FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

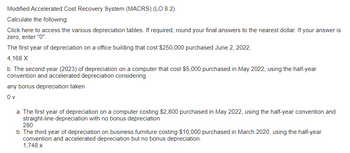

Transcribed Image Text:Modified Accelerated Cost Recovery System (MACRS) (LO 8.2)

Calculate the following:

Click here to access the various depreciation tables. If required, round your final answers to the nearest dollar. If your answer is

zero, enter "0".

The first year of depreciation on a office building that cost $250,000 purchased June 2, 2022.

4,168 X

b. The second year (2023) of depreciation on a computer that cost $5,000 purchased in May 2022, using the half-year

convention and accelerated depreciation considering

any bonus depreciation taken

Ov

a. The first year of depreciation on a computer costing $2,800 purchased in May 2022, using the half-year convention and

straight-line depreciation with no bonus depreciation

280

b. The third year of depreciation on business furniture costing $10,000 purchased in March 2020, using the half-year

convention and accelerated depreciation but no bonus depreciation.

1,748 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using Excel to prepare depreciation schedules Download an Excel template for this problem online in MyAccountingLab or at http://www.pearsonhighered.corri/Horngren. The Fraser River Corporation has purchased a new piece of factory equipment on January 1, 2018, and wishes to compare three depreciation methods, straight-line, double-declining-balance, and units-of-production. The equipment costs $400,000 and has an estimated useful life of four years, or 8,000 hours. At the end of four years, the equipment is estimated to have a residual value of $20,000. Requirements Use Excel to prepare depreciation schedules for straight-line, double-declining-balance, and units-of-production methods. Use cell references from the Data table. Prepare a second depreciation schedule for double-declining-balance method, using the Excel function DDB. The DDB function cannot be used in the last year of the asset's useful life. At December 31, 2018, Fraser River is trying to determine if it should sell the…arrow_forwardi need the answer quicklyarrow_forwardHello, I am needing help with answering question 2 and final question #1.arrow_forward

- Haresharrow_forwardile Edit View Go Tools Window Help A MT1305Q1Spring2021.pdr (1 page) Q Search 3. An automobile purchased for use by the manager of a firm at a price of $32,000 is to be depreciated by using the straight-line method over 5 years. What will be the book value of the automobile at the end of 3 years? (Assume that the scrap value is $0). 4. AutoTime, a manufacturer of electronic digital timers, has a monthly fixed cost of $48,000 and a production cost of $8 for each timer manufactured. The timers sell for $14 each. a. What is the cost function? What is the revenue function? b. Find the profit(loss) corresponding to a production level of 4000. guys know I was in the Hunger Games?" Jennifer Lawrence on where she keeps Katniss's bow. dtv MacBook Pro 23 $ & 3arrow_forwardcomplete the following problem and explain how you got the numbers please. I am very confused on how solve thesearrow_forward

- PLEASE PROVIDE THE NEEDED ANSWER AND SOLUTION ASAP PLEASE THANKYOU A company purchased an air conditioner at SY Appliance Center for Php 45,000 and paid an installation fee of Php 6,000 with a delivery charge of Php 1,000. The air conditioner has an estimated life span of 5 years with a residual value of Php 15,000 a. What is the depreciable cost of the air conditioner? b. How much is the annual depreciation?arrow_forwardProvide step by step manual solution, given, and depreciation table for below mentioned problem. Make sure yet that your answer is the same as the given answer before sending your solution. An asset costing P50,000 has a life expectancy of 6 years and an estimated salvage value of P8,000. Calculate the depreciation charge at the end of the fourth period using fixed-percentage method. Answer. P5,263.87arrow_forwardSolve all questions otherwise leave itarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education