000. The monopolistic car dealer will want to sell 3 cars and the price will be $................. thousand.c) In a perfectly competitive market, the number of cars sold would be 5 cars. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardHelp with grapharrow_forwardGiven the following demand schedule for a monopolist in the diamond industry, assume the marginal cost of producing diamonds is constant and equal to 200 and that there are no fixed costs. Quantity 1 2 3 4 5 Price $500 400 300 200 100 Suppose that rival producers enter the market and the market becomes perfectly competitive. How large is the deadweight loss associated with monopoly in this case? Explain the excess capacity problem. (Note: I am not asking for a definition. I want an explanation of the problem.) Explain what is meant when we say that monopolistic competition is a "second-best" outcome. (Note: I am not asking for a definition. I want an explanation of the problem.)arrow_forward

- Consider the relationship between monopoly pricing and the price elasticity of demand.arrow_forwardExplain how monopolies employ average cost pricingarrow_forwardThe three graphs below illustrate the market for electricity. The distribution of electricity is a natural monopoly; therefore, to take advantage of lower production costs, it is efficient to have only one firm in the market. Unfortunately, if a monopoly were allowed to provide electricity, it would charge a higher price and provide a smaller amount of electricity than would be desirable. In other words, the unregulated monopoly would charge the monopoly's profit-maximizing price. To avoid this, the government will allow a single firm to provide electricity, but the government will regulate the price. Let’s compare possible regulatory solutions.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education