FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format thanku

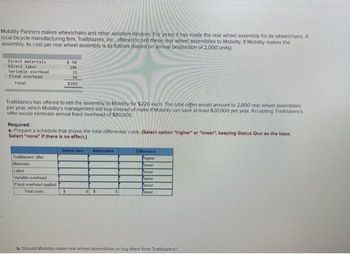

Transcribed Image Text:Mobility Partners makes wheelchairs and other assistive devices. For years it has made the rear wheel assembly for its wheelchairs. A

local bicycle manufacturing firm, Trailblazers, Inc., offered to sell these rear wheel assemblies to Mobility. If Mobility makes the

assembly, its cost per rear wheel assembly is as follows (based on annual production of 2,000 units).

Direct materials

Direct labor

Variable overhead

Fixed overhead

Total

$50

106

32

94

$282

Trailblazers has offered to sell the assembly to Mobility for $220 each. The total oftler would amount to 2,000 rear wheel assemblies

per year, which Mobility's management will buy instead of make if Mobility can save at least $20,000 per year. Accepting Trailblazers's

offer would eliminate annual fixed overhead of $80,000

Required:

a. Prepare a schedule that shows the total differential costs. (Select option "higher" or "lower", keeping Status Quo as the base.

Select "none" if there is no effect.)

Status Quo Alternative

Difference

Trailblazers offer

higher

Materials

Tower

Labor

Towar

Variable overhead)

Tower

Fixed overhead applied)

Tower

Total costs

S

0 $

Tower

b. Should Mobility make rear wheel assemblies or buy them from Trailblazers?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Write me a human paragraph without using Al about what a memorandoms of understanding is and how it is usedarrow_forwardThe easiest way to change the order in a chart is in the __________. Multiple Choice underlying spreadsheet slicer chart options chart itselfarrow_forwardInformation that is reported free from error ________.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education